FY2024, which is 42 days away from closure on March 31, 2024 is going to set new benchmarks for the utility vehicle (UV) segment in particular and the overall passenger vehicle (PV) segment in general. That’s because with the first 10 months of FY2022 over, wholesale numbers for UVs at 20,61,075 units have zipped past FY2023’s record 20,03,718 units, and at end-January 2024 are 57,357 units ahead. And PVs, at 34,76,319 units, are 413,735 units shy of FY2023’s record 38,90,114 PVs, a number which will be surely crossed by mid-March 2024.

The UV segment, which comprises SUVs and MPVs, have proven to be the bulwark of the PV industry and its sustained double-digit growth has helped buffer the sharp decline in mass-market entry-level cars and the slowdown in other sub-segments like hatchbacks and sedans.

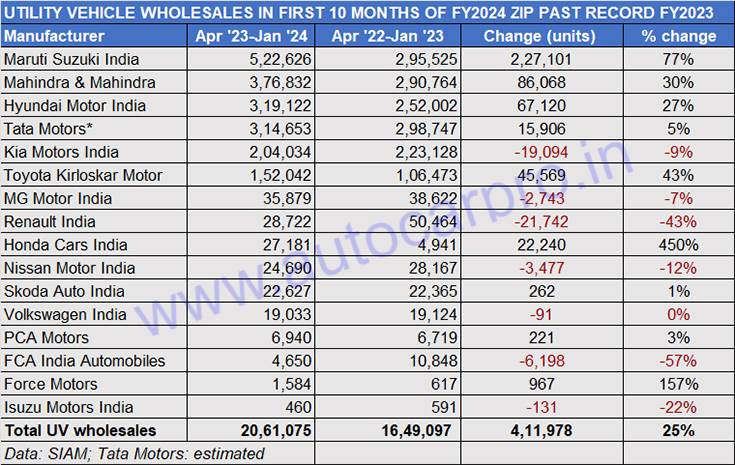

As the wholesales data table below depicts, the UV industry has averaged monthly sales of 206,107 units in the past 10 months and clocked robust YoY growth of 25 percent. Year on year, UV OEMs have sold an additional 411,978 units (April 2022-January 2023: 16,49,097 UVs), which speaks volumes for the rate of growth.

Year on year, utility vehicle manufacturers have sold an additional 411,978 units (April 2022-January 2023: 16,49,097 UVs) in the first 10 months of FY24

What has helped accelerate SUV and MPV sales is a consistent rollout of new models, increased availability of in-demand models due to ramped-up production, effective OEM marketing and an improving economy. At the current pace, India UV Inc should achieve strong YoY growth of around 25% and cumulative sales of nearly 2.5 million units this fiscal, which will raise the UV industry’s benchmark even higher.

Over 110 UVs and 800 variants, SUV-ival of the fittest

The UV customer in India is spoilt for choice – along with 16 SIAM member companies and luxury carmakers, there are over 110 UVs and a mind-boggling 800-plus variants currently on offer, all fighting a slice and more of the action. Thus, this is clearly an ultra-competitive marketplace to be in and translates into SUV-ival of the fittest.

India’s largest carmaker Maruti Suzuki is also the UV market leader with a current market share of 25 percent. Between April 2023 and January 2024, the company has dispatched over half-a-million UVs – 522,626 units to be precise. This makes for a handsome 77% YoY increase. Leading the charge from the seven-model portfolio is the Brezza (139,518 units), followed by the Ertiga MPV (119,350 units), Fronx (108,036 units), Grand Vitara (98,935 units), XL6 (36,533 units), Jimny (16,369 units) and the Invicto MPV (3,885 units). The last five are premium models from the Nexa channel and cumulatively, at 263,758 units, account for 50% of Maruti Suzuki’s UV sales in the first 10 months of FY2024.

Mahindra & Mahindra, which has a stable full of SUVs, has registered wholesales of 376,832 units, up 30% YoY, giving it a UV market share of 18 percent. The company, which has 226,000 SUV bookings on hand and has ramped up production to 600,000 units per annum, continues to see strong demand for the Scorpio and Scorpio Classic (111,260 units). They are followed by the Bolero (90,381 units), flagship XUV700 (66,241 units), Thar (53,385 units), XUV300 (47,672 units), the all-electric XUV400 (7,277 units) and the Marazzo MPV (616 units).

