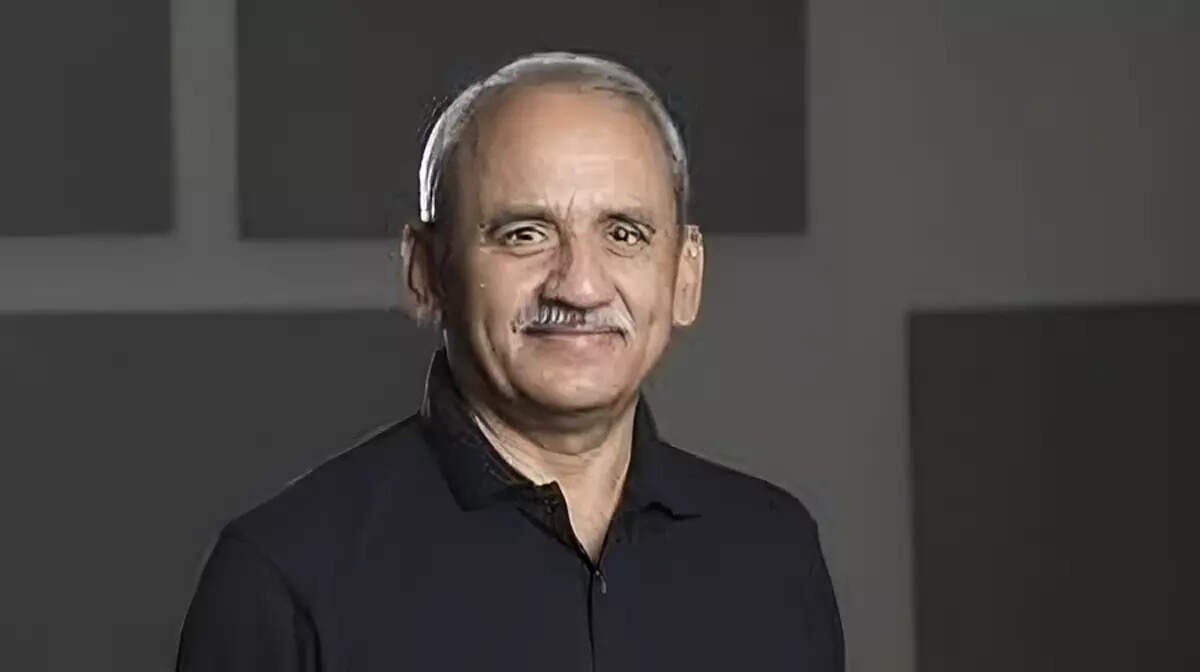

“The business was really carried forward through the revival, first of all, in the domestic market scenario and within that the outperformance of Bajaj Auto in the top half of the industry which has been our strategic focus, which then gives you both volume which is a much superior combination of both volume and revenue and bottom line and this occurred both in motorcycles as well as three-wheelers which is what combined to deliver that record-breaking quarter,” says Rakesh Sharma, ED, Bajaj Auto.

How has your third quarter been because from what we see is that the domestic markets were sort of fuelled for the company, international business as well has now been seeing a gradual recovery?Yes, the quarter three was an outstanding quarter as you know. It was a hat-trick of sorts because we breached our previous records on both top-line and bottom-line and for the first time crossed INR 2,000 crores in PAT and this despite the international business environment being very difficult still, though there is a gradual recovery as you say but it is a very-very gradual process and then with all the twists and turns which the geopolitics in the Middle East is throwing up, that recovery also becomes a little bit muted.

So, the business was really carried forward through the revival, first of all, in the domestic market scenario and within that the outperformance of Bajaj Auto in the top half of the industry which has been our strategic focus, which then gives you both volume which is a much superior combination of both volume and revenue and bottom line and this occurred both in motorcycles as well as three-wheelers which is what combined to deliver that record-breaking quarter.

But tell me, will this enthusiasm last all year or even beyond or is it rather a short-term visibility that you have right now?

Well, the business levers are seeming pretty sound and unless there is an external black swan-like event or this whole Middle East thing, conflagration spins out of control or post election there is some issues, other than that I would say slight headwinds on cost particularly on certain types of metals but otherwise the cost scenario is looking pretty steady.

I would say that the most heartening thing is that after a nice season, usually you have a fall-off in December at least in two-wheelers and three-wheelers, but we did not witness that kind of a fall-off in December. We found the southern season with Pongal also doing well in January and growth has remained at a nice clip and we are expecting the industry to definitely be between 8% to 12% growth in this quarter, and let us say in quarter two. So, the business environment is looking good. More and more customers are getting into the consumption cycle. Retail finance demonstrates that penetration is improving, so that is holding steady.

