New Delhi: The tectonic shift towards non-ICE (Internal Combustion Engine) vehicles in the market escalated the demand for electric vehicles (EVs) in India. Automobile manufacturers have accepted the transition (ICE to EV) with the launch of several models like Tata Punch.ev, Tata Tiago.ev, Volvo XC40, Mahindra XUV 400, MG Comet, and others. From approximately 2 lakh units sold in 2019 to 13 lakhs in 2023, the auto industry witnessed a commendable growth in EV sales.

Generally, EVs consist of several components like electric motors, batteries, charging socket(s), and others, thus demanding more care and protection. In light of this many moving parts EV owners or potential owners should consider buying at least comprehensive EV insurance to keep their vehicles protected. However, one challenge is that for buying an EV insurance, owners need to shell out more money from their pockets than their counterpart conventional fuel vehicle owners.

There are several Insurance companies providing insurance on EVs like HDFC Ergo, Tata AIG, Digit Insurance, Zuno, and many more. As the world moves towards an eco-friendly mode of transportation, insurance on EVs can aid the owners in getting better coverage of their vehicles if any mishap occurs. The insurance coverage covers all the components of an EV during accidental damage. Non-accidental risks, such as damage due to electric surge or water ingress, which are traditionally excluded, can be included through optional add-ons.

Insuring an EV differs from an ICE vehicle due to different mileage patterns and customer segments for EVs. Hence experts say that insuring an EV is costlier than similar ICE vehicles. “Variations in vehicle components, such as the heavier battery and the use of more plastics, along with differing manufacturing costs, directly impact the average size of insurance claims following an accident,” said Neel Chheda, Senior Executive Vice President & Head – Auto & Actuarial Analytics, TATA AIG General Insurance.

Cost of EV insurance

EV insurance coverage consists of several EV vehicle specific components like batteries, charging set-up, electric motors and others. Experts cite that insuring all of these EV specific components is riskier hence they charge a higher insurance premium than ICE vehicles.

The cost of EV batteries accounts for nearly 60% of the total vehicle cost while the cost of the motor would vary based on the model of the vehicle. It may range from INR 20,000 (roughly for two wheelers) to INR 1,00,000 (roughly for four-wheelers).

The service cost difference depends on various factors like periodic maintenance. For example, typical maintenance seen in internal combustion engine (ICE) vehicles like oil replacement etc. will not be applicable to EV vehicles. Hence, the normal service cost is nil in electric vehicles when compared to traditional ICE vehicles. However, as infrastructure for EVs expands, these costs are expected to decrease over time, says Mayur Kacholiya, Head – Motor Product, Digit General Insurance.

However, in the event of damage or flooding, it’s important to note that most of the parts in an electric vehicle may not be repairable, requiring complete replacement. Expensive components and the need for specialized mechanical expertise in electric vehicles (EVs) generally lead to higher maintenance costs compared to internal combustion (IC) vehicles.

IRDAI has stipulated a 15% discount on third-party premium for EVs and a 7.5% discount for hybrid vehicles, which makes it affordable to buy EV insurance.

Before buying an insurance for EVs few key components should be noted such as coverage for EV components, repair cost, incentives, discounts, range of coverage, emergency services, and policy flexibility, Parthanil Ghosh, President Retail Business, HDFC ERGO General Insurance, told ETAuto.

However, the higher purchase cost, increased probability of filing claims, and larger average claim size for EVs, compared to ICE vehicles within a similar segment, contribute to the elevated insurance costs associated with electric vehicles.

It has to be noted that every insurance company would offer EV insurance at different costs due to their different add-on cover packages. Though they will cover similar risks and mishaps but the prices may vary across the insurance industry.

Apart from taking a look at the insurance coverage, one should also evaluate the insurer based on various parameters like claim settlement ratio, customer complaints, online customer ratings, etc, before zeroing in on an insurer said, Mayur Kacholiya.

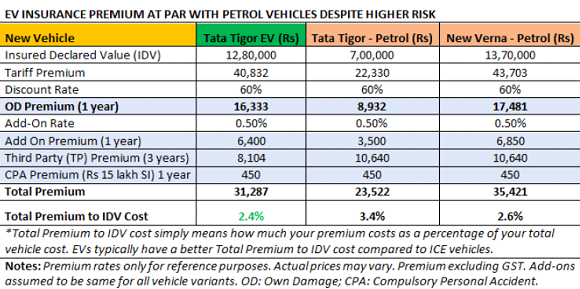

Mayur Kacholiya further told ETAuto through a table how EV insurance is different from an ICE. Where he says EVs total premium to IDV cost (cost of premium as a percentage of total vehicle cost) also typically tends to be better in comparison to ICE vehicles. The same is illustrated in the illustration below:

EV Insurance market growth

The Indian EV insurance market in 2023 was around INR 1,000 crores when we talk about insurance premiums, according to industry sources. This figure reflects a substantial growth compared to the preceding years, indicating a positive trend in the EV insurance sector.

“The EV insurance business is expected to experience significant growth in the coming years, as more people are switching to electric vehicles due to their lower carbon footprint and potential cost savings on fuel. With this shift, the EV insurance market is expected to evolve to meet the unique needs of electric vehicle drivers, and the market is likely to see continued growth in the coming years”, said Parthanil Ghosh.

Talking about the growth of the EV insurance market in India, Chheda from TATA AIG said, it is expected to grow at a CAGR (Compound Annual Growth Rate) of over 40% in the future. However, it’s crucial to note that this projection is contingent on the rate of EV adoption, as the growth rate is sensitive to the prevailing trends in electric vehicle usage in the country.

Tata AIG aims to maintain a market share of around 8%-9% for EVs in 2024, aligning with their current market share in ICE vehicles. “As part of our strategic focus, we plan to prioritize and overweight our portfolio in favor of electric vehicles throughout 2024,” he added.