There’s a clear shift the world over in the automotive industry, with the transition to more sustainable powertrain solutions. So far, electric vehicles (EVs) have emerged as the leading alternative to a greener future, but the reality in the Indian context is considerably different when compared with global trends. The common mission is to lower carbon emissions that requires a multi-faceted approach, and here, hybrids, flex-fuel- and fuel-cell vehicles, and those running on synthetic fuels and CNG are some other prominent options increasingly being considered to slash greenhouse gas emissions (GHGs).

While EV adoption has been considerably high in the last few years in markets like the US, China and Europe, post pandemic in particular, a combination of internal combustion engine (ICE) and electric powertrains — christened hybrids — also promise to be relevant for emerging markets. Brazil, India and Mexico, among other nations, are some of the key examples where the cost of personal mobility still needs to be affordable, owing to the populations’ comparatively lower per-capita income.

Historical context

Japanese carmakers Toyota and Honda popularised the concept of hybrids. Over two decades ago, these brands ventured into developed markets like the US and Europe with this advanced technology that saves fuel and

lowers emissions.

Honda Insight, the first hybrid introduced in the US, debuted in December 1999, followed by the iconic Toyota Prius in 2000. Both models played significant roles in popularising hybrid technology and establishing a market for the four-wheeler variant in the US. These early hybrids paved the way for subsequent generations and a broader range of options from various automakers.

Over the years, the technology has continued to evolve, with many manufacturers incorporating hybrid powertrains into different vehicle types, including sedans, SUVs and even pickup trucks in the US.

On Indian roads

Honda was the first carmaker to introduce the hybrid Civic in India in 2008. However, the technology gained more prominence in the country only in the past couple of years or so, with labels betting big on it to meet the stringent emission norms and Corporate Average Fuel Efficiency (CAFE) targets — particularly with a fleet that’s increasingly becoming more petrol-oriented and typically less fuel-efficient than diesel. Alliance partners Toyota and Suzuki, as well as Honda, are offering petrol-hybrid options in India, and the technology is seeing a strong adoption in the country.

Source: IIT Kanpur-NEDO study

Source: IIT Kanpur-NEDO study

The Honda City e:HEV, Toyota Urban Cruiser Hyryder, Maruti Suzuki Grand Vitara as well as the Toyota Innova Hycross are some of the popular hybrid-equipped mainstream models in India, registering a strong offtake and high levels of customer acceptance.

While about 20% of all Maruti Suzuki Grand Vitara sales come from the Toyota-sourced hybrid powertrains, its badge-engineered version — the Toyota Urban Cruiser Hyryder — accrues about a third of the SUV’s total sales from its hybrid variant. The share of hybrids is even higher in case of the company’s flagship people mover — the Toyota Innova Hycross.

Honda, on the other hand, has received a terrific market response in India to its hybrid City e:HEV sedan, which delivers up to a claimed 27.13kpl in terms of fuel efficiency.

“Hybrids are witnessing a strong acceptance in major Indian cities,” says Shashank Srivastava, Senior Executive Officer, Sales and Marketing, Maruti Suzuki India. “The fact that a hybrid vehicle runs on battery energy for about 40 to 50% of its time in city traffic, it essentially drives like an EV, without making the customer worry about range, or charging infrastructure.”

The hybrid versus EV battle

In Q3 of FY24, hybrid vehicles outsold EVs in India, with the cumulative gap narrowing to about 10,000 units. EVs clocked 58,000 units in sales, and hybrids, 40,000 units, with the difference shrinking further in the first eight months of FY24 — 52,000 units of hybrids sold from April to November 2023, as against EV sales of 63,000 units.

Modern hybrid platforms are being designed with flexibility applications — from different body styles to drivetrain configurations like 2WD, 4WD or AWD.

Modern hybrid platforms are being designed with flexibility applications — from different body styles to drivetrain configurations like 2WD, 4WD or AWD.

