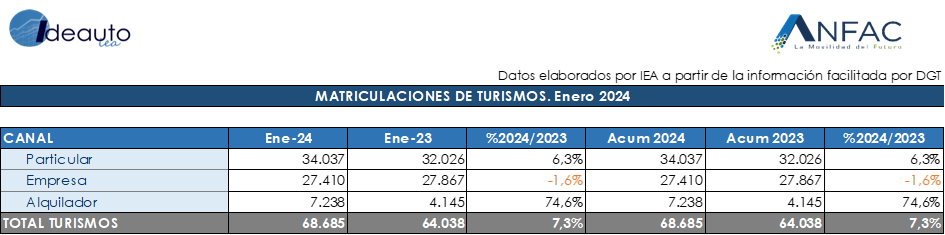

Sales of passenger cars and SUVs reach 68,685 units, 7.3% more than in the same month of 2023

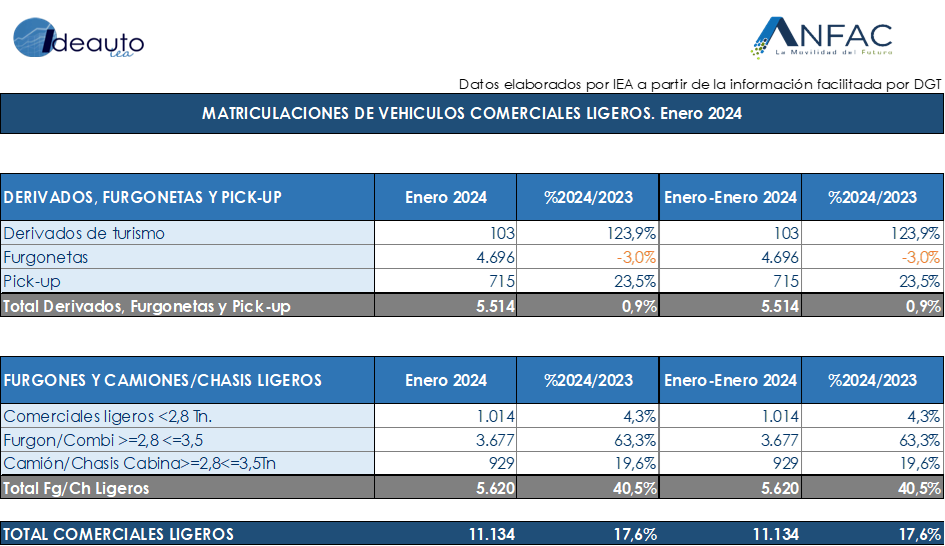

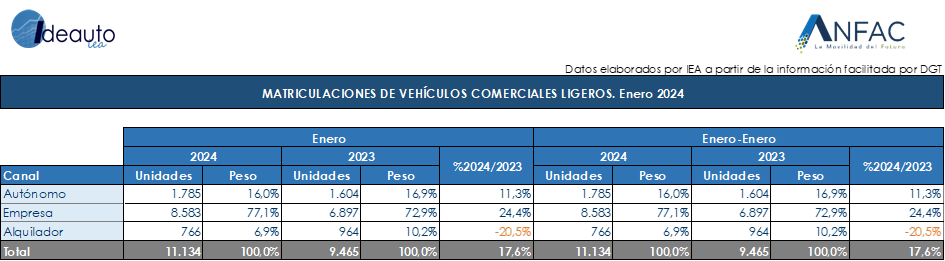

Registrations of light commercial vehicles increase by 17.6% in the first month, with 11,134 sales

