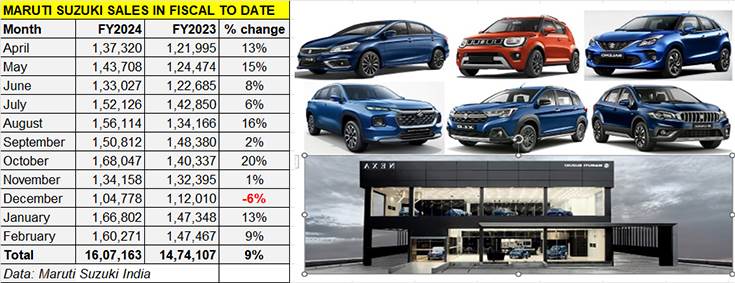

That India Passenger Vehicle Inc will scale a new high in FY2024 is a given, what with the market leader Maruti Suzuki India firing on all cylinders. The company has reported wholesale despatches of 160,271 units in February 2024, which is a 9% year-on-year increase (February 2023: 147,467 units) but down 3.91% month on month (January 2024: 166,802).

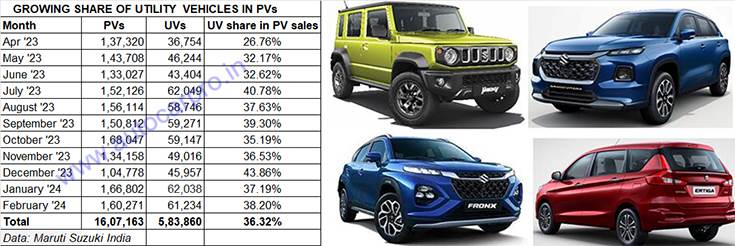

Providing the sales charge, as it has been for the entire fiscal as well as the record CY2023, has been the company’s SUV and MPV range. The eight-model utility vehicle (UV) portfolio, comprising the Brezza, Grand Vitara, Fronx, Jimny, S-Cross, XL6, Ertiga and the new Invicto, together sold 61,234 units in February, the third best monthly numbers in the current fiscal after July 2023 (62,049 UVs) and January 2024 (62,038 UVs).

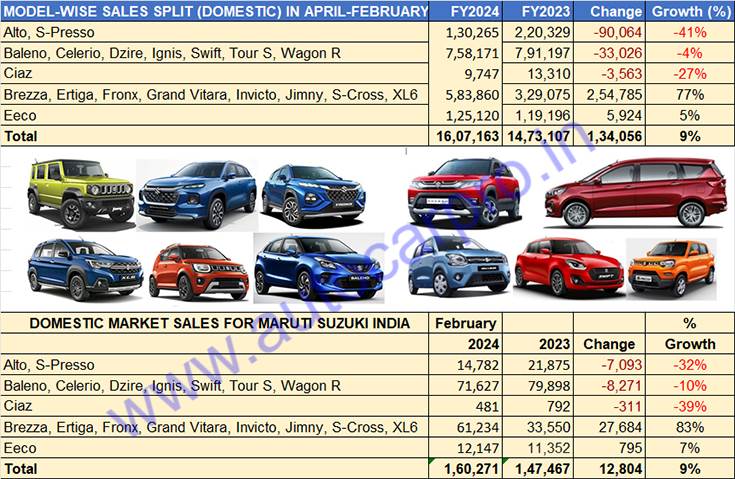

For the past year or so, utility vehicles – SUVs and MPVs – are turned into the firm growth driver for Maruti Suzuki. Cumulative 11-month UV sales of 583,860 units are up by a handsome 77% YoY (April 2022-February 2023: 329,075 units). This is an additional 254,785 UVs sold YoY.

To put things into perspective, Maruti Suzuki’s UV sales alone are more than the entire PV sales of each of the leading car and SUV OEMs in India for the first 11 months of FY2024 – Hyundai Motor India (561,723 units), Tata Motors (522,539 units), Mahindra & Mahindra (419,246 units) and Toyota Kirloskar Motor (219,821 units).

Utility vehicles now account for over a third of Maruti Suzuki’s 1.6 million passenger vehicle sales. 583,860 UVs in FY2024 to date are up 77% YoY

Utility vehicles now account for over a third of Maruti Suzuki’s 1.6 million passenger vehicle sales. 583,860 UVs in FY2024 to date are up 77% YoY

In February 2024, the share of UVs (61,234 units) in overall PV wholesales (160,271 units) is 38.20 percent. For the first 11 months of FY2024, cumulative UV sales (583,860 units) have contributed 36.32% to Maruti Suzuki’s PV sales of 1.6 million PVs.

This massive demand for its UVs has not only helped the company to top the SUV charts and market share but notably helped buffer the sizeable decline in sales of its two hatchbacks, seven compact cars and the its premium Ciaz sedan. In February 2024, the entry-level Alto and S-Presso models sold 14,782 units, down 32% YoY. Cumulative 11-month sales (130,265 units) of these two budget hatchbacks are down by 41% YoY.

Wholesales of the seven-model ‘compact’ models (Baleno, Celerio, Dzire, Ignis, Swift, Tour S and Wagon R), which were up 4% in January, are down 10% in February to 71,627 units. Their cumulative 11-month sales at 758,171 units are down 4% YoY.

It’s a similar scenario with the premium Ciaz sedan – wholesales of 481 units in February are down 39% YoY (February 2023: 792 units) and cumulative 11-month sales of 9,747 units are down 27% (April 2022-February 2023: 13,310 units).

ALSO READ:

Share of ICE vehicles to fall to 28% by 2031 and 10% by 2040, says Maruti Suzuki’s C V Raman

Maruti Suzuki to invest Rs 38,200 crore in Gujarat, to add 1.25 million units in capacity