Gestamp, the multinational company specializing in the design, development, and manufacture of highly engineered metal components for the automotive industry, has achieved best-ever revenues in CY2023.

Gestamp’s revenues for the year grew by 14.4% reaching €12,274 million (12.27 billion euros), despite the unfavourable currency environment. The company outperformed the market by 6.7 percentage points due to Gestamp’s strong competitive position with its customers, product differentiation and geographic diversification.

EBITDA between January and December amounted to 1,371 million euros, a YoY increase of 13.4% with a profitability of 12.3% (excluding the impact of raw materials) despite cost pressure in all markets and the impact of foreign exchange. Net income for the year reached 281 million euros, a year-on-year increase of 8%.

Gestamp has generated 207 million euros in free cash flow by the end of 2023. As a result, Gestamp’s debt has been reduced to 2.058 million euros, representing a net debt-to-EBITDA leverage ratio of 1.5x, the lowest ratio achieved by the company since its IPO.

Francisco J. Riberas, Executive Chairman of Gestamp, said: “2023 has been another record year for the group, demonstrating the strength and success of our strategy to be the Partner Supplier for our clients. Worth highlighting robust revenue growth, efficient margin management despite the year’s challenges, and strong cash generation. This has allowed us to reduce our leverage and strengthen our financial profile. I want to highlight and express my gratitude to the more than 44,000 employees who make up Gestamp; they have been key in our success. We continue to focus on profitable and sustainable growth and the opportunities in NAFTA, driving our technology and innovation activity to provide unique and innovative solutions that allow our clients to be at the forefront of the transition to a sustainable mobility.”

NAFTA as a strategic priority

According to Gestamp, its good performance in recent years has been diluted by the NAFTA region where the EBITDA margin is 6.7% on sales compared to the rest of its automotive business, which represents 12.6%. Gestamp has set the goal of bringing the margin in this region to double-digit by 2026, in line with the performance of the rest of its geographies.

To this end, Gestamp has launched the Phoenix plan with four key levers: operational improvement with a two-level of intervention restructuring plan affecting 6 facilities, cost savings, attracting the best talent, and commercial lever that ensures profitable growth in the region.

NAFTA is a key market in Gestamp’s future. Returning to the path of profitable growth in this region is a strategic objective and a priority for the entire management team.

