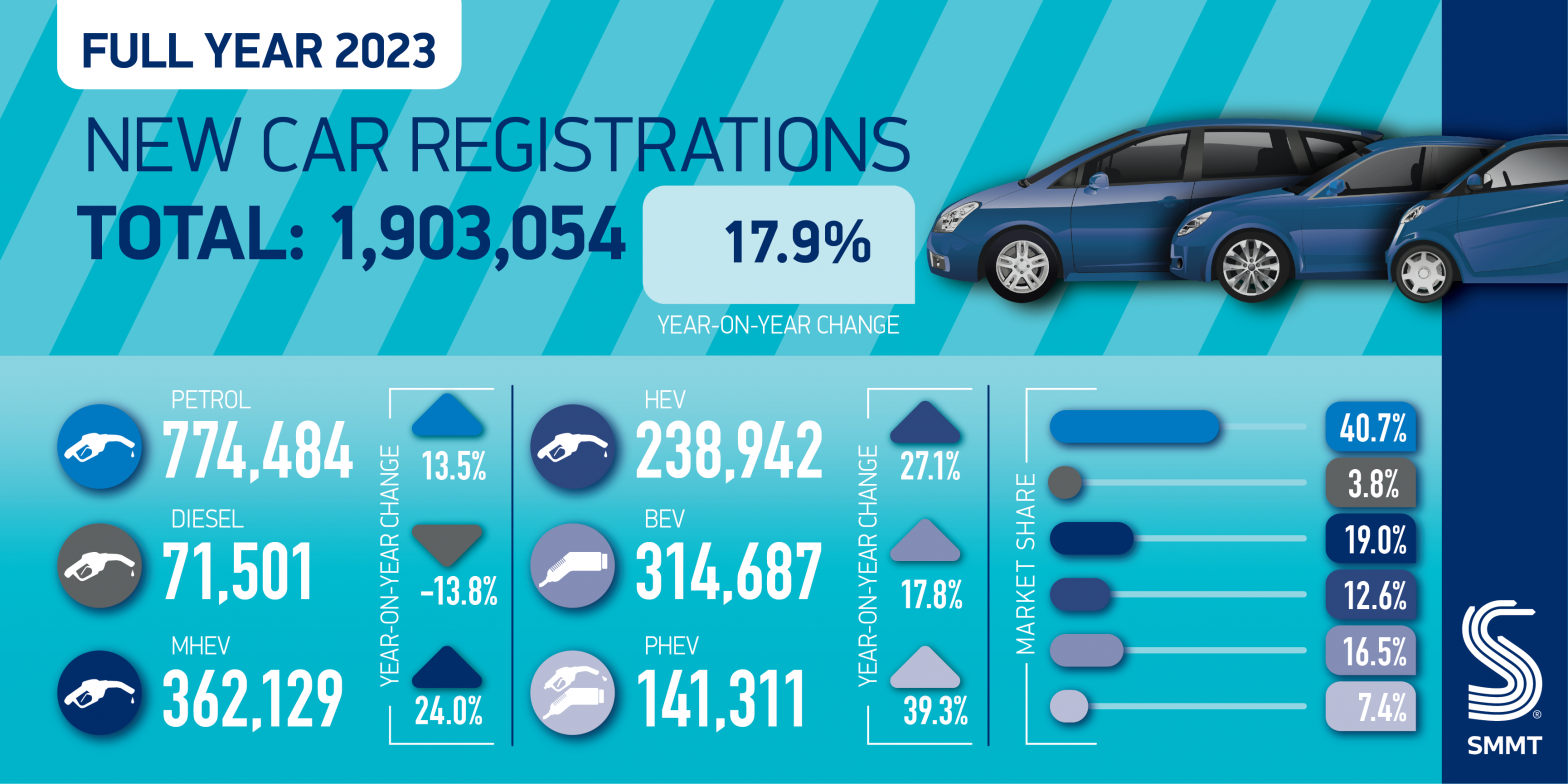

- New car registrations reach 1.903 million in 2023 – up 17.9% as fleet investment accelerates.

- Battery electric vehicle volumes reach record high but market share slips to 16.5%.

- Industry calls on government to halve EV VAT, to put more than a quarter of a million extra zero emission vehicles on the road and cut five million tonnes of CO2 by end of 2026.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new car market has recorded its best year since the pandemic as a strong December, up 9.8%, wrapped up the 17th month of consecutive growth. 1.903 million new cars reached the road during 2023 – an increase of 17.9%, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

Growth was driven entirely by fleet investment as the previous year’s supply constraints faded and helped fulfil pent-up demand. Fleet deliveries rebounded by 38.7% year on year, while business registrations, a small proportion of the market, fell by -1.5%. Private consumer demand remained stable at 817,673 units after a strong recovery in 2022, with cost of living pressures and high interest rates constraining growth. While the overall new car market remains -17.7% below pre-pandemic levels,1 the surge in uptake compared with the previous year saw the value of new car sales jump more than £10 billion to around £70 billion, with 288,991 additional vehicles reaching the road.2

In terms of vehicle type, buyers showed a continued preference for superminis, dual purpose and lower medium cars, which accounted for 29.8%, 28.6% and 28.2% of the market respectively. These three segments have been the most popular since 2013.

