India has retained its position as the third largest car market in the world in 2023. In what was a close finish to No. 3 position, Japan made a resounding comeback in 2023, registering growth of 14% growth in 2023 as against India’s 8 percent.

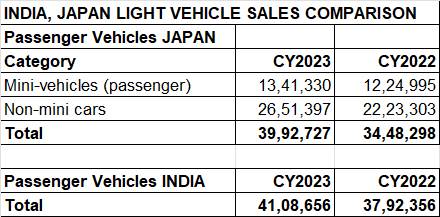

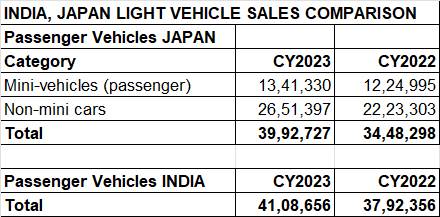

Japan ended the year a shade below 4 million units, whereas India sold 4.11 million units last year. The gap between India and Japan has reduced from 344,000 in 2022 to 115,000 units in 2023.

From the sizeable difference of 344,058 PVs in CY2022, Japan has reduced the gap with India sales to 115,929 units in CY2023.

“With its growing and young population, economic growth and rising motorisation levels India has seen a steady growth in its passenger vehicle (PV) industry in the last three decades. This has catapulted India to the No. 3 in PV volumes rank behind only China and US. Expectedly, this trend should continue in the future as well,” said Shashank Srivastava, senior executive officer, Sales and Marketing at Maruti Suzuki India.

This was a third consecutive year of growth for India, hitting a new peak in 2023. Much like matured markets, SUVs stole the show with a share of over 48% of total passenger vehicle sales in the country.

Despite the narrow finish, India is likely to keep its lead on the passenger vehicle sales and its stakes in global scheme of things is only going to grow.

India’s growing role in global markets

Reviewing 2023, Felipe Munoz, global automotive analyst at JATO Dynamics, told Autocar Professional that Japan is finally recovering from the pandemic and shortage of components and hence the demand is returning. Japan grew faster than India in 2023, but the gap between both the countries are narrowing.

Regardless of the ranking, Munoz says, “There is a positive trend of the Indian market. We will continue to see increasing role of India in the global markets. Unlike the developed markets like Japan, North America and Europe, India is still an emerging one so we expect important growth rates in the coming years if the policy and the government intervention continue to be as healthy as it was in 2023.”

But if one were to include exports and small commercial vehicles and vans, Japan has a sizeable lead over India.

In terms of output of light vehicles, India registered growth of 6.8% in 2023 with volumes of 5.45 million units, as per S&P Global Mobility.

On the production front, India is expected to go ahead of Japan only in 2030.

India still significantly trails Japan from the production perspective for light vehicles and it is only in 2030, India will overtake Japan as the third biggest light vehicle producer in the world, says Gaurav Vangaal, associate director – S&P Global Mobility.

“We expect Japan to post 8.59 million units in 2023, while India is at 5.45 million. As per our latest forecast, we now expect India to become third largest LV manufacturer country only by 2030, surpassing Japan,” added Vangaal.

Over the last few years, India’s share in global light vehicle production has increased from 4.4% in 2020 to 6.1% in 2023, as per S&P Mobility.

Made-in-India exports critical for future growth

Exports are critical for scale as well as imagery, say experts. Vangaal expects light vehicle exports to cross the one-million units mark only by the end of the decade.

“Indian exports are expected to increase rapidly from 2025. Today, almost every carmaker in India is strategizing to utilise India as an export hub, a trend we have also noticed with capacity expansion by almost every carmaker. India is going to add multiple new vehicles, new EVs & new destinations to its exports in this decade,” he added.

The guidance from S&P Mobility appears modest, given that PV market leader Maruti Suzuki itself has issued a guidance for tripling of exports to 750,000 units by 2030. Also, with the likes of Hyundai, Kia, Renault-Nissan and Volkswagen-Skoda upping the ante on exports, India is set to play a bigger global role in the years to come.

Furthermore, new-age players like Tesla and VinFast along with India’s Tata Motors and Mahindra & Mahindra, who are harbouring global ambitions, India’s stake should surely move up further.

According to S&P Global Mobility’s output forecast for India, the share of the country in the global industry volumes will increase to almost 8 percent. This is almost double of the share India had of around 4 percent just ahead of the Covid-19 pandemic.

“With the increase in domestic market and increased exports from India. We expect Indian LVP contribution to increase from 4.4% in 2020 to 7.6% in 2030 Additionally, there are multiple new entrants like Tesla, Vinfast, Foxconn, which could notably further enhance the contribution in the years ahead, if they enter the Indian LVP market,” believes Vangaal.

Global ride challenging: India needs to finds its USP for overseas drive

For the further increased role of India in the global scheme of things, Munoz is of the opinion that India needs to find its differentiating factor so it can successfully sell its locally made cars outside India.

Even on the electrification front, India is lagging and faces emerging competition from the likes of Indonesia in the South East and Saudi Arabia in the Middle East, who are pitching themselves as key hub for future exports.

While there is little doubt that India has big potential in terms of size, it needs to connect with the world standard and also find a differentiation when it comes to cars for the emerging markets, points out Munoz.

“If India wants to really play an international role, it has to catch up, move faster and find different ways of doing it by making use of its increasing technology, because India is investing a lot on technology and software, and make use of its still cheap labour cost, which is something that the developed economies don’t have,” states Munoz.

At present, global competition is centered around vehicle electrification, and Vangaal sees that Chinese carmakers are giving stiff competition to Japanese carmakers in almost every regional market (Australia, Japan, ASEAN).

“However, as of now, we do not see Indian players to make any significant impact in such global competition,” he added.

In its January 1, 2024 print edition, Autocar Professional reported that almost every car maker present in India has plans to localize EVs in the country and also export them around the world. Earlier this month, at the Vibrant Gujarat Summit, Maruti Suzuki announced plans to begin will shipping its EVs from the state by the end of the year to markets like Japan and Europe.

While Honda Cars India will ship a vehicle based on its Asian Compact Electric project back to Japan, Skoda Auto Volkswagen India too has begun work on is PEAK EV project in the country for export to both brands’ global markets from India.