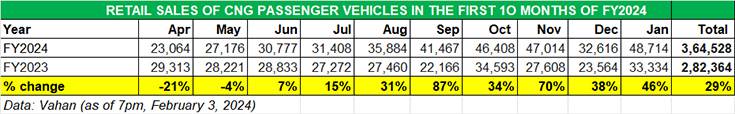

Even as news about electric vehicles (EVs) continues to dominate the headlines, CNG took a share of them last week as a result of Tata Motors’ reveal of the CNG-powered concept variant of the Tata Nexon. Demand for CNG-powered passenger cars and SUVs has bounced back. While retail offtake in the first two months of FY2024 was soft, customer purchases from June 2023 through to January 2024 have been on the upswing.

Retails of 364,528 units between April 2023 and January 2024 have crossed FY2023’s 327,820 units; headed towards record 475,000 units in FY2024.

Retails of 364,528 units between April 2023 and January 2024 have crossed FY2023’s 327,820 units; headed towards record 475,000 units in FY2024.

As per retail sales data on the Vahan website, retail sales of CNG PVs in the first 10 months of FY2024 have crossed the 350,000-unit mark at 364,528 units, up by a strong 29% (April 2022-January 2023: 282,364 units). In the process, they have crossed the FY2023’s record sales of 327,820 units. At this pace, this could translate into India CNG PV Inc registering best-ever fiscal sales of an estimated 475,000 units in FY2024.

India’s market for CNG-powered cars and SUVs expanded in August 2023 with the launch of the Tata Punch CNG compact SUV (Rs 710,000-Rs 968,000 ex-showroom), which was Tata Motors’ response to the introduction of the Hyundai Exter CNG compact SUV (Rs 824,000-Rs 897,000, ex-showroom). This takes the total number of CNG cars and SUVs sold in India to 23, with market leader Maruti Suzuki India having the biggest portfolio of 13 models, followed by Tata Motors (4 models) and Hyundai and Toyota Kirloskar Motor (three models each).

With 251,620 units, Maruti Suzuki maintains its stranglehold on the CNG market (top). Tata Motors has sold 64,972 CNG PVs in the first 10 months of FY2024 to Hyundai’s 45,646 units, with strong numbers from September.

With 251,620 units, Maruti Suzuki maintains its stranglehold on the CNG market (top). Tata Motors has sold 64,972 CNG PVs in the first 10 months of FY2024 to Hyundai’s 45,646 units, with strong numbers from September.

MARUTI SUZUKI LEADS WITH 69% MARKET SHARE, TATA MOTORS SELLS 65,000 UNITS

There are only four CNG carmakers in India. Maruti Suzuki India, with all of 13 models (Alto K10, Baleno, Brezza, Celerio, Dzire, Eeco, Ertiga, Grand Vitara, S-Presso, Swift, Wagon R, XL6, and the Fronx), understandably, has a vice-like grip on the market.

While Tata Motors has four models (Altroz, Tigor, Tiago, Punch), Hyundai Motor India’s CNG range has expanded to three models now (Aura, Grand i10 Nios, Exter) and Toyota Kirloskar Motor has three CNG-powered passenger vehicles (Glanza, Hyryder, Rumion).

OEM-wise retail sales numbers in the April 2023-January 2024 period shows that market leader Maruti Suzuki India has sold 251,620 CNG variants of its cars, SUVs and MPVs, which gives it a commanding 69% share of the market. By the end of this decade, Maruti Suzuki expects to see CNG vehicles account for a third of its total PV retail sales.

Retail sales of 64,972 CNG cars and SUVs in the first 10 months of FY2024 give Tata Motors an 18% market share.

Retail sales of 64,972 CNG cars and SUVs in the first 10 months of FY2024 give Tata Motors an 18% market share.

Tata Motors, which has gone ahead of Hyundai Motor India in the CNG PV market, possibly due to the introduction of its Punch CNG model in August 2023, has retailed a total of 64,972 CNG cars and SUVs in the first 10 months of FY2024. This gives Tata Motors an 18% market share.

