The December spike in rental fleet sales pushed up overall sales for the month, leading to a stronger cap for the year.

Graphic: Bobit

U.S. fleet vehicle sales passed another post-pandemic milestone in 2023 as supply chain kinks straightened out and vehicles inventory available to fleets ramped up, according to Bobit/Automotive Fleet sales data released Jan. 3.

Among all commercial, rental, and government sector fleets total sales for the year reached 2,179,751 vehicles compared to 1,698,656 in 2022, for a robust increase of 28.3%.

Bobit fleet sales numbers reflect aggregate sales from the three major Detroit-based auto manufacturers and the Asian Big 6. [Three of the Asian automakers exclude sales figures from their luxury vehicle sub-brands].

Broke down by fleet sector, 2023 sales figures show:

- Commercial sales totaled 888,123, up 4.1% from 853,113 in 2022.

- Rental fleet sales reached 1,019,225, up a sizable 58.1% from 644,494 in 2022. The auto rental industry benefitted from increased supply as it was able to replace higher mileage vehicles that were run during the COVID years.

- Government sales came in at 272,403 vehicles, up 35.5% from 201,049 in 2022.

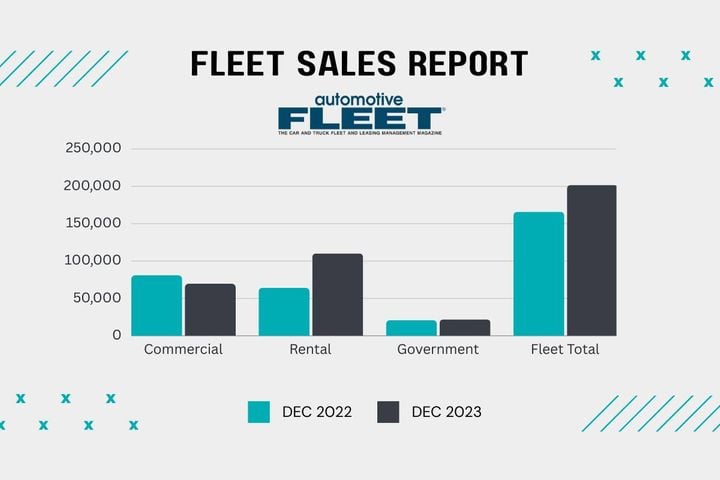

December 2023 Fleet Sales Provide End of Year Bump

The December spike in rental fleet sales pushed up overall sales for the month, leading to a stronger cap for the year.

Overall, among the three fleet sectors, December sales totaled 201,808 vehicles, up 21.7% from 165,809 in 2022. Monthly sales figures broken down by fleet sector:

- Commercial fleets were the only category to decline in December, dipping to 69,647 vehicles sold last month compared to 80,888 in December 2022, a decrease of about 14%.

- Rental fleets surged 71.8% year-over-year in December, from 64,152 vehicles sold in December 2022 to 110,198 last month.

- Government fleet sales last month were 21,963 vehicles sold, up 5.7% from 20,769 in December 2022.

Originally posted on Automotive Fleet