Of the 17.78 million (1,77,80,852 units) vehicles India Auto Inc dispatched as wholesales in the first nine months of FY2024, three-wheelers accounted for 5,26,905 units or just a 3% share but this vehicle segment is seeing growing demand, particularly in view of the shift towards electric mobility and lower cost of ownership. The three-wheeler segment is split into passenger-carrying and goods-transporting vehicles.

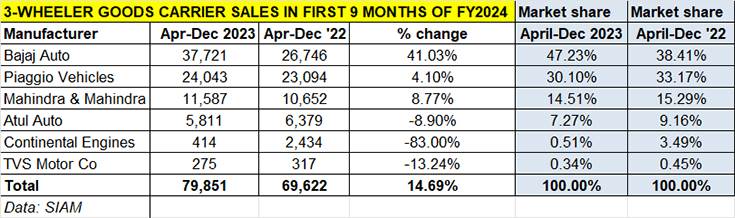

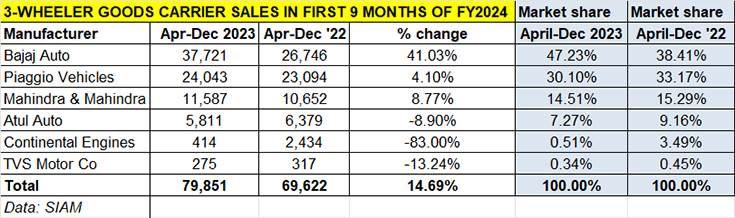

Compared to passenger-carrying three-wheelers (4,17,706 units, up 70%), total sales of good-carriers were more modest – 79,851 units, up 15% – in the April-December 2023 even as their applications are as important in the overall scheme of things.

Of the six OEMs, Bajaj Auto, Piaggio and Mahindra have registered YoY growth but Bajaj is the only one to have increased its market share in the expanded market, indicating that it is also eaten into rivals’ market share.

The boom in e-commerce and last-mile deliveries is having a positive impact on demand for goods-carrying three-wheelers, particularly those needed for urban operations. Easily manoeuvrable, they can navigate tight roads and also enter locations where four-wheelers would fear to tread. It also helps that the newer models of three-wheelers are designed and/or customised to handle such duties. And the demand is coming from logistics operators too.

Bajaj Auto, which took leadership of the three-wheeler goods carrier segment in October 2021, has maintained its numero uno status. With sales of 37,721 Maximas, the company has posted 41% YoY growth (April-December 2022: 26,746 units). This strong performance has resulted in the company increasing its three-wheeler goods carrier market share by nearly nine percentage basis points – to 47.23% from 38.41% a year ago.

What has benefited the segment and Bajaj is the market shift to cheaper CNG (Rs 76 a kg in Mumbai) from the more expensive diesel (Rs 94.25 a litre) is benefitting the Bajaj Maxima which is available in diesel, CNG, LPG and more recently electric.

Bajaj Auto’s entry into the electric three-wheeler market in June with the Maxima XL Cargo E-Tec 12.0 would have helped accelerate overall sales. Priced at Rs 377,391 (ex-showroom Pune after FAME II subsidy), the Bajaj EV develops 5.5 kW power and 36 Nm torque, has an 11.8 kWh lithium-ion (LFP) battery which provide range of 183km per charge. Top speed is 40kph, with the Maxima XL Cargo E-Tec 12.0 taking 5 hours 40 minutes for a full charge, and 80% in four hours.

Piaggio Vehicles has registered wholesales of 24,043 units in the first nine months of FY2024, 949 units fewer than it sold in the year-ago period (April-December 2022: 23,094 units). Like Bajaj Auto, Piaggio too has its cargo range with multi-fuel variants – diesel (599cc & 435cc Ape Xtra), CNG (Ape Xtra HT, 230cc Ape Xtra LDX) and its electric three-wheelers. The company is currently a good 13,678 units behind the market leader but expect the battle between the top two players to turn more intense in the coming months.

Mahindra & Mahindra, with sales of 11,587 units in April-December 2023, posted 14.51% YoY growth. The company has three models in the goods carrier market – the e-Alfa (CNG, diesel, electric) and the electric Treo Zor and Zor Grand. Of the three electric models, the 310kg payload e-Alfa cargo has a range of 96km, Zor Grand (400kg payload) a range of 100km and the Treo Zor 80km range with a 500kg payload. According to Mahindra, the Treo Zor has a lower maintenance cost of 11 paise per kilometre and offers savings of Rs 100,000 per year. And that the Zor Grand can help a user save up to Rs 600,000 in ownership costs over a five-year period when compared to a diesel-engined cargo three-wheeler and up to Rs 300,000, versus a CNG cargo three-wheeler.

Three-wheeler goods carrier sales headed for record sales in FY2024

The three-wheeler goods market, like its passenger-transporting sibling, is witnessing changing dynamics over the past four-odd years. There continues to be a consumer shift from diesel-engined products to CNG to benefit from the lower operating costs, and more recently operators are realising the even more wallet-friendly gains from going electric.

With three months to go for FY2024 to come to a close, the three-wheeler goods carrier industry has already achieved 82% of FY2023’s 97,540-unit sales and 95% of FY2022’s 84,032 units. With sustained demand for transport of small goods across India, will this vehicle sub-segment, like other segments, headed for record sales in the ongoing fiscal. With this segment currently averaging monthly sales of 8,872 units, it could be surmised that the FY2024 total could go past the 100,000-units mark for the first time.

ALSO READ:

CY2023 wholesales rise 10% at 22.8 million units but still below 2018’s record 26.7 million units

Auto retails increase 11% in CY2023 to 23.8 million units, all segments record growth