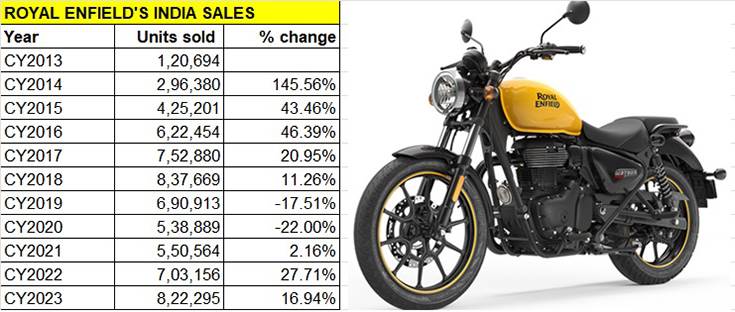

Chennai-based midsize motorcycle market leader Royal Enfield, which yesterday signed an MoU with the Tamil Nadu government to invest Rs 3,000 crore in brownfield and greenfield projects for electric and ICE models, has sold 822,295 bikes in CY2023 in the domestic market. While this total constitutes a 17% year-on-year increase over CY2022’s 703,156 units, it has missed beating the company’s best-ever annual sales of 837,669 units in CY2018 by 15,374 units.

A deep dive into decadal wholesales data reveals that CY2023 is the second year in which Royal Enfield has surpassed 800,000-unit sales, after breaking into the big number in CY2018 for the first time (see 10-calendar-year sales data below).

At 822,295 units in CY2022, Royal Enfield registered 17% YoY growth but missed beating CY2018’s 837,669 units by 15,374 units.

At 822,295 units in CY2022, Royal Enfield registered 17% YoY growth but missed beating CY2018’s 837,669 units by 15,374 units.

CY2018 was, of course, a big year for India Auto Inc when it recorded total sales of 3.39 million units, up 5 percent. In the two-wheeler market, motorcycles with 13,794,510 units or 13.79 million units recorded handsome 15.59% YoY growth, of which Royal Enfield (822,295 units / up 11.26%) accounted for a 6% percent share.

The next couple of years saw RE’s annual sales fall to 690,913 units and to their lowest in the past four years in the Covid-impacted CY2020 (538,889 units). Since then, the company has bounced back on the back of new models and a resurgence in the market for premium, high-powered motorcycles. CY2022 saw demand rise substantially by 28% to 703,156 units and surpassed the 800,000-unit mark in CY2023. And it is headed in the same direction in the ongoing fiscal year.

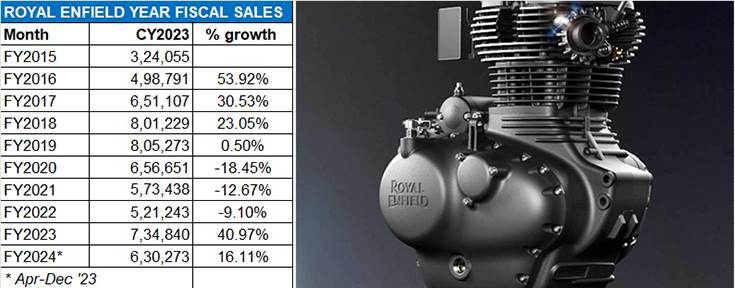

RIDING TOWARDS 800,000-PLUS SALES IN FY2024

As in CY2023, the strong sales momentum continues for Royal Enfield in the fiscal year. In the first nine months of FY2024, the company has dispatched a total of 630,273 units, which makes for 16% YoY growth (April-December 2022: 542,818 units). Festive October 2023 with 80,958 units has been the best month in CY2023 as well as the ongoing fiscal.

RoyaL Enfield has, at present, nine models in the domestic market – Bullet 350, Classic 350, Hunter 350, Meteor 350, the 411cc-engine powered Scram 411 and Himalayan adventure bikes, the 650cc twins (Interceptor 650, Continental GT 650) and the Super Meteor 650.

The midsize motorcyle market leader has averagd monthly sales of 70,030 units in the April-December 2023 period. With three months to go for FY2024 to come to an end, RE looks well set to surpass the 800,000-unit mark again.

Sales of the 350cc models in the April-November 2023 period, as per SIAM industry wholesales data, were 525,300 units, up 18.42% YoY (April-November 2022: 443,554 units). The 411cc Himalayan adventure bike saw dispatches of 25,843 units, down 3.85% (April-November 2022: 26,878 units). Demand remains strong for the 650 Twins as well as the Super Meteor – the 21,839 units sold in the first 9 months of FY2024 are a handsome increase of 74% YoY (April-November 2022: 12,565 units)

With three months still to go for FY2024 to close and Royal Enfield having averaged monthly sales of 70,030 units in the April-December 2023 period, an 800,000-plus score is there for the asking for the midsize motorcycle market leader, despite the growing competition in this segment in India.

While Royal Enfield’s existing plants in Oragadam and Vallam Vadagal have a combined manufacturing capacity of over a million units per annum and capable of meeting growing demand for the next few years, the expected recovery in the domestic two-wheeler market, RE’s aggressive global expansion and diversification into EVs calls for the company to be future-capacity-ready.