As the industry transitions away from fossil fuels, drivers continued to invest heavily in low and zero emission vehicles – which meant average new car CO2 fell by -2.2% to 108.9 g/km. Hybrid electric vehicles (HEVs) recorded robust growth, up 27.1% to reach a 12.6% market share. Plug-in hybrids (PHEVs) also enjoyed a strong year, with a 39.3% increase in registrations to account for 7.4% of the market.

Battery electric vehicle (BEV) uptake reached a record volume – up by almost 50,000 units with 314,687 new registrations. Indeed, 2023 saw more BEVs reach the road than in 2020 and 2021 combined.3 BEV volumes actually fell by -34.2% in the last month of the year, but this is a reflection of an abnormal December 2022 when significant numbers of orders were able to be fulfilled in the month.4 The next few months are also likely to be volatile due to the regulatory uncertainties that have beset the market over the past few months – most obviously the last-minute deal on UK-EU Rules of Origin, which avoids tariffs on EVs but which has made planning difficult.

Overall, BEVs accounted for one in six new cars registered in 2023, with the majority taken by business and fleet buyers who benefit from compelling tax incentives.5 In contrast, one in 11 private buyers chose a BEV.6 Since the end of the Plug-in Car Grant in June 2022, the UK is the only major European market with no consumer BEV purchase incentives – but it is now also the only market with mandated minimum targets for new ZEV registrations.

With mainstream consumer demand flat, the industry is calling on government to support private buyers by halving VAT on new BEVs for three years. This temporary cut would give private consumers access to fiscal support at a level similar to that enjoyed by business buyers, enabling manufacturers to deliver larger volumes of zero emission vehicles. Combined with a retention of the business incentives that have already proven their value in increased EV uptake, the measure would accelerate the UK’s market transition. More drivers would upgrade their existing petrol or diesel car to a new zero emission alternative, widening the future supply of used electric vehicles and making investment in chargepoint rollout even more compelling.

Over the past five years, BEV uptake has risen almost 20-fold, with the Treasury reaping a VAT windfall due to these vehicles typically having higher purchase costs than their ICE counterparts.7 Halving VAT would give consumers an estimated additional £7.7 billion in BEV buying power to the end of 2026, while reducing the Treasury’s tax take by just 22% per vehicle for each additional driver switching from an ICE to a BEV. This would encourage an extra 270,000 new car buyers in Britain to go electric and put 1.9 million new EVs on the road by the end of 2026.8 Such a step would have a profound impact on the UK’s carbon footprint, reducing road vehicle emissions by more than five million tonnes cumulatively over the next three years.9

Mike Hawes, SMMT Chief Executive, said,

With vehicle supply challenges fading, the new car market is building back with the best year since the pandemic. Energised by fleet investment, particularly in the latest EVs, the challenge for 2024 is to deliver a green recovery. Government has challenged the UK automotive sector with the world’s boldest transition timeline and is investing to ensure we are a major maker of electric vehicles. It must now help all drivers buy into this future, with consumer incentives that will make the UK the leading European market for ZEVs.10

Looking ahead to 2024, the latest market outlook – published in November – anticipates 2024’s new car market to reach 1.97 million units, with 439,000 BEVs taking a 22.3% market share. The next quarterly revised outlook will be published in February.

Notes to editors

1 2019 registrations: 2,311,140

2 Based on JATO average value (£36,474)

3 298,932 BEVs registered in 2020 and 2021

4 BEVs achieved a record market share of 32.9% in December 2022, making them the most popular type of car for the month

5 BEV large fleet and business = 77.1% of BEV volumes (compared with 57% of overall market)

6 8.8% of private registrations are BEVs – 1:11.4

7 2018: 15,510 BEVs registered; 2023: 314,687 BEVs registered. JATO average BEV cost: £47,471. Average ICE cost: £30,483 (1H 2023)

8 Based on SMMT analysis – assumed 65% of the market would benefit from a VAT cut, lifting demand for that proportion by 25% (based on 1% price fall delivers 3% demand rise), raising outlook for BEVs between 2024 and 2027 from a 1.67 million base to 1.94 million, a 270,000 unit rise

9 Based on SMMT analysis – 1.94 million X VAT saving (£3,956, based on JATO average price of BEV) = £7.7bn. CO2 saving based on 1.5tCO2 saved per car pa by the 1.94 million new BEVs registered between 2024 and 2026.

10 As of the latest available ACEA European market data, for November 2023, the UK is the second largest European BEV market by volume and 16th by market share