In third position is Hyundai Motor India with 319,122 UVs, up 27% YoY. SUV sales for the company, which has a seven-model portfolio, continue to be led by the Creta, the best-selling midsize SUV in India, with 131,039 units. Up next are Hyundai’s first compact SUV, the Venue (110,348) and its second compact SUV, the recently launched Exter (55,244 units). While the flagship Alcazar (19,043 units) is the fourth highest seller, it is followed by the Tucson (2,616 units), all-electric Ioniq 5 (1,269 units) and the Kona (563 units).

Just 4,469 UVs behind Hyundai is Tata Motors with 314,653 units, up 5% YoY. Tata Motors’ UV portfolio comprises two compact SUVs and two midsize SUVs. While the Nexon, which is available with petrol, diesel, CNG and electric, powerplant is the currently UV market leader with 143,244 units, the Punch compact SUV is also doing well (134,091 units). The Harrier (20,085 units) and Safari (17,233 units) deliver the rest. Of the company’s four models, three – Nexon, Harrier and Safari – have aced the Global NCAP crash test with a five-star rating under the new protocol.

Kia India, at No. 5, dispatched a total of 204,034 UVs in the 10-month period, down 9% (April 2022-January 2023: 223,128 units). The Seltos (86,246 units) remains the best-seller, followed by the Sonet (63,532 units), the Carens MPV (53,598 units) and the EV6 (658 units).

Toyota Kirloskar Motor, which is delivering a strong showing, clocked wholesales of 152,042 units, up 43% YoY. Demand is led by the popular Innova/Hycross MPV (79,799 units), followed by the Urban Cruiser Hyryder (37,350 units). The Rumion MPV, launched in August, has sold 4,555 units till end-January 2024. Combined sales of three other models (Fortuner, Hilux and Vellfire) add another 30,338 units to TKM’s total UV sales for the first 10 months of FY2024.

Seventh ranking of the 16 OEMs goes to MG Motor India with 35,879 units, down 7% YoY. The wholesales comprise 23,722 units of the Hector, 8,259 Astors, 2,151 Glosters and 1,747 ZS EVs.

Renault India, which has two SUVs in the market, has sold 28,722 units – Triber: 17,994 & Kiger: 10,728) in the past 10 months, down 43% YoY.

Honda Cars India, which was missing out on the action in the SUV market, is back in the game with the Elevate midsize SUV (27,181 units).

Nissan Motor India sold 24,690 Magnite SUVs in the period under review, down 12% YoY.

Skoda Auto India, which is set to announce plans to enter the booming compact SUV segment in India in 2025, sold 22,627 SUVs are up 1% YoY and comprise 20,965 units of the Kushaq and 1,662 Kodiaqs.

Next in line is Volkswagen India with 19,033 units – 17,611 Taiguns and 1,422 Tiguans – which constitutes flat sales compared to the year-ago wholesales of 19,124 units.

PCA Motors, the OEM representative for Citroen India has chalked up sales of 6,940 units in the first 10 months of this fiscal, up 3%, and comprising 3,998 units of the C3, 1,443 units of the all-electric eC3, a similar 1,443 units of the C3 Aircross launched five months ago, and 56 units of the C5 Aircross.

FCA India, which retails the Jeep Compass (2,767 units) and Meridian (1,883 units), registered sales of 4,650 units, down 57% YoY.

Force Motors, with sales of 1,584 units of the Trax, posted 157% growth on a low year-ago base of 617 units.

The 16th OEM in the sales table is Isuzu Motors India, with 460 units (34 MU-X and 426 V-Cross), down 22% YoY.

Sales fest coming up in February and March 2024

With the wave of UV demand continuing, it’s not surprising that the companies with SUV-heavy portfolios continue to make gains month after month in the overall PV market. Of the top six OEMs with six-pack sales numbers, the first three have already exceeded their FY2023 UV sales – Maruti Suzuki (522,626 vs 3,66,129 units in FY2023), Mahindra (376,832 vs 3,56,961 in FY2023), Hyundai (319,122 vs 301,681 units). While Tata Motors (314,653 vs 357,249 units in FY2023) and Kia India (204,034 vs 269,229 units in FY2023) are yet to achieve that, Toyota Kirloskar Motor has delivered a sterling performance (152,042 vs 132,490 units in FY2023).

Given the strong customer and market momentum, it can be surmised that both February and March should deliver sales in spades with 400,000 units or more. Enough to take India UV Inc achieve the 2.5 million UV sales milestone for the first time.

ALSO READ: Nexon, Brezza and Creta battle for SUV crown in FY2024

OEMs dispatch record 393,074 PVs in January to feed SUV-hungry market

CNG car and SUV sales jump 29% in current fiscal, Maruti share at 69%, Tata ahead of Hyundai