On January 24, in a move designed to rev up demand for its CNG models, Tata Motors revealed and opened bookings for automatic transmission-equipped models of its CNG-powered Tiago hatchback and Tigor compact sedan. This is the first time in India that factory-fitted CNG vehicles have been offered with an automatic gearbox. By 2026, it is targeting the share of CNG cars and SUVs to its overall sales to grow from the existing 14% to 25 percent. The planned introduction of the Nexon CNG model is a step in that direction.

Meanwhile, Hyundai Motor India has sold a total of 41,806 CNG cars and SUVs and currently has an 11.46% market share. A close look at the Vahan month-wise retail sales split below reveals that from April 2023 through to July 2023, Hyundai (13,881 units) was ahead of Tata Motors (12,166 units) but following the launch of the Punch CNG, Tata has driven ahead of Hyundai in the next six months outselling the Korean carmaker every month since July 2023.

Toyota Kirloskar Motor, which has recently entered the CNG market with the Glanza hatchback, Urban Cruiser Hyryder SUV and the Rumion MPV, has sold a total of 6,064 units in the first 10 months of FY2024 and has a 1.66% share of the CNG PV market.

GROWING CNG PV MARKET IN INDIA

The sustained growth of the CNG PV sector is also why vehicle manufacturers are gradually expanding their product portfolios to include CNG variants. A deep dive into decadal retail sales numbers since FY2015 shows that over 2.1 million CNG passenger vehicles have been sold in India. Of this, a little over half – 52% or 11,04,645 units – have been sold in the past four years since FY2021, reflecting the growing consumer demand for CNG models.

The data table above reveals that sales, which were flat in FY2021 (176,461 units) as a result of the delayed Covid-19 market impact, rose 34% in FY2022 (235,836 units) and by 39% in FY2023 (327,820 units). Having already gone past last fiscal’s retails in the first 10 months of this fiscal (April 2023-January 2024: 364,528 units), this segment of the PV industry will be setting a new sales high in FY2024.

WALLET & ECO-FRIENDLY FUEL

From a consumer point of view, other than the environment-friendliness of CNG, a CNG-powered vehicle provides considerable savings compared to its petrol or diesel-engined siblings. What’s also driving the consumer shift to CNG models is the unchanged (since May 2022) high price of petrol (Rs 106.29 a litre in Mumbai) and diesel (Rs 94.25 a litre in Mumbai on February 4, 2024).

The slashing of CNG prices in early April was a welcome respite to motorists using CNG-powered vehicles and at present, at Rs 76 per kg in Mumbai, CNG is Rs 30.29 cheaper than petrol and Rs 18.25 cheaper than diesel.

CNG POWER VS CONSUMER SHIFT TOWARDS EVs

CNG POWER VS CONSUMER SHIFT TOWARDS EVs

While CNG vehicle running costs are significantly lower compared to petrol or diesel as a CNG vehicle inherently delivers better fuel economy, a few challenges to speedier adoption of CNG vehicles remain.

Refuelling takes longer due to a fewer number of CNG stations and highway driving requires additional planning in terms of trying to take a route with a CNG station. That’s set to gradually change though. Plans are to substantially increase the existing parc of 4,500 CNG stations to 8,000 over the next two years. Also, servicing costs of CNG-powered cars are higher compared to petrol siblings with the CNG filter requiring scheduled replacement in factory-fitted CNG kits.

CNG vehicle manufacturers also face some level of competition from electric vehicles, which are seeing demand accelerate with new models rolling out, a fast-expanding EV charging network across India and greater consumer awareness. While the initial cost of an EV is higher than a CNG or petrol/diesel model, the much lower cost of EV ownership in the long run remains a very attractive buying proposition. Nevertheless, with both modes of power, the focus is on eco-friendly transportation.

ALSO READ: CNG becoming a strong alternative to diesel