Allison Transmission Holdings ALSN delivered fourth-quarter 2023 earnings of $1.91 per share, which rose 25.6% year over year and topped the Zacks Consensus Estimate of $1.42. The outperformance can be attributed to higher-than-expected sales from North America On-Highway, Defense and Outside North America Off-Highway end markets. Record quarterly revenues of $775 million grew 8% from the year-ago period and outpaced the Zacks Consensus Estimate of $755 million.

Thanks to robust results, shares of ALSN rallied roughly 14% yesterday to close at $70.10. The stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

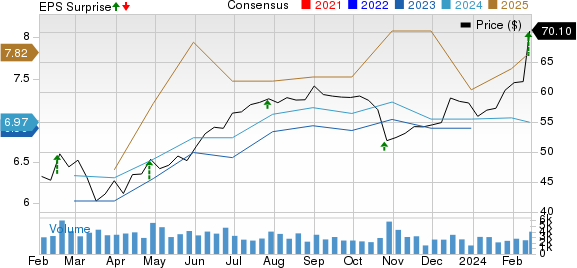

Allison Transmission Holdings, Inc. Price, Consensus and EPS Surprise

Allison Transmission Holdings, Inc. price-consensus-eps-surprise-chart | Allison Transmission Holdings, Inc. Quote

Segmental Performance

Allison segregates revenues in terms of end markets served, which are as follows:

In the reported quarter, net sales in the North America On-Highway end market rose 14% year over year to $380 million and surpassed the Zacks Consensus Estimate of $358 million. High demand for Class 8 vocational medium-duty trucks resulted in sales outperformance.

Net sales in the North America Off-Highway end market tanked 79% to $5 million from the year-ago period and lagged the consensus mark of $18.77 million.

In the reported quarter, net sales in the Defense end market rose 34% year over year to $63 million and beat the Zacks Consensus Estimate of $51 million, driven by higher demand for Tracked and Wheeled vehicle applications.

The Outside North America On-Highway end market’s net sales of $128 million declined from $131 million generated in the corresponding quarter of 2022. The reported figure also fell short of the consensus mark of $138 million.

Net sales in the Outside North America Off-Highway end market surged 31% year over year to $38 million and surpassed the Zacks Consensus Estimate of $29.10 million thanks to high demand in the mining sector.

Net sales in the Service Parts, Support Equipment & Other end markets grew 4.5% year over year to $161 million in the quarter and came in line with the consensus estimate.

Financial Position

Allison saw a gross profit of $371 million, an increase from $338 million for the same period in 2022, mainly driven by price increases in certain products.

Adjusted EBITDA in the quarter came in at $277 million, an increase from $245 million a year ago. The growth was led by higher gross profit.

Selling, general and administrative expenses in the quarter decreased to $92 million from $97 million for the same period in 2022. Engineering – research and development expenses were $54 million compared with $49 million recorded in the corresponding quarter of 2022.

Allison had cash and cash equivalents of $555 million on Dec 31, 2023, up from $232 million as of Dec 31, 2022. Long-term debt was $2,497 million compared with $2,501 million as of Dec 31, 2022.

Net cash provided by operating activities totaled $238 million. Adjusted free cash flow in the reported quarter was $186 million, up from $132 million generated in the year-ago period.

During the fourth quarter, the company paid out a quarterly dividend of 23 cents/share and repurchased shares worth $105 million.

2024 Outlook

Allison’s full-year 2024 net sales are estimated in the band of $3.05-$3.15 billion. Net income is expected in the band of $635-$685 million. Adjusted EBITDA is estimated within $1.07-$1,13 billion. It expects net cash provided by operating activities between $700 million and $760 million. Capex is expected in the band of $125-$135 million. Adjusted free cash flow is estimated within $575-$625 million.

Peer Releases

Autoliv ALV released its fourth-quarter 2023 results on Jan 26. Its fourth-quarter 2023 adjusted earnings of $3.74 per share surpassed the Zacks Consensus Estimate of $3.25 and jumped 105% year over year. The company reported net sales of $2,751 million in the quarter, which topped the Zacks Consensus Estimate of $2,746 million and soared 18% year over year.

Autoliv had cash and cash equivalents of $498 million as of Dec 31, 2023. Long-term debt totaled $1.32 billion. It forecasts full-year 2024 organic sales growth of around 5%. The adjusted operating margin is anticipated to be approximately 10.5%. Operating cash flow is expected to be $1.2 billion in 2024.

Oshkosh Corp OSK reported fourth-quarter 2023 results on Jan 30. Its adjusted earnings of $2.56 per share topped the Zacks Consensus Estimate of $2.17. The bottom line also rose from $1.60 per share recorded in the year-ago period. In the quarter under review, consolidated net sales climbed 12% year over year to $2,466.8 million. However, the top line marginally missed the Zacks Consensus Estimate of $2,468 million.

Oshkosh had cash and cash equivalents of $125.4 million as of Dec 31, 2023. Long-term debt totaled $597.5 million. The company anticipates full-year 2024 sales to be around $10.4 billion. It expects diluted earnings of $9.45 per share and adjusted earnings of $10.25 per share.

BorgWarner BWA unveiled fourth-quarter 2023 results on Feb 8. It reported adjusted earnings of 90 cents per share, down from $1.26 recorded in the prior-year quarter. The bottom line also missed the Zacks Consensus Estimate of 93 cents. Net sales of $3.52 billion missed the Zacks Consensus Estimate of $3.61 billion and declined 14.4% year over year.

As of Dec 31, 2023, BorgWarner had $1.53 billion in cash/cash equivalents/restricted cash. Long-term debt stood at $3.71 billion. For 2024, the company anticipates net sales within $14.4-$14.9 billion, up from $14.2 reported in 2023. The adjusted operating margin is expected in the band of 8.5-8.9%. Adjusted earnings are estimated within $3.65-$4 per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report