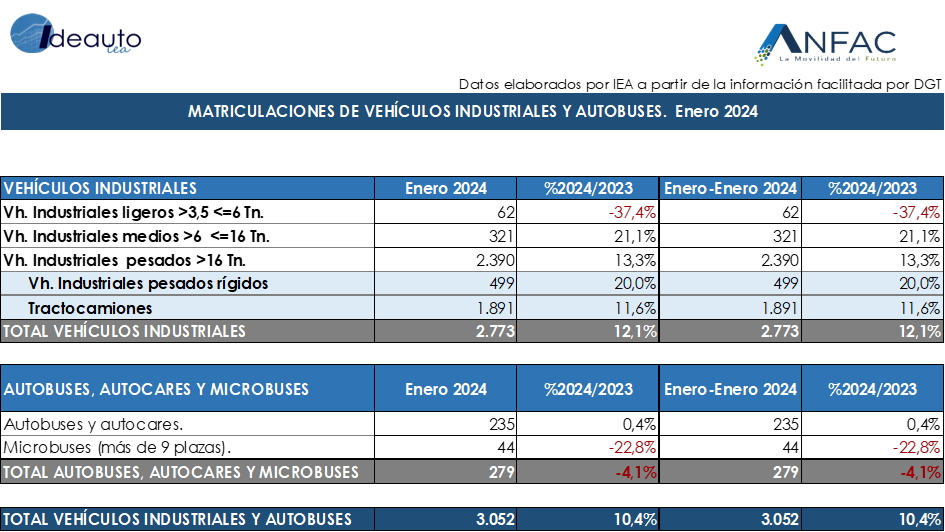

Sales of commercial vehicles, buses, coaches and minibuses grew by 10.4% in January with 3,052 units

Madrid, February 1, 2024. The passenger car and SUV market starts the year with a 7.3% increase in sales and a total of 68,685 units sold. This record allows the positive trend of recent months to be maintained. In any case, the boom in this month of January is due to the boost in sales in the rental channel, since both sales to individuals and companies maintain similar records to those of a year ago. In any case, the market is still 20.5% below January 2020, before the start of the pandemic.

The average CO2 emissions of passenger cars sold in January remain at 116.2 grams of CO2 per kilometer traveled, 1.99% lower than the average emissions of new passenger cars sold in the same month of 2023.

Regarding sales by channels, those directed to rental companies are the ones that obtain the best results, with a growth of 74.6%, up to 7,238 units, being the channel that drives sales the most for the month. For their part, sales to individuals increased by 6.3%, with 34,037 new registrations. While the business channel decreased slightly by 1.6%, with 27,410 purchases.

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles achieved a notable growth of 17.6%, with 11,134 units in the first month. By channels, everyone manages to grow in January, except for renters. The greatest increase was recorded in the business channel, with 24.4% and 8,583 units. For its part, sales to the self-employed total 1,785 units, growing 11.3%. Only renters registered a decrease, with 20.5% of sales and 766 units.

INDUSTRIAL AND BUSES

For the first month of 2024, registrations of commercial vehicles, buses, coaches and minibuses maintain their good pace with a growth of 10.4% and 3,052 units. By type of vehicle, industrial vehicles added 2,773 new registrations, increasing 12.1% in January. As for buses, coaches and minibuses, they registered 279 sales, which registered a decrease of 4.1% compared to the same period the previous year.

Félix García, director of communication and marketing at ANFAC, explained that “we start 2024 with a positive result. The market grows 7.3% and is close to 69,000 units. If we take into account that a large part of the orders placed in November and December 2022 were registered in January 2023 and that their deliveries were delayed due to a lack of vehicle transport trucks, last January has produced good data. It is true that we are still very far from the 2020 figures, but starting the year on the rise gives us optimism. We should realize how resilient the automobile sector is, knowing how to adapt to all types of endogenous and exogenous crises without stopping. Now we get the delays caused by the terrorist attacks in the Red Sea that force cargo ships to go around Africa to reach Europe and the severe drought that can affect not only people’s routines but also production of all kinds. of goods. We will see how February behaves, but, with this figure and, with all the precautions of it being January, we could be close to one million new passenger cars in 2024.”

Raúl Morales, communication director of FACONAUTO, indicated that “the months of January registrations are never buoyant and the figures for this start of the year also show it. It is true that we are talking about growth, but this growth has been due above all to the good performance of the rental channel, which is growing by 90%. Without that contribution, it is very likely that we would be talking about a decrease in the market, a drop in registrations. Even so, we are at very low sales volumes and that cannot make us lose the great objective for 2024, which is to ensure that all electrifications, both the pure electric vehicle and the plug-in hybrid, manage to far exceed that 12% contribution. to the market with which we end the year 2023. Of course with the registrations of the month of January we cannot aspire to those figures and we must bet on a much more robust market.

Ganvam’s communications director, Tania Puche, highlighted that “registrations are starting the year positively, although still around 25% below pre-pandemic levels. The market has overcome the chip crisis, but we cannot lose sight of the impact of geopolitical tensions in the sector, as is the case of the Red Sea conflict, which is causing delays and increased costs in the transport of goods, which can put upward pressure on the price of cars in these first months of 2024. This circumstance complicates the recovery and will cause Spain to remain on the threshold of one million units sold at the end of this year, when our natural volume is around 1 .2 million units; a figure that we have not seen since 2019.”