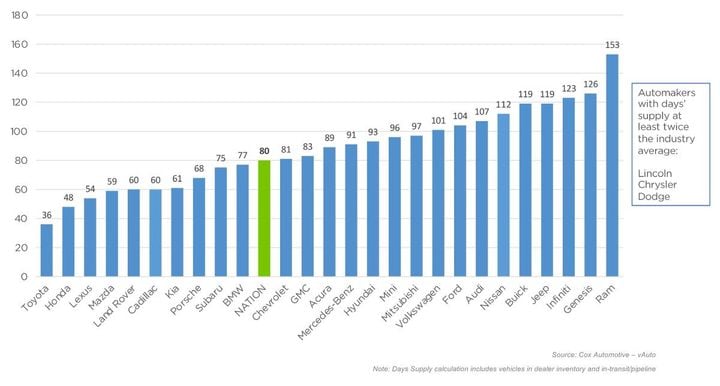

Many domestic makes had the highest inventory. Brands with the lowest supply were Asian imports.

Source: Cox Automotive

February opened with 80 days of new-vehicle supply across the industry, the highest since June 2020, according to Cox Automotive’s analysis of vAuto Available Inventory data released Feb. 15.

At the start of February, the total U.S. supply of available unsold new vehicles was 2.61 million units. That is 870,000 units – or 50% – above a year ago. Inventory was down from 2.66 million at the start of January.

Day’s supply at the start of January hit 80, up 38% from the same time a year ago. The last time days’ supply crossed the 80-days mark was June 1, 2020, when it was 83 days’ supply.

The Cox Automotive days’ supply is based on the daily retail sales rate for the most recent 30-day period, which ended Feb. 5. Sales during that period ran 9% ahead of a year ago. For the full month of January, new-vehicle sales decreased to a 15 million seasonally adjusted annual rate (SAAR), the lowest sales pace since last March due partly to harsh winter weather that disrupted sales in what is typically the lightest sale volume month of the year.

Domestic Automakers Have Highest Inventory Levels

Many domestic makes had the highest inventory. Dodge had the highest of any make by a wide margin, followed by Chrysler, Lincoln and Ram. Brands with the lowest supply were Asian imports. Toyota had the lowest at 36 days of supply, followed by Honda, Lexus and Mazda. Cadillac was at the low end as well.

Of the top-selling 30 models, the ones with the lowest inventory were mostly Toyota and Honda models. The new Toyota Grand Highlander had the lowest, followed by the Ford Maverick, which comes standard as a hybrid. The new Chevrolet Trax was also at the low end.

At the other end of the spectrum, pickup trucks, led by the Ram 1500, and SUVs, led by the Ford Bronco Sport, had the highest inventory.

The average new-vehicle listing price opened February at $47,142, down 1% from a year ago. The average listing price rose throughout December 2023 and started January high, but prices began declining in the second week of January and have been dropping by almost 1% a week.

The U.S. new-vehicle average transaction price in January was $47,401, down nearly 4% from a year ago and down almost 3% from December 2023, according to Kelley Blue Book. (The month of December, when luxury vehicle sales typically surge, often sees a jump in average transaction prices.) Discounts and incentives in January averaged 5.7% of ATP, up from 5.5% in December and nearly 100% higher than a year ago.

New Vehicle List and Transaction Prices Dip

Trends in new-vehicle affordability factors moved in support of consumers in January, leading to better affordability compared to December and much improvement year over year, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

“Just as new-vehicle affordability improved in January to its best level in over two years, access to auto credit moved in the other direction,” said Cox Automotive chief economist Jonathan Smoke in a news release. “Income growth continued while both the average new-vehicle price and the average interest rate declined making new vehicles more affordable. However, we saw credit access to auto credit decline to its lowest level since August 2020.”

The typical payment declined 3.2%, and the number of median weeks of income needed to purchase the average new vehicle declined to 37.5 weeks from an upwardly revised 38.8 weeks in December. The January number of weeks was the lowest since August 2021.

Originally posted on Automotive Fleet