TVS Motor Co has wrapped up CY2023 on a high note with its best-ever annual sales in the domestic market as well as record EV sales. The Chennai-based scooter motorcycle and moped manufacturer registered total two-wheeler wholesales of 30,39,436 units last year, surpassing the 3-million mark for the first time, and posting strong 24% YoY growth (CY2022: 24,57,232 units). And the iQube e-scooter also clocked its best-ever calendar year sales.

TVS’ best month for wholesales in CY2023 was festive October when it despatched 344,957 units to its showrooms across the country.

TVS averaged monthly sales of 253,286 units in CY2023 compared to 204,769 units in CY2022, which depicts just how strong demand has been in the year gone by. The festive month of October was TVS’ best month in CY2023 – 344,957 units (see 12-month data table above).

In December 2023, TVS sold a total of 214,988 units, up 33% YoY (December 2022: 161,369 units) albeit the segment-wise scooter, motorcycle and moped splits are not available as yet.

Scooters lead the charge but motorcycle growth is better

TVS Motor Co currently retails 12 models in the domestic market – six motorcycles and their variants (Sport, Star City Plus, Apache, Ronin, Raider, Radeon), three scooters (Jupiter, NTorq 125, iQube) and three mopeds (XL 100, Scooty Pep+, Scooty Zest).

A deep dive into the January-November 2023 wholesales reveals that 28,24,488 units were sold, up 23% YoY (January-November 2022: 22,95,863 units), one percent less than the 24% growth in CY2023 (with total December 2023 sales factored in).

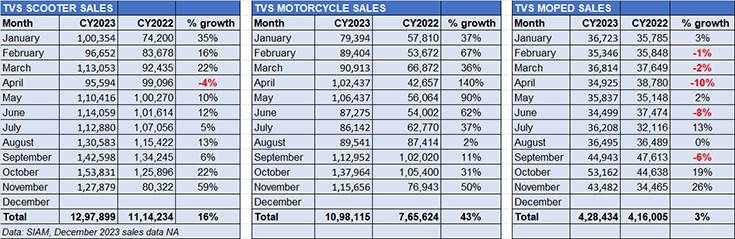

The segment-wise split for the first 11 months of CY2023 reveals that scooters (12,97,899 units) recorded 16.48% YoY growth (January-November 2022: 11,14,234 units) had a 46% share of total TVS two-wheeler sales. The Jupiter and the NTorq 125 are the two best-selling scooters for TVS.

Motorcycle sales at 10,98,115 units were up 43.42% YoY (January-November 2022: 765,624 units) and had a 38.87% share of total two-wheeler sales. While the Apache series comprising seven models is seeing strong demand, the Raider has carved a niche of its own.

The humble moped continues to see demand and 428,434 units were sold, up 3% YoY (January-November 2022: 416,005 units) and had a 15.16% share of TVS sales.

In CY2022 (for the same January-November period), the segment-wise split saw scooters have a 48.27% share, motorcycles with a 33.73% share and mopeds with a 17.98% share. This also means that in CY2023 (even after the December 2023 sales are factored in), motorcycle growth has been higher than for scooters.

Sustained demand for the iQube has helped make TVS the No. 2 EV OEM and a 19% market share in the fast-growing Indian e-two-wheeler market.

TVS iQube sales soar 216% in CY2023 to 187,181 units

In sync with the surge in demand for electric two-wheelers, and retail sales surpassing a record 850,000 units in CY2023, the iQube e-scooter has recorded strong market gains. Total 12-month wholesales last year were 187,181 units, up by a massive 216% (CY2022: 59,165 units).

The zero-emission e-scooter, which has averaged monthly sales of 15,598 units in CY2023, witnessed its best-ever month in August (23,887 units) as TVS ramped up production and deliveries ahead of the festive season that began in September and ended in mid-November. Sustained demand for the iQube has helped give TVS the No. 2 rank (after Ola Electric) and a 19% market share in the fast-growing Indian e-two-wheeler market.

The reduced-by-15% FAME subsidy on two-wheelers from June did little to dampen buyer interest in the iQube, and 119,986 units in the June-December 2023 period meant that the higher-priced iQube continued to see demand.

What has helped accelerate sales has been the introduction of the refreshed iQube, with improved range and features. The eco-friendly scooter, which bagged the ‘Green Two-Wheeler of the Year’ title at the Autocar Awards 2023, is currently available in three variants (iQube, iQube S and iQube ST). The base iQube model, pieced at Rs 134,422 (ex-showroom Bengaluru), has a range of 100km, a top speed of 78kph and charging time of four-and-a-half hours. The iQube S, with similar range, top speed and charging time but more features, costs Rs 140,025. The top-end iQube ST has a range of 145kph, 85kph top speed and a four-hour charging time.

The refreshed iQube retains its all-LED lights and 12-inch wheels but gets a host of connectivity features, driven by the various TFT instrument clusters on offer. While the entry-level iQube gets a 5-inch unit that supports turn-by-turn navigation, the iQube S comes equipped with a larger 7-inch TFT cluster that offers music controls and theme personalisation as well. The top-end ST variant features a 7-inch touchscreen instrument cluster, which is also ready for OTA updates, and also offers voice assistance.

TVS has gradually expanded the iQube’s retail network to over 140 cities and 310 touchpoints across India and plans to double it to almost 600 touchpoints. Meanwhile, the company continues to improve on the ease of charging quotient for iQube owners, who currently have access to over 2,000 charging points with various charging partners through the TVS iQube mobile app.

The company, which has expanded its EV sales programme to Nepal and to Europe (from January 2024), is understood to be plotting a series of new EVs targeted at different customer segments with a complete portfolio offering between 5 to 25 kilowatts.

Exports begin to look up

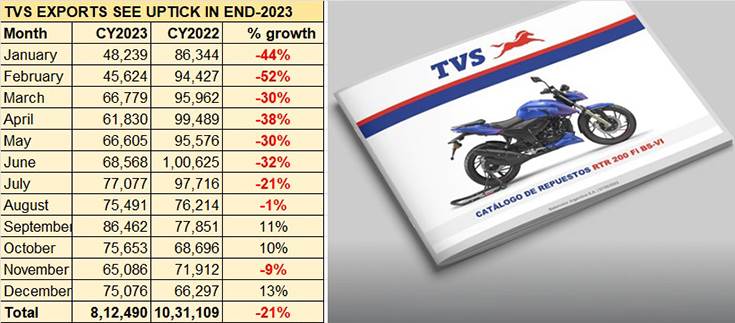

TVS Motor Co is the second ranked two-wheeler exporter after Bajaj Auto, both of whom have witnessed a downturn in their export numbers for the past couple of years as a result of inclement financial conditions in their key target markets.

TVS’ export sales data reveals that it shipped 812,490 units in CY2023, down 21% on CY2022’s 10,31,109 units. However, the past few months have seen an uptick in numbers and the company closed the year with December sales up 13% YoY.

All images: TVS Motor Co

ALSO READ:

EV share of auto sales in India grows to over 6% in CY2023

Record-breaking year for electric two-wheeler sales, Ola-TVS-Ather command 62% market share

Electric 3-wheeler sales clock 66% growth in CY2023 to over 581,000 units

Electric car, SUV and MPV sales jump 114% to over 81,000 units in CY2023