The auto sector tends to have promising companies with strong growth narratives due to their essentiality. Following their favorable fourth quarter reports this week Allison Transmission ALSN and Goodyear Tire GT are starting to fit this description and also stand out in terms of value.

With that being said, here’s a look at their quarterly results and an overview of why now is an ideal time to buy these top-rated auto stocks.

Allison’s Intriguing Growth & Value

As the world’s largest producer of fully automatic transmissions, the expansion narrative is certainly there for Allison Transmission’s stock. Surpassing Q4 top and bottom line expectations after market hours on Tuesday was certainly reassuring to investors with ALSN shares spiking +14% in today’s trading session.

Image Source: Zacks Investment Research

Earnings of $1.91 per share largely surpassed estimates of $1.42 a share by 34% and climbed 25% from the comparative quarter. Quarterly sales of $775 million came in 2% better than expected and rose 8% from a year ago. Allison Transmission has now surpassed earnings expectations for six consecutive quarters posting an average earnings surprise of 19.45% in its last four quarterly reports. Furthermore, ALSN shares trade at just 8.8X forward earnings with annual EPS projected to dip -6% in fiscal 2024 but rebound and rise 10% in FY25 to $7.67 per share.

Image Source: Zacks Investment Research

Goodyear’s Rebound & Value

Starting to once again showcase its potential as one of the world’s largest tire manufacturers Goodyear largely eclipsed its Q4 earnings expectations on Tuesday as well despite sales of $5.11 billion missing estimates by -4%. Still, EPS of $0.47 a share surpassed Q4 estimates of $0.33 a share by 42% and soared from $0.07 a share in the prior year quarter.

Image Source: Zacks Investment Research

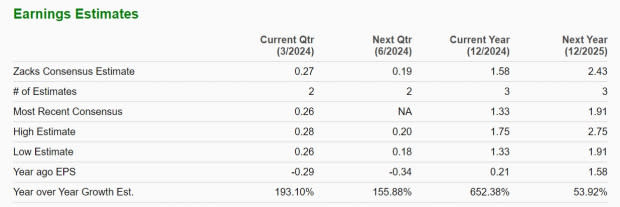

The rebound in Goodyear’s profitability is very intriguing with GT shares trading at $11 and 7.3X forward earnings. Most importantly, the eye-catching Q4 earnings beat helped reconfirm lofty projections and a sizeable rebound in Goodyear’s bottom line with fiscal 2024 EPS now projected at $1.58 per share versus $0.21 a share last year. Plus, FY25 EPS is projected to soar another 54% to $2.43 per share.

Image Source: Zacks Investment Research

Bottom Line

At the moment Goodyear’s stock currently boasts a Zacks Rank #1 (Strong Buy) with Allison Transmission sporting a Zacks Rank #2 (Buy). Earnings estimate revisions are likely to move higher for both companies in the coming weeks further clarifying that their stocks are cheap especially in terms of P/E valuation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report