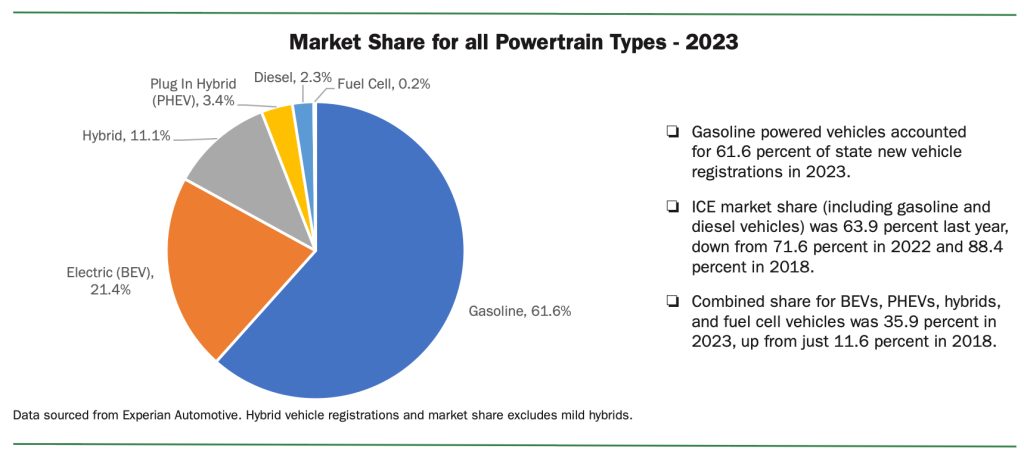

California hit a new record last year with 21.4% of new cars being all-electric, and once again Tesla led the pack with the two best-selling cars in the state, the Tesla Model Y and Tesla Model 3. But Toyota narrowly maintained its leadership as the top-selling brand in the state, with Tesla nipping at its heels.

The data was released yesterday by the California New Car Dealer’s Association (CNCDA) in their quarterly Auto Outlook. This was the Q4 and full-year report, reflecting on trends in auto sales for the full year in the state that leads the US in EV sales.

Compared to a national market share of 7.5%, EVs commanded 21.4% of sales in California. But just a couple years ago, California was down at ~7% of new EV sales, while the rest of the country was at ~2% – so we like to check in on CNCDA’s data every quarter to get a look at where the trends for the rest of the country might be going soon.

But California’s share of nationwide BEV registrations was down. Not long ago, California accounted for more than half of the EVs in the United States, but in 2023 California accounted for 33.8% of US BEV sales. This means that the rest of the country is picking up pace in EV sales, and that EVs are no longer the sole purview of California. This is an expected trend, but a welcome one – we don’t need California to keep hogging all the health benefits of EVs.

Leading the pack, as expected, were Tesla’s vehicles. The Model Y and Model 3 both outsold the competition by a wide margin – with Model 3 holding a 15.3% share in passenger cars (a 61% lead over the Toyota Camry, which had previously been the best-seller in California for decades) and Model Y holding a 10.8% share in light trucks, more than double its highest challenger, the RAV4, with a 4.7% share.

