- Britain’s new light commercial vehicle (LCV) registrations rise 21.0% in 2023 as businesses and fleets invest in 341,455 vehicles carrying out essential roles in UK economy.

- Record battery electric van (BEV) uptake as 20,253 units registered, up 21.0%, with almost 60,000 joining UK roads since 2019.

- As ambitious Zero Emission Vehicle Mandate requires BEVs to represent 10% of market in 2024, rollout of sufficient van-suitable public chargepoints is mission-critical.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

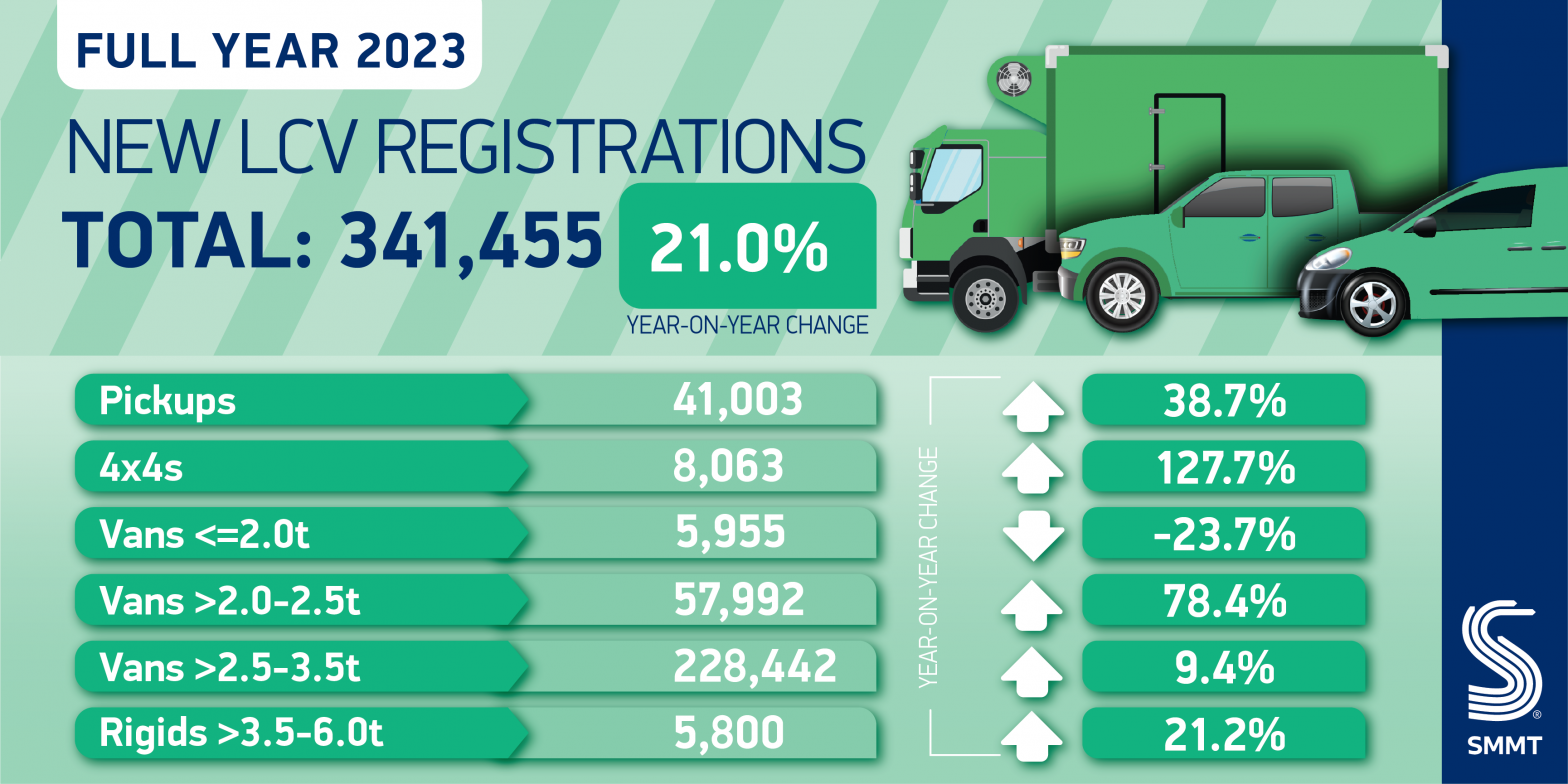

UK demand for new light commercial vehicles (LCVs) grew by 21.0% to reach 341,455 units in 2023, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT). More businesses invested in fleet renewal every month compared with the year before – with a record number of zero emission vans joining Britain’s roads.

Britain saw an additional 59,316 LCVs of all types and sizes join its roads than in 2022, following an extra £2 billion spend by companies that carry out essential roles in the economy, from local trades to retailers and online delivery services.1 December was particularly strong, with demand up 36.1% – the best total for the month since 2015.2 As a result of rising vehicle investment across the year, 2023 saw the highest demand for new vans since the sector’s post-pandemic bounceback in 2021, with the market just -6.6% below 2019 levels.3

Popular demand for the largest vans (weighing more than 2.5 tonnes to 3.5 tonnes) continued, rising 9.4% to 228,442 registrations – with these models representing 66.9% of all new vans as operators opted for payload efficiencies. The largest growth in volume was for medium-sized vans (weighing above two tonnes to 2.5 tonnes), surging by 78.4% to 57,992 units, with such vehicles still able to carry heavy loads while at the same time delivering the smaller vehicle size requirements of urban operators. Demand for pickups and 4x4s also rose, by 38.7% and 127.7% to 41,003 and 8,063 units respectively, while registrations of the smallest vans (weighing equal to or less than two tonnes) declined by -23.7% to 5,955 units.