It’s certainly evident that the hybrid powertrain technology is making its mark as a significant solution for emerging markets such as India, where EVs face several challenges at this juncture. High cost of acquisition, lack of adequate charging infrastructure and range anxiety are the key impediments to the greater adoption of EVs in the country. Also, given our heavy reliance on thermal (coal) power for over 75% of its energy requirements, EVs do not fulfil the sustainability target from a well-to-wheel perspective.

India’s greener solution

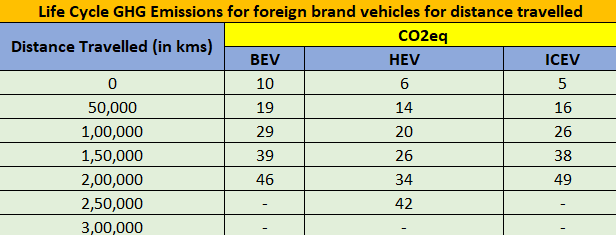

According to an IIT-Kanpur study on the life cycle analysis (LCA) and total cost of ownership (TCO) of a hybrid vehicle vis-à-vis an EV and its ICE counterpart, the GHG emissions for hybrids were found to be lower than those of EVs and ICE vehicles in India. The study — supported by the New Energy and Industrial Technology Development Organisation (NEDO) — also found that the emissions over the vehicle life cycle (presumed at 200,000 km) of a hybrid was 27.5% lower than that of an EV and 28.1% lower than an ICE vehicle, from a cradle-to-grave perspective.

GHG emissions during the manufacturing of the vehicle were found to be the highest for an EV — 41.17% higher than those emitted during the making of a hybrid — whereas those of a hybrid was 14.7% lower than its pure ICE counterpart. While the emissions for ICE vehicles were found to be lower than EVs in this context, they lessened for EVs after a certain distance travelled.

The total GHG emissions from EVs over the vehicle lifetime were found to be lower than a petrol-powered ICE vehicle only in cases where a minimum annual distance travelled was more than 33,000km. On the other hand, the emissions increased slightly for the hybrid and significantly for the EV after incorporating a one-time battery-pack replacement for the two electrified powertrains.

The report further suggests that hybrids powered by e-fuels or synthetic fuels are the most sustainable option for greener transportation in India.

An unfeasible time for EVs

With over 75% of the country’s power generation distributed from coal-based power plants at present, an accelerated shift towards EVs may not be the ideal solution for India at the moment — considering our mission to achieve carbon neutrality by 2070 as well as lower transportation emissions. This wait is exacerbated by the low use of solar and wind power in India’s overall energy mix — each contributed less than 5% in 2020-21.

However, the situation is on track to change as the share of renewables shows a steady rise. In 2022-23, India’s solar energy generation stood at 70 GW; the country aims to up the figure to 500 GW by 2030.

“While India’s dependence on coal is projected to drop to 50% by FY31, in the existing scenario, hybrids are cleaner than EVs in terms of total carbon emissions,” asserted RC Bhargava, Chairman of Maruti Suzuki India.

India’s largest carmaker, Maruti offers hybrid tech in the country in partnership with Toyota and is witnessing growing adoption of these variants, like their newly launched Invicto. The Indian passenger vehicle (PV) market is increasingly preferring hybrids over EVs, and the gap between the volumes of the two technologies is narrowing rapidly.

“While the difference in volumes of hybrids and EVs stood at 0.7% in the first half of FY24, it is further narrowing in the second half, already pegged at 0.3% in H2 FY24,” revealed Bhargava. “Customers are extremely happy with the performance and convenience of hybrids over their challenges, particularly with respect to the range anxiety and charging infrastructure that EV owners face.”

High taxes and wary automakers

With an intent to propel the PV industry towards making a quick transition to EVs, the Indian government has incentivised electric cars by placing them in the lowest tax slab of 5% GST, in comparison to petrol cars (48%) and hybrids (43%), even though the latter is currently the more eco-friendly option.

