In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Director Peter Carlin of Adient PLC (NYSE:ADNT) made headlines by selling 3,553 shares of the company’s stock. This transaction, which took place on December 12, 2023, has sparked interest among shareholders and potential investors as they seek to understand the implications of such insider actions.Who is Peter Carlin of Adient PLC?Peter Carlin is a notable figure within Adient PLC, serving as a member of the company’s board of directors. His role in the company provides him with a deep understanding of Adient’s operations, strategic direction, and financial health. Directors like Carlin are privy to the inner workings of the company, and their trading activities are often scrutinized for insights into the company’s future prospects.About Adient PLCAdient PLC is a global leader in automotive seating, supplying seating systems and components for virtually every major automaker. The company’s expertise spans the entire spectrum of automotive seating solutions, including complete seating systems, frames, mechanisms, foam, trim, and fabric. Adient’s focus on innovation, quality, and operational excellence has positioned it as a key player in the automotive industry, with a presence in 34 countries around the world.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe recent sale by Peter Carlin is part of a broader pattern of insider trading activity at Adient PLC. Over the past year, Carlin has sold a total of 3,553 shares and has not made any purchases. This one-sided transaction history could be interpreted in various ways by market analysts and investors. Some may view the lack of purchases as a lack of confidence in the company’s growth potential, while others may consider the sales as routine portfolio management or personal financial planning.When examining the overall insider trends at Adient PLC, it is evident that there have been zero insider buys and seven insider sells over the past year. This trend may raise questions about the insiders’ collective outlook on the company’s stock, although it is essential to consider that insider selling can occur for many reasons unrelated to a company’s performance, such as diversification or liquidity needs.

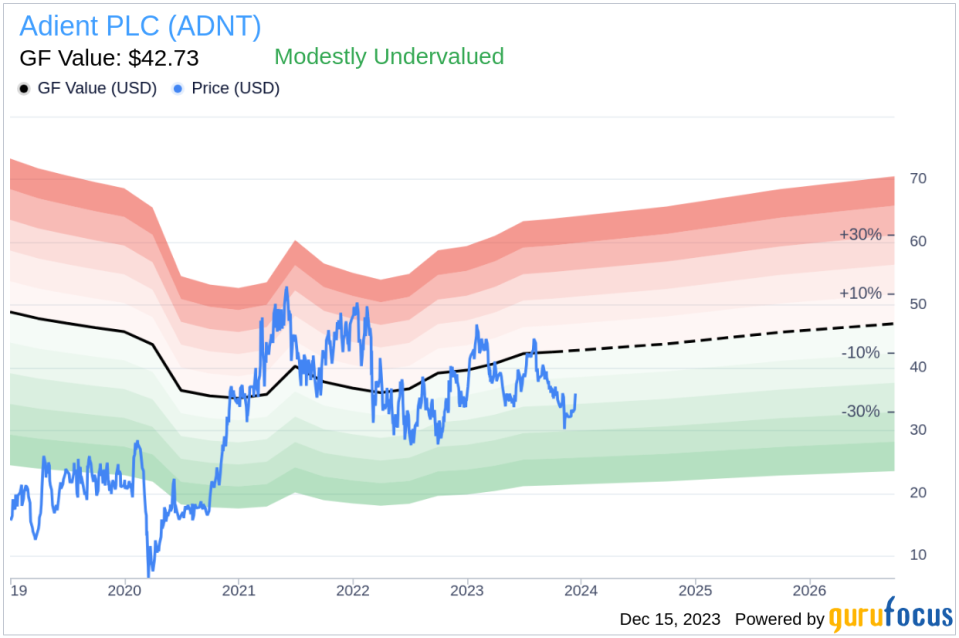

Adient PLC’s Market Cap and ValuationOn the day of Peter Carlin’s recent sale, Adient PLC’s shares were trading at $33.58, giving the company a market cap of $3.347 billion. This valuation places Adient PLC within the competitive landscape of the automotive seating industry.The price-earnings ratio of Adient PLC stands at 16.54, which is slightly lower than the industry median of 17.18. This indicates that, relative to its peers, Adient’s stock is trading at a somewhat more attractive valuation based on earnings. However, it is also higher than the company’s historical median price-earnings ratio, suggesting that the stock has been trading at higher multiples in the past.Adient PLC’s Price-to-GF-Value RatioA critical aspect of stock valuation is the price-to-GF-Value ratio, which compares the current share price to the intrinsic value estimate developed by GuruFocus. With a share price of $33.58 and a GF Value of $42.73, Adient PLC has a price-to-GF-Value ratio of 0.79. This ratio indicates that the stock is modestly undervalued based on its GF Value, which could signal a potential buying opportunity for value investors.The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

ConclusionThe insider selling activity by Director Peter Carlin at Adient PLC, particularly in the absence of insider purchases, may prompt investors to delve deeper into the company’s financials and future prospects. While the insider trend suggests a cautious stance from those within the company, the valuation metrics indicate that the stock may be undervalued. Investors should consider these factors alongside broader market conditions, company performance, and individual investment strategies before making any decisions.As with any insider trading activity, it is crucial to remember that such transactions can be influenced by various personal and professional factors. Therefore, while insider trends can provide valuable insights, they should be just one component of a comprehensive investment analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.