India Auto Inc has had a good CY2023 with OEM dispatches nearing the 23 million-units mark as a result of all four vehicle segments recording good growth. Last year saw passenger vehicle wholesales soar to a record 4.1 million units and three-wheeler sales jump 63% YoY to 680,550 units.

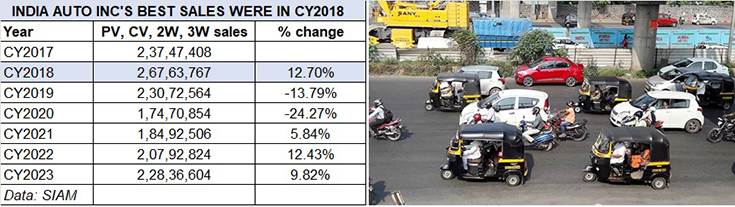

Nevertheless, seen in the context of the past five years, CY2023’s total vehicle sales are still 17% down and 39,27,163 units away from what was India Auto Inc’s best year yet – CY2018 with 2,67,63,767 units (see data table below). In CY2019, demand fell 13% to 23 million units, fell sharply by 24% in the Covid- and lockdown-impacted CY2020 to 17.47 million units but has since recovered.

CY2023’s 22.83 million units constitute 10% growth but are 17% down and 39,27,163 units away from CY2018”s 2,67,63,767 units.

India Auto Inc has entered CY2024 on a strong note. Combined sales of passenger vehicles, two- and three-wheelers and commercial vehicles at 2,28,36,604 or 22.83 million units were a 10% increase over CY2022’s 2,07,92,824 units.

As per the data released by apex industry body SIAM (Society of Indian Automobile Manufacturers) today, all the four vehicle segments have witnessed good growth with passenger vehicles up 8% to a record 41,01,600 or 4.10 million units, two-wheelers up 9% to 1,70,75,160 or 17 million units, three-wheelers up 63% to a best-ever 680,550 units and commercial vehicles by 5% to 978,385 units.

Utility vehicle sales power PV demand to a record 4.10 million units

As has been apparent over the past two years, the surging demand for utility vehicles (UVs) continues to be the growth accelerator to overall sales of the PV (cars, UVs and vans) segment.

Total PV sales at 41,01,600 units were up 8% and the best yet for the segment but that’s thanks to the massive demand for UVs which, at 23,53,605 units, registered robust 22% YoY growth on a high year-ago base (CY2022: 19,22,805 UVs). This sterling performance sees the UV share of PV sales rise to 57% from the 50.70% they had in CY2022. What’s more, UVs continue to buffer the continuing downturn in sales of passenger cars (hatchbacks and sedans) which at 16,01,873 units were down 8% on CY2022’s 17,37,171 units.

The PV segment’s best-ever year of sales was a result of a number of OEMs recording strong growth, particularly those armed with a strong UV portfolio. Maruti Suzuki sold 1.7 million units, up 8%, and accounted for 41.63% of the PV market. However, at 17,07,668 units, it missed beating its best-ever calendar-year sales of 17,31,450 units in 2018 by a mere 23,782 units.

Meanwhile, a number of other car and SUV makers achieved their best-ever annual sales in CY2023. They include Hyundai Motor India (602,111 units, up 9%), Tata Motors (550,838 units, up 5%), Mahindra & Mahindra (433,172 units, up 29%) and Toyota Kirloskar Motor (221,356 units, up 38%). What’s common to all its their strong UV portfolio and ramped-up production as a result of eased-up supply of semiconductors.

Two-wheeler industry clocks 17 million units, up 9%

The Indian two-wheeler industry, which has felt the heavy impact of slowed-down sales of entry-level motorcycles, which are the bi volume sellers, for over two years now is beginning to see demand grow in this affordable segment, what with demand from rural India beginning to kick in.

In CY2023, this segment clocked total sales of 1,70,75,160 units, which is 9% growth over the 1.56 million units in CY2022. This is thanks to Hero MotoCorp (53,29,568 units / up 6%), Honda Motorcycle & Scooter India (40,78,370 units / down 4%), TVS Motor Co (30,39,436 units, up 24%), Bajaj Auto (21,07,049 units / up 21%), Suzuki Motorcycle India (862,759 units / up 22%) and Royal Enfield (822,295 units, up 17%).

Strong as CY2023’s sales are, they are still 45,70,009 or 4.57 million units less than India Two-Wheeler Inc’s best-ever annual sales in CY2018: 2,16,45,169 units. CY2018 had seen record sales in all three sub-segments – scooters (6,962,083 vs CY2023’s 55,74,27 units), motorcycles (13,794,510 units vs CY2023’s 1,10,34,166 units, and mopeds (888,576 units vs CY2023’s 4,66,724 units).

Three-wheeler sales soar 63% to 680,550 units but 37,734 units short of record CY2018

With fast-growing demand for both people as well as last-mile delivery transportation, the three-wheeler industry is seeing a strong rebound in its fortunes. At 680,550 units, its CY2023 wholesales were a handsome 63% increase on CY2022’s 418,510 units. There is also a growing shift towards electric mobility in this segment and 39,106 units were EVs, accounting for 5.75% of total three-wheeler sales (from SIAM member companies).

Bajaj Auto is the leader in this segment with a commanding market share of over 75%, followed by Piaggio Vehicles, Mahindra Last Mile Mobility, TVS Motor Co, Atul Auto and Continental Engines.

Commercial Vehicle sales up 5% to 978,385 units

What’s good news for the commercial vehicle industry is that thanks to mega investments by the Central and state governments as also the private sector in infrastructure projects across the country, the critical M&HCV (medium and heavy CV) segment is witnessing strong growth. At a total of 380,812 units, M&HCV sales in CY2023 were up 14% YoY. Overall CV sales at 978,385 units were up 5% YoY but would have been higher if the overall numbers weren’t pulled down slightly by the decline in sales for light goods carriers even while light passenger carrier (buses / vans) sales rose by 36% to 547,119 units.

However, CY2023’s total sales of 978,385 units are 26,995 units less than the CV industry’s best-ever annual sales of 10,05,380 units in CY2018, when the million-units milestone had been surpassed for the first time.

Outlook for CY2024: sales momentum to continue with strong domestic consumption

Commenting on India Auto Inc’s performance, Vinod Aggarwal, President of SIAM, said:, “CY2023 has been a satisfactory year for the Indian automotive sector with the PV industry having reached a significant milestone by crossing a million units by Q3 of FY2024. Although there is a strong recovery in the two-wheeler segment, the volumes are still lower compared to the CY2016 levels.”

“The three-wheeler segment which caters to the last-mile mobility needs posted strong growth last year, whereas the growth in CVs has been driven by M&HCVs, indicating a strong economic performance and continued infrastructure development in the country.”

“The industry is confident that the overall growth momentum will continue in CY2024 as well. The Indian economy is more resilient than other markets, and with the GDP growth outlook remaining positive, there is a good reason for the country’s automotive sector to grow further.”

“As far as the Red Sea crisis is concerned, the government of India has taken critical action, and there is stronger surveillance in the region. With more surveillance and control, things should be smooth, despite risks being there. With respect to geopolitical challenges, we do not see any major impact, and while there has been a drop in exports, it is being compensated by the strong consumption in the domestic market,” he concluded.