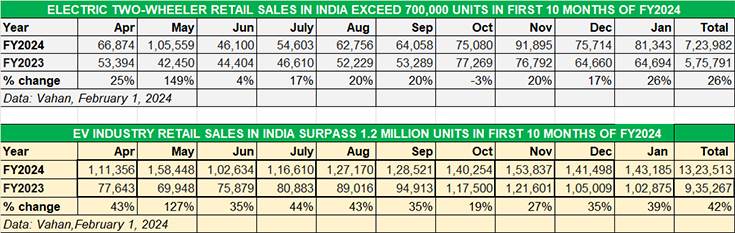

Maintaining the strong growth trajectory witnessed in CY2023, electric two-wheeler manufacturers have sold a total of 81,343 units in January 2023, recording strong 26% year-on-year growth (January 2023: 64,694 units). This data is as per 5am on the Vahan website on February 1, 2024.

Cumulative sales for the first 10 months on FY2024 at 723,982 units are up 26% YoY (April 2022-January 2023: 575,791 units). This is just 4,253 fewer units that the 728,235 units sold in entire FY2023. If the pace of sales is either maintained for the next two months or accelerates in March, FY2024 could see India E2W Inc clock total retails in the region of 900,000 units, setting a new fiscal record and achieving 24% growth over FY2023.

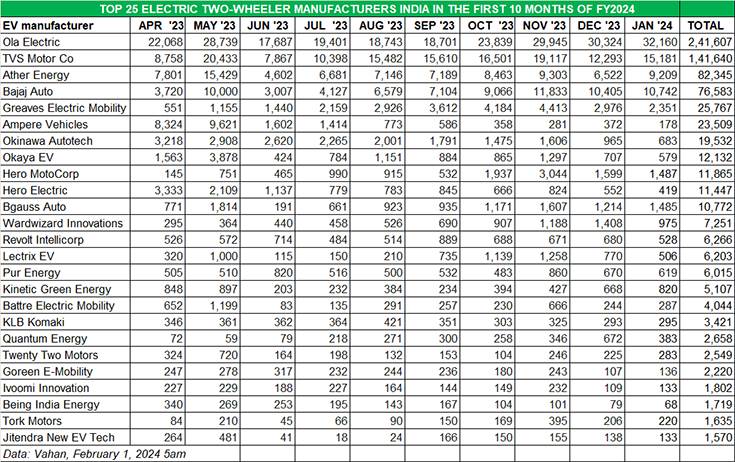

In a field comprising nearly 180 players, five OEMs continue to be the market toppers – Ola Electric, TVS Motor Co, Ather Energy and the Greaves Electric-Ampere Vehicles combine. This quintet accounted for 69,643 units or 86% of total retails in January 2024 and 591,451 units or 82% of total retails in the April 2023-January 2024 period. Interestingly, all of them have their manufacturing plants in Tamil Nadu.

In a field comprising nearly 180 players, five OEMs continue to be the market toppers – Ola Electric, TVS Motor Co, Ather Energy and the Greaves Electric-Ampere Vehicles combine. This quintet accounted for 69,643 units or 86% of total retails in January 2024 and 591,451 units or 82% of total retails in the April 2023-January 2024 period. Interestingly, all of them have their manufacturing plants in Tamil Nadu.

With sales of 32,160 units in January 2024 – its best-ever monthly retails – Ola’s market share rose to 39 percent.

With sales of 32,160 units in January 2024 – its best-ever monthly retails – Ola’s market share rose to 39 percent.

OLA ELECTRIC: 32,160 units in January, 39% market share

April 2023-January 2024: 247,607 units

Ola, the first Indian EV maker to sell over 250,000 units in a single year, understandably maintains its commanding lead in FY2024. With sales of 32,160 units in January 2024 – its best-ever monthly retails – Ola has a huge lead over its rivals. Cumulative sales of 247,607 units in the first 10 months of FY2024 mean Ola has averaged handsome monthly retails of 24,760 units. Given the same momentum in February and March, Ola should close FY2024 with record fiscal year sales in the region of 285,000 units or even breach the 300,000 mark.

On December 8, 2023 Ola began deliveries of its all-new S1 X+. Built on the Gen 2 platform, the S1 X+, which has a 3kWh battery, offers a certified range of 151km. Powered by a 6kW motor, the S1 X+ does the 0-40kph sprint in 3.3 seconds and can clock a top speed of 90kph.

