Sales of sport utility vehicles, motorcycles and scooters in the local market increased in healthy double digits in February, on the back of improved supplies and sustained consumer demand.

Sales of commercial vehicles and tractors though remained muted, on a high base and amid a cyclical slowdown in demand.

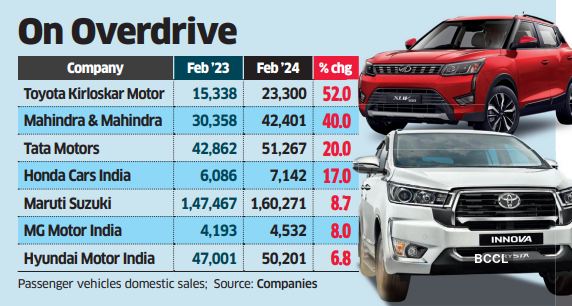

As per industry estimates, passenger vehicle sales last month rose 11.3% from a year earlier to 373,177 units, the highest ever for the month of February. Those were also the third-highest monthly sales on record, behind 3,94,500 units the previous month and 3,91,811 units in October 2023.

Automakers in India mostly report wholesale dispatches from factories to dealerships and not retail sales to customers.

Homegrown Tata Motors dispatched more cars and SUVs last month than Korean automaker Hyundai Motor, the long-time No.2 player in the market behind Maruti Suzuki. Tata Motors sold 51,267 units, compared with 50,201 by Hyundai.

Maruti Suzuki’s sales volume rose about 9% to 160,271 units, with SUVs driving the demand. Senior executive officer (marketing and sales) Shashank Srivastava said: “This is the 14th straight month that monthly sales breached the best-ever mark. Demand continued to be strong for SUVs, which now account for a little over half of all passenger vehicles sold in the country.”

While retail sales of passenger vehicles too are estimated to have gone up by 11.3% to 335,900 units last month, higher dispatches from factories added on to stocks at dealerships. Inventory in the channel now stands at about 300,000 units.

At Mahindra & Mahindra, sales rose 40% to 42,401 units. Toyota Kirloskar Motor reported monthly sales of 23,300 units.

Honda Cars India, which has been growing volumes steadily after the launch of the Elevate SUV, also posted strong sales.

In the commercial vehicle segment, sales remained under pressure with market leader Tata Motors reporting a 4% decline in sales at 33,567 units in the domestic market. At Chennai-based Ashok Leyland, local sales fell 6% to 16,451 units.

Two-wheeler sales remained robust with companies across the board posting healthy numbers. While Hero MotoCorp saw sales go up by about 17% to 445,257 units, rival Honda Motorcycle & Scooter India posted 82% growth at 413,967 units.

Tractor sales were weak. Market leader Mahindra reported an 18% decline in volumes at 20,121 units.

Hemant Sikka, president of the farm equipment sector at Mahindra, said the southern and western states continued to face stress in the agriculture sector due to erratic and deficient monsoon rains. However, the rabi crop outlook is very good, with wheat crop likely to be a bumper crop, he added. “Harvesting has started in a few states with the government supporting early procurement of the wheat crop. Continued government support through various rural schemes and enhanced institutional credit will further help boost tractor demand going forward.”