Goodyear Tire GT delivered fourth-quarter 2023 adjusted earnings per share (EPS) of 47 cents, surpassing the Zacks Consensus Estimate of 33 cents and increasing from 7 cents reported in the year-ago quarter.

The company generated net revenues of $5.12 billion, falling 4.8% on a year-over-year basis and missing the Zacks Consensus Estimate of $5.35 billion due to lower replacement volume & third-party chemical sales.

In the reported quarter, tire volume was 45.4 million units, down 3.8% from the year-ago period’s levels.

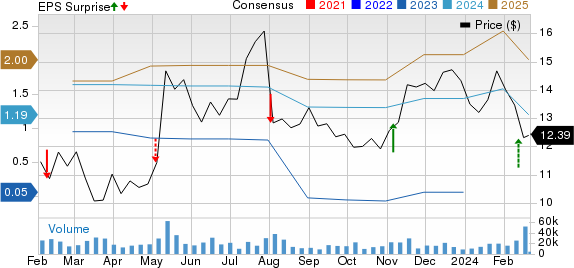

The Goodyear Tire & Rubber Company Price, Consensus and EPS Surprise

The Goodyear Tire & Rubber Company price-consensus-eps-surprise-chart | The Goodyear Tire & Rubber Company Quote

Segmental Performance

In the reported quarter, the Americas segment generated revenues of $3.1 billion, 9.8% lower than the prior-year period’s levels and lagging our estimate of $3.34 billion due to lower volume. The segment registered an operating income of $309 million, which increased 10.8% from the year-ago period’s figures. The operating margin benefited from stronger performance in the chemical business. The figure also surpassed our expectation of $232.6 million.

Revenues in the Europe, Middle East and Africa segment were $1.4 billion, up 2.6% from the year-ago period’s levels, driven by an increase in revenue per tire of 2%. The figure also surpassed our estimate of $1.39 billion. The operating income for the segment was $6 million in the quarter against an operating loss of $80 million in the year-ago period. The figure, however, lagged our estimate of an operating income of $18.3 million.

Revenues in the Asia Pacific segment rose 6.6% year over year to $650 million due to an increase of 10% in tire volume and surpassed our estimate of $603.5 million. The segment’s operating profit was $68 million, up 83.8% from the year-ago figure, owing to an increase in sales volume.

Financial Position

Selling, general & administrative expenses rose to $769 million from $697 million in the year-ago period.

Goodyear had cash and cash equivalents of $902 million as of Dec 31, 2023, down from $1.23 billion as of Dec 31, 2022.

Long-term debt and finance leases amounted to $6.83 billion as of Dec 31, 2023, down from $7.27 billion as of Dec 31, 2022.

Capital expenditure in the quarter was $1.05 billion, down from $1.06 billion in the year-ago quarter.

2024 Outlook

For the first half of 2024, the company anticipates raw material costs, excluding Goodyear Forward, to decrease $375 million year over year.

Capital expenditures are expected in the range of $1.2-$1.3 billion.

Interest expenses are estimated between $520 million and $540 million. Depreciation and amortization is expected to be $1 billion.

Zacks Rank & Key Picks

GT currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Modine Manufacturing Company MOD, NIO Inc. NIO and Oshkosh Corporation OSK. MOD sports a Zacks Rank #1 (Strong Buy), while NIO & OSK carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MOD’s 2024 sales and earnings suggests year-over-year growth of 4% and 67.2%, respectively. The EPS estimates for 2024 and 2025 have improved 22 cents each in the past 30 days.

The Zacks Consensus Estimate for NIO’s 2023 sales implies year-over-year growth of 10.4%. The EPS estimates for 2024 have improved 6 cents in the past 60 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 6.7% and 4%, respectively. The EPS estimates for 2024 and 2025 have improved 8 cents and 30 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report