Despite the turbulence, the current state of the market shows signs of recovery as economic conditions stabilize and improve.

Graphic: Bobit

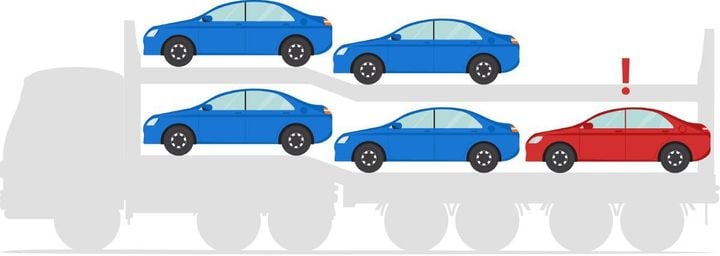

The automotive logistics market is a complex business system that often reflects the broader state of economic conditions. It observes cyclical patterns, heavily influenced by supply and demand dynamics. As we enter 2024, there are signs of change and potential inflection points.

This article will provide a general view of the automotive logistics market. We will journey back to its pre-pandemic state, explore current conditions, and hear from our carriers about their experiences and insights. Finally, I’ll offer a forecast, briefly exploring technology trends in the auto logistics industry.

Traditional Auto Logistics Market

In the past, the traditional auto logistics market was closely tied to overall economic conditions. Factors such as the job market, inflation, interest rates, and consumer spending shaped the industry’s trajectory. However, these patterns have been thrown into disarray over the past three years, due to the pandemic and its associated supply chain issues.

State of the Market

Despite the turbulence, the current state of the market shows signs of recovery as economic conditions stabilize and improve. The job market has gained stability, the inflation rate is declining, and interest rates may be easing. Consumer spending is slowly growing, reflecting a cautious optimism among shoppers.

In the auto logistics sector, we’ve seen excess carrier capacity exit, a correction expected to continue until early into the second quarter. This aligns with the busier summer season that traditionally comes with more demand. New and used vehicle supply continues to recover and with more production comes more work for carriers, inching closer to normal conditions. An increase in rental car activity will also spur demand for fleet logistics services.

Carrier Survey Insights

Ship.Cars recently surveyed our carriers to better understand their expectations and predictions for the year. The survey included questions about carrier pay rates, available loads, fleet changes, and technology investments for 2024.

- Expectations for carrier pay rates: When asked about their expectations for carrier pay rates this year compared to 2023, the response was mostly positive. Most of our carriers anticipate a pay increase, reflecting a stronger market position and higher demand for their services.

- Anticipated availability of loads: Our carriers expressed an overwhelmingly positive outlook compared to last year. They expect that as the economy recovers and consumer spending increases, there will be a corresponding rise in the production and sales of automobiles.

- Expectations for fleet changes: Our carriers are anticipating changes with some downsizing and others planning for expansion this year.

- Likelihood of investing in technology: Our carriers scored an average of 56 out of 100, indicating a moderate to high likelihood of investing in technology in 2024. This reflects the growing importance of innovative tools in streamlining operations and improving efficiency in the logistics industry.

Forecasts for 2024

Looking ahead, 2024 is anticipated to be a better year for carriers, providing respite from the downward trend experienced over the past two years.

Diesel fuel prices will likely peak in March, and while some volatility is expected, we will not likely experience record prices. The overall automotive supply chain will continue to recover and improve, further normalizing the market.

There will be a greater focus on technology, with artificial intelligence (AI) and transportation management systems being leveraged to automate manual tasks, streamline processes, and increase efficiency. Since launching AI-powered vehicle inspections in our SmartHaul APP, Ship.Cars reports 80% of carriers using this technology, an increase of 100% over the last six months.

Electric vehicle (EV) sales will continue to impact logistics with car haulers preparing for more EV cargo. Trucking companies will also start planning to invest in sustainable practices.

While estimates for truck driver shortages will continue to drop, the underlying problems such as parking, safety, and operational costs will persist. This highlights the need for quality drivers.

Vlad Kadurin, head of product and operations for Ship.Cars, foresees a better year for auto carriers in 2024, compared to the downturn of the previous two years.

Photo: Ship.Cars

A Transformative Conclusion

The automotive logistics carrier market is poised for a transformative year in 2024. The industry’s resilience, coupled with shifting dynamics and early indicators of improvement, paints a positive picture.

Ship.Cars will act on feedback from carrier surveys to enhance features that optimize loads and routes for carriers. Plans are underway to implement Load Scout feature improvements to eliminate dead miles and maximize revenue.

The road ahead may still have its challenges, but clearly the industry is moving in the right direction.

ABOUT: Vlad Kadurin is the product and operations lead of Ship.Cars.

[This article was authored and edited according to Auto Rental News editorial standards and style. Opinions expressed may not reflect those of ARN].