You must be getting real-time information from your dealers on how sales is actually panning out. I just want to flavour how are your sales and enquiries…, demand is coming from tier II, tier III going into rural which was the scenario was quite weak last few quarters.

I find this trying to impose divide between urban and rural less efficient for analysis than looking at it segment wise because I find that the entry level segments are performing poorly both in urban and rural whereas the like 125 cc or the 150 cc, the upper half of the industry is performing well in both urban and rural.

So, I would say the right way to look at it is the segmental approach and within that I must add that the entry level and the 100 cc which till at least three-four months back was in a difficult spot has improved but still the growth of the industry is being really powered by very high double digit numbers in the 125 cc to upwards segment and that kind of feedback we are getting from metros, mini metros, tier I, tier II type of towns and I find that dealerships in these places are seeing a steady flow of inquiries and the very important aspect of this is that with the retail financing capability really penetrating the heart of India, it is to some extent having a positive impact.

This has to be combined with the confidence of these customers who if I may remind you earn less thanINR 40,000 per month, they are far more optimistic and far more confident of a continuing income whether it is a three-wheeler driver or whether it is a two-wheeler owner which emboldens them to take a loan, which emboldens the finance company to give a loan and all these things are what are driving the 8% to 15% growth, 8% to 13% growth outlook for us.

I also wanted to talk about the 15000 volumes Chetak reaching this quarter, do you think that that will be manageable despite the fact that we have seen a lot of competition offering very aggressive discounts these days?

Yes, there of course, a sort of goal which we have set ourselves, when we started the year we were at 3000-4000 units level, then we said in quarter three we will do 10000 and now we have set a goal of reaching 15000.

We are dancing on the edges of 15000, I would say January was pretty good. And I am saying from a bookings perspective which may not have still reflected in Vahan but we are very-very close to breaching the 15000 mark.

There are two things which are happening here; one is, of course, that the industry is consolidating, the electric two wheeler industry is consolidating in favour of the larger and more established players. So whilst it is the penetration rates have sort of slowed down, it is not a triple digit growth which is taking place but we have to also understand the underlying ICE industry is also growing now.

The penetration rates have slowed down but the customer is pretty much switched on now in terms of adopting electric two wheelers.

It is firmly in the consideration set. We think that going to the customer with a complete proposition, not just a product with a massive discount and that kind of a thing but ultimately people buy two wheelers with a view of ownership of three years, five years, I mean, average five years if not even seven years and they have a view on that it is not a use and throw thing where the customers will just buy any product at a discount, the fundamentals have to be in place.

Customer care right through the ownership cycle has to be in place and for that they look forward to trusted brands. We are putting in an infrastructure, I mean, we have got a fairly good, dedicated, exclusive infrastructure and apparatus to take care of the ownership. And I feel the customer will reward us for that, particularly it takes time for this proposition to be felt by the customer. And we thing it is a marathon, we are not in a hurry to wave the flag. We want to put these basic fundamental capabilities in position so that we can give reassurance to the customer over the ownership cycle and that is what is happening, that is what is actually driving Chetak’s growth. And we have added one more product this quarter.

We hope we add another couple of products in the next fiscal year. So through a combination of products and the proposition of customer care we think we should be able to continue to drive volumes up and up. Of course, the joker in the pack so to say is what happens to FAME and we will get clarity about that I hope earlier than later because definitely temporarily will impact the assessment of buyers.

This year being seen as the year for a lot of new launches; 2024 not only by you some of your peers as well, I would not call them competitors alone but everybody is trying to gain market share in bigger segments. Are you doing it on your existing dealership network or you have an aggressive plan to hike your dealership network to new regions, talk to us a little bit about the dealership part of the strategy.

Fundamentally we have chosen a slightly more difficult path, if I may say so, a little more expensive but I think which is much superior and better for the customer of having exclusive dealerships for the different brands.

So we have Bajaj Motorcycles, which primarily sell Pulsar and Platinum brands as the backbone of the company because that is the largest business. So those are dedicated to Bajaj brands.

We have another dealership network for three wheelers. We have set up three different networks or in the process of expanding these networks for KTM, which is an exclusive network, which is now at about 450 stores.

Then we have got Chetak, which is a new business, as you know, which has again got exclusive dealerships and service centres.

And we are running at about, I think, 170 stores across the country. And the youngest of the brands which we brought in is Triumph, for which we have 50 dealerships.

So we believe that to really engage with the customer in a more specific way, it is important to have retail as well as a service environment, which is in step with the essence of the brand and what we are trying to accomplish in delivering the brand proposition. The dealership and the service centres are an essential part of the delivery of the brand proposition. So that has been our strategy. And we are going to obviously continue to expand the network, particularly in Chetak and Triumph. It is a very high priority agenda for us as this year FY25 unfolds.