Ola recently expanded its S1 portfolio to five scooters. Priced at Rs 147,499, the second-gen S1 Pro is the flagship scooter while the S1 Air costs Rs 1,19,999. Ola has targeted the ICE scooter market with its S1X in three variants – S1 X+, S1 X (3kWh), and S1 X (2kWh).

TVS Motor Co retailed 15,181 units, which gives it a market share of 19%, and takes its cumulative first 10-months’ total to 141,640 units.

TVS Motor Co retailed 15,181 units, which gives it a market share of 19%, and takes its cumulative first 10-months’ total to 141,640 units.

TVS MOTOR CO: 15,181 units in January, 18.66% market share

April 2023-January 2024: 141,640 units

TVS Motor Co continues to maintain its strong growth trajectory and with a single product – the iQube e-scooter. In January 2024, the company retailed 15,181 units, which gives it a market share of 19%, and takes its cumulative first 10-months’ total to 141,640 units.

In CY2023, TVS sold a total of 166,190 iQubes, up a massive 252% YoY (CY2022: 47,185 iQubes) for an EV market share of 19.39 percent. In September, the iQube rode past the cumulative 200,000 sales milestone in 45 months since launch in January 2020. This level of sustained strong growth has helped increase the EV penetration level for the company.

Between April-December 2023, TVS Motor Co sold a total of 23,60,783 two-wheelers in India, of which 144,126 units comprised the iQube which makes for an EV penetration level of 6.10 percent. The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years.

The company, which has expanded its EV sales programme to Nepal and to Europe (from January 2024), is understood to be plotting a series of new EVs targeted at different customer segments with a complete portfolio offering between 5 to 25 kilowatts.

January saw Ather, which saw retail sales of 9,209 e-scooters in January, launch the new 450 Apex at Rs 189,000.

January saw Ather, which saw retail sales of 9,209 e-scooters in January, launch the new 450 Apex at Rs 189,000.

ATHER ENERGY: 9,209 units in January, 11.32% market share

April 2023-January 2024: 82,345 units

India’s No. 3 e-two-wheeler OEM is Bengaluru-based Ather Energy retailed 9,209 units in January 2024, which gives it an 11% market share.

While Ather’s rapid growth has been in tandem with the Indian electric two-wheeler market, with an aggressive Bajaj Auto hard on its heels, it is already begun protecting its turf. Not only has it recently slashed the price of the 450S e-scooter by Rs 20,000 to Rs 109,000 but it also launched the new Apex 450 in early January. Priced at Rs 189,000, the Apex 450 uses the same 3.7kWh battery pack as the 450X but claimed IDC range has gone up to 157km, due to the new regenerative braking system. The company recently received a shot in the arm with early investor Hero MotoCorp set to increase its stake to 39.7% in January 2024.

Ather now plans to roll out its family scooter named Rizta on Ather Community Day, slated to be either in February or March. Expected to be priced between Rs 110,000 and under Rs 130,000, Ather will expand its market reach with the Rizta which will compete with the high-selling TVS iQube, Bajaj Chetak and Vida V1 Pro in the below-Rs 130,000 price category, which benefits from FAME 2 subsidies.

On the network front, Ather at present has over 175 experience centres across India and plans to add another 75 outlets to achieve a 250-showroom network by end March 2024. While it will refrain from going into deep rural areas, Ather Energy is confident that its upcoming products will strengthen its potential in Tier-2, Tier-3, and Tier-4 markets.

With sales of 10,742 units in January, Bajaj outsold Ather for the fourth straight month. On December 1, it launched the new avatar called Chetak Urbane MY2024 (above) with a 113km range and top speed of 73kph

With sales of 10,742 units in January, Bajaj outsold Ather for the fourth straight month. On December 1, it launched the new avatar called Chetak Urbane MY2024 (above) with a 113km range and top speed of 73kph

BAJAJ AUTO: 10,742 units in January 2024, 13.20% market share

April 2023-January 2024: 76,583 units

Pune-based Bajaj Auto, which entered the EV market in January 2020 (just like TVS), has retailed 10,742 Chetaks in January 2024 and a total of 76,582 units in April 2023-January 2024. Demand continues to rise sharply for the Chetak – from 3,790 units in April 2023, monthly sales hit a high of 11,833 units in November.

