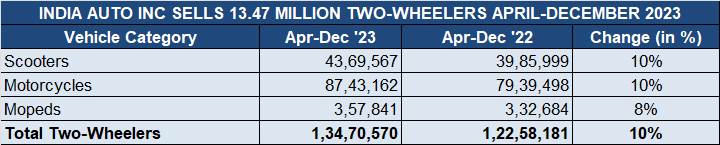

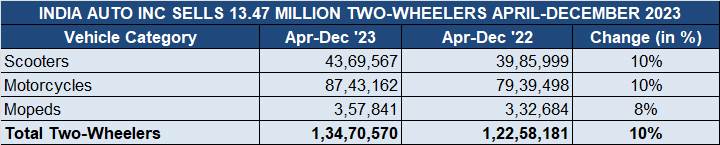

India’s two-wheeler sector is back on growth road. Latest wholesales numbers released by industry body SIAM for the April-December 2023 period show that OEMs dispatched a total of 13.47 million units, up 10% on the 12.25 million units in the year-ago period. And the growth is across all three sub-segments: scooters, motorcycles and even mopeds. Interestingly both scooters and motorcyles have logged in similar 10% YoY growth. This analysis looks closely at only the scooter market.

Scooter sales accounted for a 32% share of the overall two-wheeler market (43,69,567 units). Motorcycles (87,43,162 units), where demand for commuter bikes is returning from rural India, had a 65% share while mopeds (3,57,841 units) had a 2.65% share.

At 4.36 million units, scooters accounted for 32% of total two-wheeler sales.

At 4.36 million units, scooters accounted for 32% of total two-wheeler sales.

That most scooter OEMs are benefiting from the return of demand is clear because of the 10 SIAM member OEMs which make scooters, only two (Piaggio and Okinawa) saw YoY declines (see sales data table).

The nine-month cumulative wholesales of 43,69,567 units are already 84% of FY2023’s 51,90,018 units and have surpassed FY2021’s 41,12,672 units.

An additional 383,568 units were sold between April-December 2023 and April-December 2022.

HOW THE MANUFACTURERS FARED

Scooter market leader Honda Motorcycle & Scooter India (HMSI), whose third assembly line at its scooter-only plant in Gujarat went on stream earlier this month and adds capacity of 650,000 units per annum, sold 1.92 million scooters in April-December 2023, 29,150 units more than it did in the year-ago period and up 2 percent. HMSI’s current market share is 44%, down from the 47.51% it had a year ago.

Honda Motorcycle & Scooter India (HMSI), which sells the best-selling brand of Activa scooters, has 1.75 million units to its credit, 20,232 units fewer than a year ago and down 1% YoY. This sees HMSI’s scooter market share reduce to 44.28% from the 48.11% it had a year ago.

TVS Motor Co with 1.08 million units registered 16% growth, which helps increase its market share to 25% from 23% a year ago. While the Jupiter continues to be its best-seller, followed by the NTorq 125, the iQube electric scooter has contributed 144,126 units to its overall scooter sales, which works out to be a 13.31% EV share.

Suzuki Motorcycle India also has seen strong growth – its 648,282 units are a 24% YoY increase and give the company a market share of 15% compare to 13% a year ago.

In fourth rank is Hero MotoCorp with 309,450 units, up 10% and a market share of 7%. India Yamaha Motor with 210,064 units, saw demand rise 38% YoY, a strong performance that enables its scooter share rise to nearly 5%, up from 3.81% a year ago.

There’s a see-saw battle underway for the fifth and sixth spots between two electric-only scooter makers – Bajaj Auto and Ather Energy.

At present, Bajaj Auto, which is seeing strong demand for its Chetak (which completed 4 years of its market presence on January 14, 2024) has sold 75,999 units (up 188% on a low year-ago base) in the first nine months of FY2024, which gives it a market share of 1.73% compared to just 0.66% a year ago.

Just 3,157 units behind Bajaj Auto is Ather Energy with 72,842 units and 36% YoY growth. Its scooter market share has risen marginally to 1.66% from 1.44% a year ago. Ather recently slashed the price of its entry-level 450S by Rs 20,000 to Rs 109,000, a move which should see its sales accelerate and also take on the base models of the Bajaj Chetak Urbane, TVS iQube and the Ola S1 Air.

The electric two-wheeler market leader though is Ola Electric, which is not a SIAM member company and thus not present in the data table.

With eight of the 10 scooter OEMs registering YoY sales increases, the growth momentum has returned to this segment.

With eight of the 10 scooter OEMs registering YoY sales increases, the growth momentum has returned to this segment.

SCOOTER INDUSTRY RIDES TOWARDS 5.5 MILLION UNITS IN FY2024

Average monthly scooter sales for the April-November 2023 period are 485,550 units. With three months left for FY2024 to end and if the sales momentum continues at the same pace, India Scooter Inc could go on to reach total sales of around 5.6 million units or more in FY2024.

While FY2023’s 5.19 million scooters is set to be surpassed soon, will FY2024 sales surpass the FY2020 total of 5.5 million units (55,66,036 units)?The scooter industry’s fiscal benchmark though remains the record 6.71 million units (67,19,811 units) of FY2018.

While there is no doubt that the domestic market scenario is much improved since a year ago, the scooter market in tandem with motorcycles is yet to see fulsome demand come its way. The cost of two-wheeler ownership has increased over the past year and the demand in the critical entry-level segment continues to be impacted. However, along with India’s much-improved economic climate, the green shoots of recovery in rural India are welcome news for India Auto Inc, which should see sustained demand in CY2024.

ALSO READ:

Auto retails increase 11% in CY2023 to 23.8 million units, all segments record growth