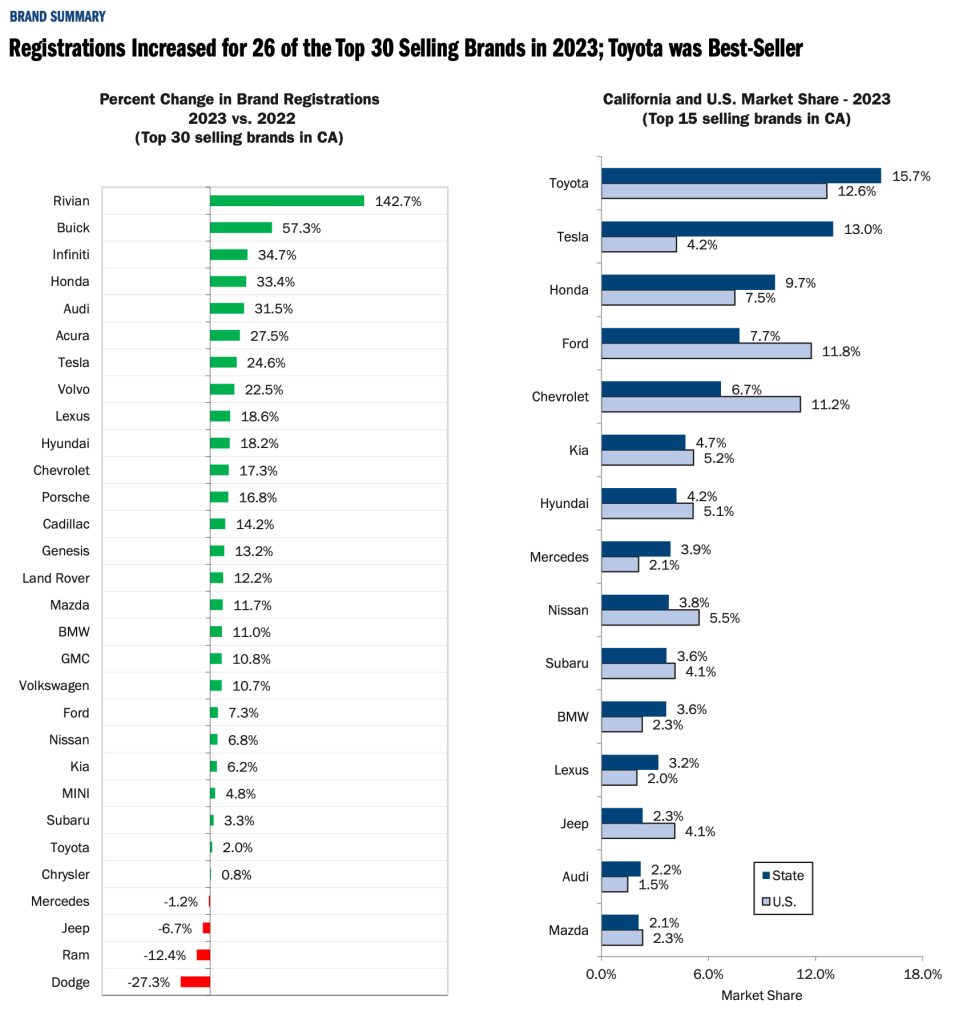

However, since Tesla only has a few models and Toyota has many, Toyota still maintained the crown for most sales in California. Toyota had a 15.7% market share for the whole year, and Tesla had a 13% market share, with Honda in third place at 9.7%.

13% means that one out of every 8 vehicles sold in California last year was a Tesla – from a company in just its 15th year of selling cars anywhere. Earlier in the year, it even looked like Tesla might be able to beat Toyota in California, as Tesla did outsell Toyota in Q2, but Toyota took back the crown in Q3 and maintained it in Q4.

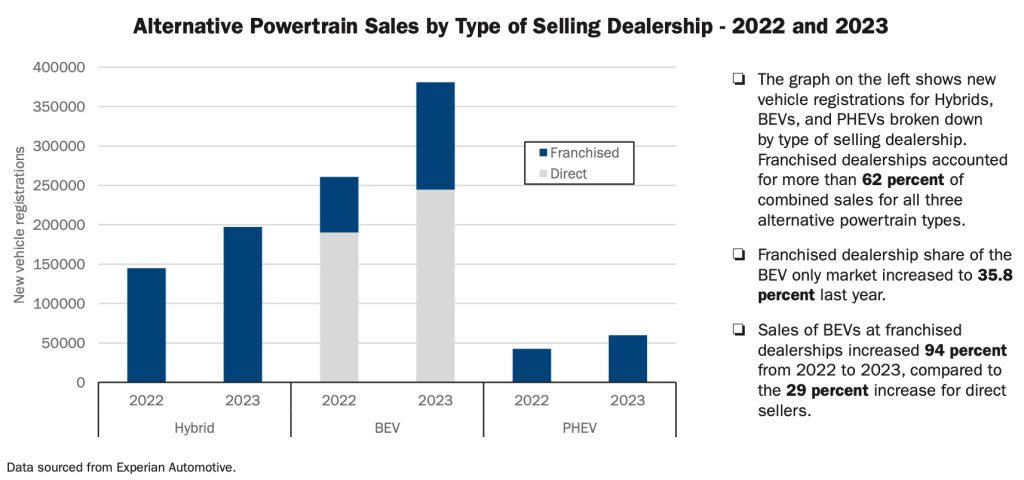

One particularly interesting graph in the report is the share of alternative powertrain vehicles by type of dealership – Direct or Franchised. In this case, “Direct” refers to dealerships owned by the automaker in question, the vast majority of these sales coming from Tesla.

But in the chart we can see an increasing number of BEVs being sold by franchised dealers, as other manufacturers have finally gotten their BEV programs off the ground and are now selling a variety of vehicles, many of which only hit the market in the last model year or two. A majority of BEVs were still sold direct, but franchised dealer sales are catching up.

Between BEVs, PHEVs, and FCEVs, a full quarter of vehicles could access some sort of dedicated non-combustive energy source. Adding hybrids into the mix (you know, the cars that Toyota loves to pretend are electric, even though they aren’t), 35.9% of vehicles had an electric motor in them.

This was on the back of a tick down in EV share quarter over quarter, from 22.3% to 21.1%, and a tick up in hybrid share, from 11.7% to 13.3%. Plug-in hybrid share held roughly steady at 3.6%, up from 3.4%. Plug-in hybrids were buoyed by the exceptional popularity of the Jeep Wrangler PHEV, which is the 4th-best-selling car in the state with a plug on it, behind the two Teslas and the outgoing Chevy Bolt. The Wrangler PHEV outsold the RAV4 Prime almost two to one.

Tesla maintained its position as one of the companies with the best sales growth over the course of the year, up 24.6% from the previous year. Though this level of growth was lower than it has been in the past. With Tesla already being well established in California, it’s inevitable that growth percentages will slow down over time – or perhaps California, moreso than other states, is getting tired of Tesla CEO Elon Musk’s nonsense.

Tesla’s share of California’s BEV market dropped from 71% to 60.5%, another expected result of other vehicles entering the market. This was still higher than Tesla’s share of the overall US EV market, which stood at around 55% for the year.

But the winner in terms of sales growth was Rivian, which saw a 142.7% increase year over year. Big numbers like this are to be expected out of a new company with new models, but Rivian’s ramp up in production and sales this year was impressive nonetheless, with the company even raising (and then beating) production guidance during a year when media spent a lot of time falsely claiming that EV sales were down.

And on that point – in 2022, EVs made up 16.4% of the EV market in California, whereas in 2023 they made up 21.4%. That certainly looks like an increase to me, not a decrease. Meanwhile, one media narrative we haven’t heard much of is how ICE car sales actually are not growing. While auto sales as a whole were up in California by 11.9% in 2023, that’s because 190k more “electrified” vehicles (BEV/PHEV/HEV) were sold in 2023 than 2022, for a 2023 total of ~638k, whereas sales of pure combustion vehicles were flat at ~1.1 million. So in a year where the auto industry saw a significant recovery, most of that recovery, at least in California, was led by rising electric vehicle sales.

FTC: We use income earning auto affiliate links. More.