With its January 2024 sales, Bajaj has outsold the No. 3 EV OEM Ather Energy for the fourth month in a row – clearly, there is a stiff battle underway for this position in the coming months.

On December 1, 2023, Bajaj Auto launched the Chetak Urbane, which costs Rs 115,000 in its standard form, and Rs 121,000 for an additional ‘Tecpac’, which unlocks more features and performance. The company website lists the Chetak Urbane as having slightly higher range (113km) than the current Chetak (108km). However, in the case of the Urbane, this is the IDC-certified range, while for the current Chetak Premium, 108km is its claimed real-world range (its IDC rating is 126km). The new Chetak Urbane gets the same 2.9kWh battery capacity as the current model. The Chetak Urbane utilises the same colour LCD display as the Premium variant. In standard form, the Urbane offers a 63kph top speed, and comes with only one riding mode – Eco. With the ‘Tecpac’ installed, top speed rises to 73kph and the user gets a Sport riding mode as well.

Ramped-up production and an expanded Bajaj Chetak network, currently in 141 cities across India, is to be expanded to 250 cities by March 2024, should make Bajaj Auto a regular entry in the best-selling two-wheeler EVs monthly chart in India.

In terms of monthly sales for January 2024, fifth position goes to Greaves Electric Mobility which clocked sales of 2,351 units. Hero MotoCorp, with 1,487 units sold last month, jumps into sixth rank. It is followed by Bgauss Auto with 1,485 units.

FY2024 e2W RETAILS COULD SCALE A RECORD 900,000 UNITS

While the initial cost of an electric two-wheeler remains higher than its petrol-engined sibling, a growing number of consumers are making the transition to e-mobility due to the EV promise of wallet-friendliness in the long term. Petrol prices (Rs106.29 on January 31 in Mumbai) have remained more or less unchanged since May 2022.

Two-wheeled EV manufacturers are also benefiting from sustained demand for last-mile deliveries from urban India as well as town and country, which is acting as a sales catalyst for e-two-wheelers used for e-commerce and food deliveries. This is thanks to the key advantage stemming from TCO (Total Cost of Ownership), particularly for fleet operators who clock plenty of kilometres each day. Like the aircraft industry, e-vehicles used for fleet operations make money the more they are on the road. It’s a plug-in-plug-out seamless operation for them – while 50% of the fleet would be out on the job, the other half is getting charged, ready to replace their parched brethren when they come in for their ‘juice’ of electricity.

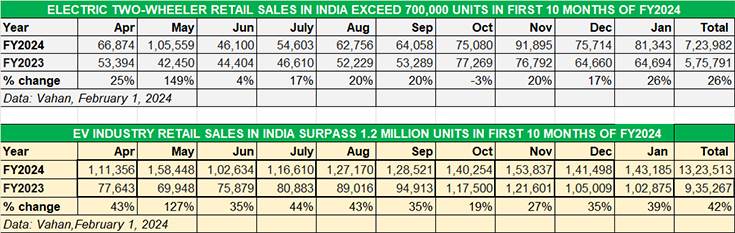

CY2023 saw record retail sales of over 857,000 electric scooters and motorcycles in India, up 36%YoY. FY2023 also saw record retails of 728,235 two-wheeled EVs. Sales in the first 10 months of FY2024 are already 99% of the FY2023 total. Strong sales in February and March 2024 could power the FY2024 total to over 850,000 units, perhaps even nudge the 900,000 mark.

What is creditworthy about this segment’s performance is that, despite the sharp slashing of the FAME II subsidy by 25% in June 2023, sales have rallied back. The fact that 190,800 e-two-wheelers have been purchased at higher prices reflects a growing maturity in the market and a level of resilience, which offers hope to OEMs regarding the FAME II subsidy, which is active at present till March 31, 2024. Or will it get an extension? The jury is still out on that at the moment but suffice it to say that the remaining two months of 2024 should see strong demand come from EV OEMs’ way, both from personal buyers as well as fleet operators. Stay plugged in as we bring you the latest updates on India EV Inc’s speedy zero-emission ride.

ALSO READ:

Over 3.4 million EVs on Indian roads, Maharashtra leads in 2Ws, PVs and buses, UP in 3Ws

TVS iQube e-scooter turns four, sales cross 250,000 units, last 100,000 in 6 months

Bajaj Auto’s electric Chetak turns four years old, sees rapid growth in current fiscal