The global venture capital (VC) landscape witnessed a paradigm shift in 2023 as limited partners (LPs) – institutional investors such as pension funds and university endowments – adopted a more cautious approach and tightened their purse strings.

Southeast Asia’s VC firms felt the squeeze as they closed 25 funds last year, a drop of over 32% from the preceding year’s historical high of 37 closes, according to the latest report by DealStreetAsia – DATA VANTAGE.

Regional VCs raised a record $5.37 billion through these fund closes in 2023, but their performance was heavily skewed by B Capital’s massive $2.1 billion fund, finds the report titled SE Asia’s VC Funds: H2 2023 Review. Exclude this outlier, and the picture becomes significantly less rosy. Other large funds closed during the year include Vertex Ventures’s fifth Southeast Asia and India vehicle ($541 million) and B Capital’s healthcare fund ($500 million).

The report delves deeper, analysing fundraising milestones every six months. Milestones here refer to interim and final closes reported by a VC, focusing only on the amount of capital raised within a specific half-year period.

Southeast Asia-based VCs reported 20 fundraising milestones in the second half of 2023, marking a decrease from the 25 recorded in the first half. This continues the downward trend that began after the peak reached in the second half of 2021.

In total, region firms recorded 45 fundraising milestones last year, a drop from the 61 and 60 milestones seen in 2022 and 2021, respectively. On a positive note, the 2023 performance matched the pre-pandemic level in 2019. VCs collected $5.01 billion in new capital during the year, down from $6.64 billion in 2022.

Tough time for debut funds

In a review of what transpired in 2023, Sam Gibb, the managing partner at Resolution Ventures, believes fundraising challenges will persist in 2024.

“Based on where we are in the cycle, we’d expect that there are fewer fundraising milestones again in 2024 as there are fewer first-time funds coming to market and existing strategies fail to raise follow-on capital. Funds in the region haven’t been returning capital, and this is frustrating investors; it also makes them question what the actual return profile will look like for venture funds in Southeast Asia,” he said.

In line with Gibb’s assessment, DealStreetAsia’s report shows only two debut funds succeeded in achieving a final close last year, a stark contrast to 12 in 2022 and 13 in the pre-pandemic years of 2018 and 2019. Together, these two funds amassed a total of $70 million, in contrast to the $622 million and $346 million gathered by debut funds in 2022 and 2021, respectively.

FEBE Ventures managing partner Olivier Raussin said his first Vietnam-focused fund, which was closed in 2022 at $30 million, navigated through a boom and bust cycle of VC funding. The experience, he said, validated the importance of focusing on sustainable business models rather than short-term hype.

Now raising his second fund with a target of $75 million, Raussin said his LPs “remain cautiously optimistic and understand that successful VC investments demand both patience and strategic foresight”.

Winston Joshua Adi, vice president of portfolio management at Indonesia-based MDI Ventures, expects monetary policy easing in the US to act as a catalyst in improving capital flows to Southeast Asia.

“This should help ease the private capital issue and allow more private investments to gradually grow again. We may not see as quick of a growth that we see pre-pandemic but we will see many sectors grow, led by few companies who are able to scale up,” Adi said.

Fewer foreign funds make beeline for SE Asia

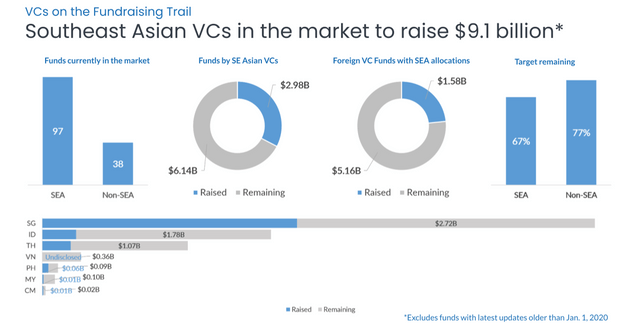

The report also covers fundraising activities by international VC firms that are in the process of gathering capital for global and regional funds with majority or minority allocations for Southeast Asian markets.

In the second half of 2023, only two foreign funds with exposure to Southeast Asia achieved a final close, down from eight in the preceding six months. These 10 funds collectively secured $3.12 billion during the year. This contrasts starkly with 2021, when excess global liquidity fueled 20 final closes. The momentum began tapering in 2022 when 13 foreign funds raised $5.51 billion.

While the exact allocation for Southeast Asia is difficult to ascertain, the yearly trends in final closes point to dwindling interest in emerging market funds. Two key factors are driving this shift – the strategic reallocation of assets towards developed markets amid tightening global monetary policies, and the gradual decoupling of US trade and investment from China.

A closer examination of the VC firms that achieved final and interim closes over the last six years reveals a dominance by US-based companies, which lead the pack with 39 funds, followed by Greater China, Japan, and South Korea. American firms alone accounted for 61% of the total capital raised, with Lightspeed Venture Partners spearheading the charge with its $1.5 billion global fund.

ZWC Ventures stood out among Chinese investors with its $770 million China-Southeast Asia Fund II, followed by HashKey Capital from Hong Kong, which secured $500 million for its third fintech fund last year.

SE Asia VC Funds: H2 2023 Review covers fundraising by VC firms based in Southeast Asia and their regional and global counterparts with a mandate to invest in the region. It offers:

- Fundraising data for SE Asian VC firms since 2018

- Fundraising data for Asian, APAC and global funds with SE Asia allocations since 2018

- Fundraising milestones across strategies since 2018

- List of funds currently in the market

- Insights from prominent investors on the region’s VC landscape