Indonesian tech giant GoTo expects a bigger contribution from its e-commerce arm Tokopedia in 2024 following the latter’s merger with ByteDance’s popular short-video platform TikTok, a senior executive said on Wednesday.

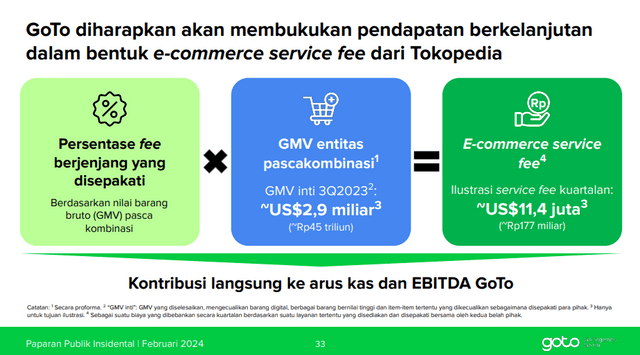

GoTo anticipates positive results from its e-commerce segment in 2024, riding on e-commerce service fees which are expected to rake in $11.4 million each quarter. In Jan-Sep 2023, GoTo’s e-commerce segment booked roughly $134 million in losses.

“We expect Tokopedia to grow at least in line with the industry, meaning we’ll receive an increasing benefit over the years ahead,” Jacky Lo, GoTo’s financial director, said during a streamed public expose.

“Due to steadily increasing e-commerce service fees, should we achieve our aspiration for Tokopedia to become the leading e-commerce player in Indonesia, the benefit to GoTo Group will be increasing even more,” he said.

Lo said the company will begin receiving e-commerce service fees in Feb 2024. For example, Tokopedia and TikTok’s combined gross merchandise value (GMV) in Q3 2023 was $2.9 billion; therefore, GoTo is expected to gain around $11.4 million in e-commerce service fees.

“E-commerce service fees will play an important role in backing our financials this year,” said Patrick Walujo, GoTo president director, noting that more updates on the company’s financials will be published in March.

“The company will continue to improve its performance and focus on implementing strategies for sustainable long-term growth investments that will strengthen the business and increase the company’s resilience and competitiveness in a dynamic market,” he said.

Tokopedia and TikTok finalised their transaction at the end of Jan 2024, and the businesses are now formally merged under the PT Tokopedia entity which is co-owned by GoTo and TikTok, with the latter holding a controlling stake.

The ongoing integration and migration process between Tokopedia and the TikTok app in Indonesia is progressing well and is expected to conclude in the next one or two months, in consultation with the relevant ministries and adherence to prevailing regulations, said the company.

The GoTo Group achieved positive adjusted EBITDA in Q4 2023 and is expected to continue doing so this year, it said.

At the end of Q3 2023, GoTo’s losses adjusted EBITDA stood at -942 billion rupiah, a 74% improvement from Q3 2022. In 9M 2023, GoTo clocked an adjusted EBITDA of 3.7 trillion rupiah, a 71% improvement from the same period a year earlier.

Besides relying on e-commerce service fees, the company will also grow its on-demand services and financial technology businesses. Under on-demand services, it will focus on increasing affordable products through GoCar Hemat and GoFood Hemat, which booked 36% and 2.6x higher order numbers in Q3, respectively.

“We will also provide ride-hailing and public transportation integration features called GoTransit. This feature has become one of the biggest ticket channels in Indonesia’s commuter,” Catherine Hindra Sutjahyo, GoTo’s director, said during the same public expose.

In addition, GoTo is starting to grow its on-demand services to the upper middle segment through express food delivery, comfort ride-hailing, and luxury ride-hailing services.

In financial technology, the company will increase GoPay’s exposure in lending products through GoPay Pinjam and GoPay Later whose lending book swelled 44% in Q3 2023. It also sees opportunities with TikTok in fintech services, including buy now and pay later. Since launching the app in July 2023, GoPay has been downloaded for over 10 million times as of December 2023.