Source: IIT Kanpur-NEDO study

Source: IIT Kanpur-NEDO study

According to the IITK-NEDO report, in the current circumstances, the TCO of an EV is lower than that of a hybrid in India due to this high tax — the GST levied on hybrids is nearly 10 times higher. If the same subsidies were to extend to hybrids, it would emerge as the most economical vehicle powertrain option, the study suggests, adding that even though hybrids are more environmentally sustainable in the Indian context, the current taxes and subsidies penalise them and limit their adoption despite their lower LCA and TCO.

While Honda introduced its hybrid technology in the City sedan in India, the carmaker subsequently went the all-electric way with its latest market entrant — the Elevate SUV.

“We chose to introduce the pure-battery EV in the Elevate SUV as we foresee strong potential for EVs in this segment going forward due to a sustained focus from the government,” Kunal Behl, Vice-President of Marketing and Sales, Honda Cars India, told Autocar Professional in an earlier interaction.

This leaves Japanese alliance partners Suzuki and Toyota as the leading original equipment manufacturers (OEMs) driving the push towards hybrid tech in India.

“There’s still a possibility of the government recognising that hybrid technology will be the cleaner option for Indian conditions for at least the next 8 to 10 years,” Bhargava said. “The government has already acknowledged that a mix of technologies will be required to achieve our carbon neutrality goals, for which EVs, hybrids, biofuels and CNG are all viable options. Taking this into consideration, the government may reconsider its stance on the taxation on hybrids and reduce the existing 38% difference between hybrids and EVs. Then, the growth of hybrid technology in India

would be even faster.”

In conversation with sister publication Autocar India, Vikram Gulati, Country Head and Executive Vice President at Toyota Kirloskar Motor, had called it unfair to label hybrids a “transitionary technology.”

“Like EVs, hybrids, too, face a similar set of challenges around acquisition price and TCO, as far as adoption is concerned,” he had said. “When we get into the more mass-market segments, higher sticker price is an inhibitor for hybrids, as well… Hopefully, if a policy resolving the current taxation issue for smaller vehicles is introduced, more people can jump into the hybrid ecosystem and let scale do the rest. This would benefit both hybrids and EVs because the same ecosystem feeds both technologies.” This exorbitant tax on hybrids is also why Hyundai is focusing on EVs in India. Tarun Garg, Chief Operating Officer at Hyundai Motor India, said: “The case is much stronger for EVs than hybrids in India. That is why we have invested in the localisation of battery packs and other components, which will allow us to introduce more all-electric products in the future…”

“Since we are investing in the localisation of EVs, we would want the policy to favour them. We are following the government’s guidelines and its vision for full electrification, and would rather focus our energy in the direction where there’s a clear policy roadmap… Having said that, we have access to all powertrain technologies, including hybrids that we sell in Europe. So if we see merit at any point, we would consider hybrids for India.”

BMW has so far steered clear of the hybrid route in India. “We don’t intend to introduce the plug-in-hybrid version of the BMW XM in the Indian market as there is no cost benefit for customers given the high tax rates,” said Vikram Pawah, President of BMW Group India.

Way forward

While hybrids offer an immediate solution to adopting a sustainable means of mobility and a lower oil import bill — not to mention the gradual development of a localised ecosystem to manufacture pure-battery-powered vehicles — the high acquisition costs driven by unfavourable taxes must be addressed to give them a chance to flourish on Indian roads. The future of hybrid vehicles in India appears promising as the nation increasingly emphasises sustainable mobility. However, it would be pertinent to understand that the road to sustainability would require a technology-agnostic approach, and therefore, policies and incentives must not favour any respective solution.

Analysts believe that given a level-playing field and equal opportunity, hybrids could certainly emerge as a popular choice for accelerating the transition towards sustainable mobility, and eco-friendly vehicles.

This feature was first published in Autocar Professional’s February 1, 2024 issue.