Magna International MGA reported fourth-quarter 2023 adjusted earnings of $1.33 per share, which rose 46.2% on a year-over-year basis but missed the Zacks Consensus Estimate of $1.37.

Net sales increased 9% from the prior-year quarter to $10.45 billion, surpassing the Zacks Consensus Estimate of $10.44 billion.

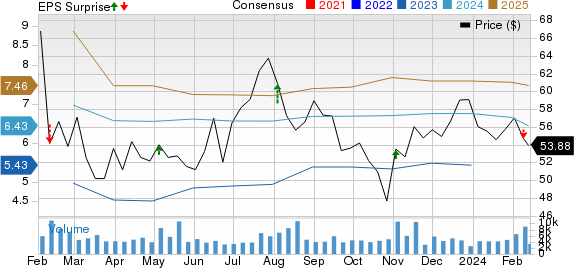

Magna International Inc. Price, Consensus and EPS Surprise

Magna International Inc. price-consensus-eps-surprise-chart | Magna International Inc. Quote

Segmental Performance

The Body Exteriors & Structures segment’s revenues were $4.18 billion, rising 4% year over year due to higher global light vehicle production and the launch of new programs. The metric, however, missed the Zacks Consensus Estimate of $4.20 billion due to the adverse impact of the UAW strikes-related lost vehicle production. The segment reported an adjusted EBIT of $280 million, up from $200 million recorded in the year-ago period, but missed the Zacks Consensus Estimate of $286 million because of the adverse impact of the UAW strikes, higher restructuring costs, employee profit sharing and incentive compensation.

The Power & Vision segment’s revenues increased 25% year over year to $3.76 billion, outpacing the Zacks Consensus Estimate of $3.73 billion on high global light vehicle production, the launch of new programs, net strengthening of foreign currencies against the U.S. dollar and customer price increases. The segmental adjusted EBIT soared from $116 million to $231 million and exceeded the Zacks Consensus Estimate of $206 million. This can be attributed to higher sales, lower net warranty costs and customer recoveries.

Revenues from the Seating Systems segment rose 6% year over year to $1,429 million on high global light vehicle production, the launch of programs and net strengthening of foreign currencies against the U.S. dollar. However, the metric marginally lagged the Zacks Consensus Estimate of $1,433 million due to net customer price concessions and the UAW strikes-related lost vehicle production. The segmental adjusted EBIT jumped from $14 million to $44 million but lagged the Zacks Consensus Estimate of $60 million due to higher production costs, the adverse impact of the UAW strikes and losses on the weakening of the Argentine peso.

The Complete Vehicles segment’s revenues decreased 10% year over year to $1,201 million and missed the Zacks Consensus Estimate of $1,203 million due to lower assembly volumes. The segment reported an adjusted EBIT of $43 million. It fell 25% year over year but outpaced the Zacks Consensus Estimate of $30.63 million owing to customer recoveries.

Financials

Magna had $1.2 billion in cash and cash equivalents as of Dec 31, 2023, down from $1.23 billion as of Dec 31, 2022.

Long-term debt, as of Dec 31, 2023, was $4.18 billion, up from $2.85 billion as of Dec 31, 2022.

In the reported quarter, cash provided from operating activities totaled $1.58 billion, up from the year-ago figure of $1.26 billion.

The company declared a fourth-quarter dividend of 47.5 cents per common share, implying an uptick of 3% from the prior payout. The dividend will be paid on Mar 8, 2024, to shareholders on record as of the close of business on Feb 23, 2024.

Guidance 2024

Magna expects full-year 2024 revenues in the band of $43.8-$45.4 billion, up from $42.8 billion recorded in 2023. Adjusted EBIT margin is projected in the range of 5.4-6%, up from 5.2% recorded in 2023. Capex is estimated at $2.5 billion.

Zacks Rank & Key Picks

MGA currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked players in the auto space are Modine Manufacturing Company MOD, NIO Inc. NIO and Oshkosh Corporation OSK. MOD sports a Zacks Rank #1 (Strong Buy), while NIO & OSK carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MOD’s 2024 sales and earnings suggests year-over-year growth of 4% and 67.2%, respectively. The earnings per share (EPS) estimates for 2024 and 2025 have improved 22 cents each in the past 30 days.

The Zacks Consensus Estimate for NIO’s 2023 sales implies year-over-year growth of 10.4%. The EPS estimates for 2024 have improved 7 cents in the past 30 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 6.7% and 4%, respectively. The EPS estimates for 2024 and 2025 have improved 16 cents and 29 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magna International Inc. (MGA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report