American Axle & Manufacturing Holdings AXL reported a loss of 9 cents per share in fourth-quarter 2023, narrower than the Zacks Consensus Estimate of a loss of 16 cents. The company had incurred a loss of 7 cents per share in the year-ago quarter.

The company generated quarterly revenues of $1.46 billion, outpacing the Zacks Consensus Estimate of $1.45 billion. Revenues increased 5% on a year-over-year basis.

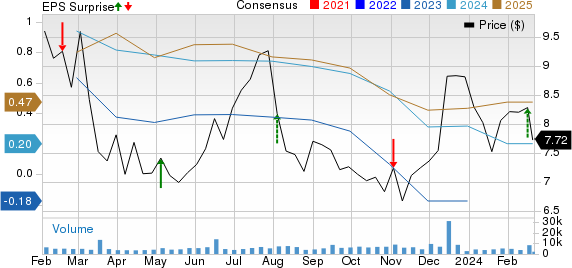

American Axle & Manufacturing Holdings, Inc. Price, Consensus and EPS Surprise

American Axle & Manufacturing Holdings, Inc. price-consensus-eps-surprise-chart | American Axle & Manufacturing Holdings, Inc. Quote

Segmental Performance

In the reported quarter, the Driveline segment recorded sales of $1.02 billion, rising 6.8% year over year. The figure was in line with our estimate. The segment registered adjusted EBITDA of $140.1 million, rising 17.9% on a year-over-year basis and outpacing our estimate of $116.1 million.

The company’s Metal Forming business generated revenues of $576.2 million during the quarter, rising 2.2% from the year-ago figure and exceeding our estimate of $541.1 million. The segment witnessed an adjusted EBITDA of $29.4 million, falling 24.6% and lagging our estimate of $32.6 million.

Financial Position

American Axle’s fourth-quarter SG&A expenses totaled $95.7 million, up from $88.5 million reported in the prior-year quarter.

Net cash provided by operating activities was $52.9 million, down from $148.5 million in the year-ago period.

Capital spending in the quarter was $55.9 million, up from $53.1 million.

In the three months ended Dec 31, 2023, the company posted an adjusted free cash flow of $4.5 million, down from $99 million recorded in the year-ago period.

As of Dec 31, 2023, American Axle had cash and cash equivalents of $519.9 million compared with $511.5 million as of Dec 31, 2022.

Its net long-term debt was $2.75 billion, down from $2.85 billion as of Dec 31, 2022.

2024 Outlook

American Axle envisions revenues in the range of $6.05-$6.35 billion compared with $6.08 billion registered in 2023.

Adjusted EBITDA is estimated in the band of $685-$750 million compared with $693.3 million registered in 2023.

Adjusted free cash flow is expected in the range of $200-$240 million compared with $219 million registered in 2023.

Zacks Rank & Key Picks

AXL currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Modine Manufacturing Company MOD, NIO Inc. NIO and Oshkosh Corporation OSK. MOD sports a Zacks Rank #1 (Strong Buy), while NIO & OSK carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MOD’s 2024 sales and earnings suggests year-over-year growth of 4% and 67.2%, respectively. The earnings per share (EPS) estimates for 2024 and 2025 have improved 22 cents each in the past 30 days.

The Zacks Consensus Estimate for NIO’s 2023 sales implies year-over-year growth of 10.4%. The EPS estimates for 2024 have improved 6 cents in the past 60 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 6.7% and 4%, respectively. The EPS estimates for 2024 and 2025 have improved 8 cents and 30 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Axle & Manufacturing Holdings, Inc. (AXL) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report