Positively, uptake of new battery electric vans (BEVs) hit record volumes in the year as volumes grew by 21.0% to 20,253 units – with some 28 different models registered – representing 5.9% of the market. The year ended on a high as BEV uptake jumped 73.8% to 2,964 units in December, with the very greenest vehicles representing 10.0% of registrations in the month – the second highest ever monthly BEV share.4 It means that since 2019, some 58,226 BEVs have joined UK road, helping make the UK the third largest BEV market in Europe by volume – but behind several other European nations by market share, including Germany, France and Spain.5

With the ambitious Zero Emission Vehicle Mandate now in place, however, 10% of every van manufacturer’s sales in the UK must be BEVs this year. Given the market share of BEVs flatlined last year compared with 2022, ensuring LCV demand matches supply presents a major challenge. Immediate action to reduce existing barriers to BEV uptake is crucial, therefore, with the single biggest obstacle being the insufficient number of van-suitable public chargers – requiring significant infrastructure investment in every UK region. At the same time, a long-term commitment to the Plug-in Van Grant will be necessary to make the switch accessible and equitable for operators across all sectors and parts of the country.

Mike Hawes, SMMT Chief Executive, said,

Rising demand for new vans in every month of 2023 – along with record uptake of battery electric vans – is positive news for the UK, given the vital role of these vehicles in keeping businesses and the economy moving. Demand for new vans is also essential for decarbonisation and, as the UK’s ambitious mandate for electric van sales comes into effect, every lever must be pulled to make the switch accessible for fleets in every region. If 2024 is to be the year of the electric van, investment in chargepoint infrastructure is mission-critical – bringing with it the successful green transition and economic growth the nation needs.

Notes to editors

1 Based on JATO average new van retail price in 1H 2023 (extra £2.4bn to £13.8bn retail value).

2 UK new LCV registrations, December 2015: 30,410 units.

3 UK new LCV registrations, 2021: 355,380 units; 2019: 365,778 units.

4 BEV market share, February 2022: 10.8%.

5 According to the latest ACEA data for Europe’s new commercial vehicle registrations up to Q3 2023.