EVs as a growth driver

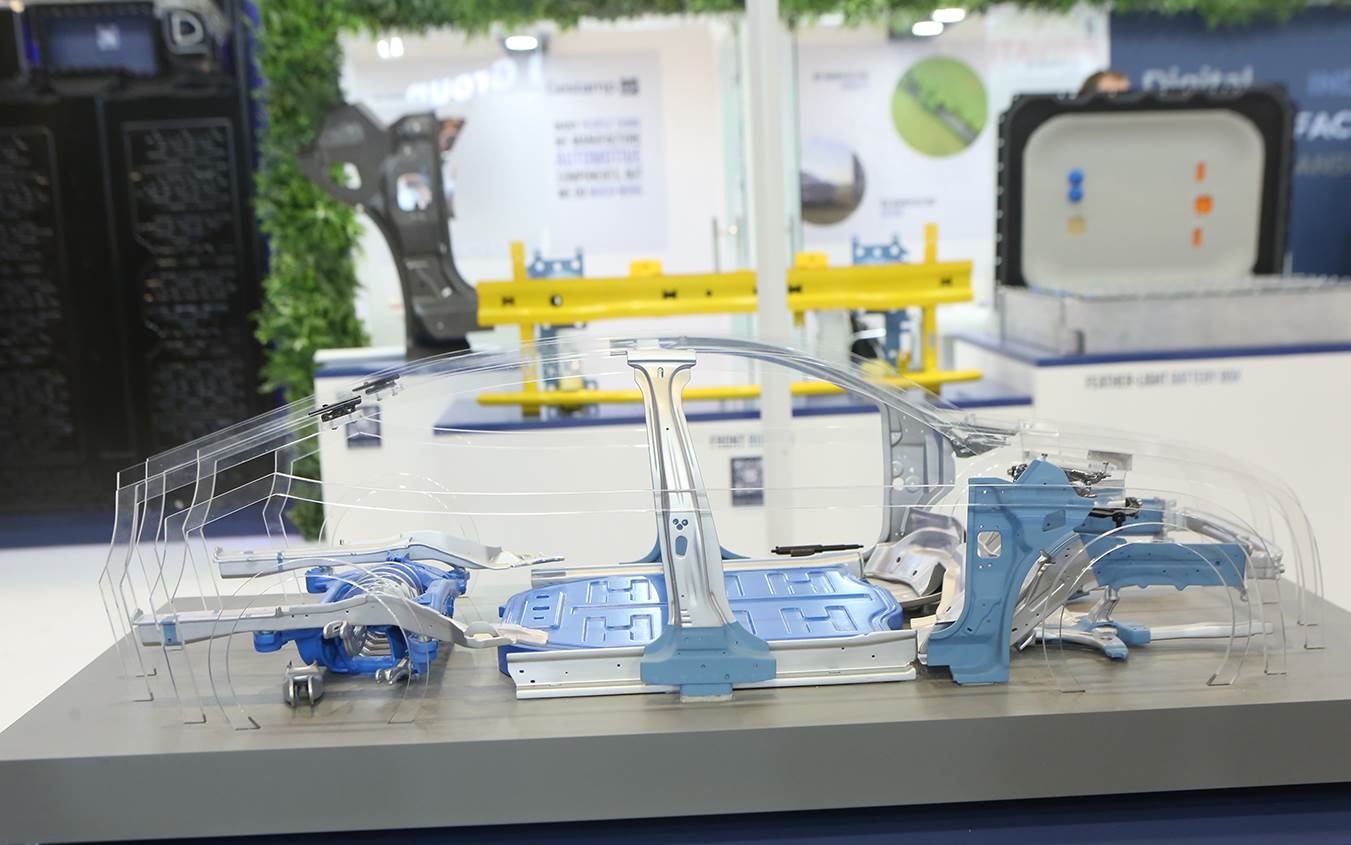

Electric vehicle-related revenues accounted for 20% of the group’s automotive components sales in 2023. This represents a growth of 6 percentage points compared to CY2022 and has benefited from its strategy of anticipating differentiated solutions for its customers, including products such as the Door Ring and the Battery box.

The EV segment will continue to be a growth driver for Gestamp, which estimates the penetration of EVs to remain stable for the coming years, with an increase of 26% in the period 2023-2027.

Meanwhile, Gestamp has also achieved an order backlog for the next five years of up to 56.6 billion euros, a figure that underpins revenue targets for the 2024-2028 period. This, as per the company, intense commercial activity is the result of the strategic positioning that the company has achieved in the market through its focus on technology and innovation, both in its products and processes.

2023 has been characterized by an increase in vehicle production, which has exceeded all forecasts. More than 90 million vehicles were produced worldwide, surpassing the amount of 2019, but far from the 95 million produced in 2017. The future forecast indicates to a limited growth, which will go from less to more until 2027, when it is expected that vehicle production will reach 94.6 million.

Outlook for 2024

The present context points towards a 2024 defined by limited growth in vehicle production (especially in Europe), inflationary pressures, and macroeconomic and geopolitical uncertainty. Despite this, Gestamp aims to outperform the market in a low-single digit range and preserve the profitability of the automotive business.

The industry as a whole, and the automotive sector in particular, is undergoing a deep transformation towards the decarbonization of its activities and its supply chain. Gestamp, as the Partner Supplier to the automotive industry, has an ambitious plan to drive neutrality through energy and material decarbonization.

To meet its commitments, throughout 2023, the company has established new partnerships to promote the use of low-emission steel with high scrap content to enhance circularity. On the one hand, Gestamp has partnered with ArcelorMittal to strengthen sustainability across the automotive supply chain by jointly designing and implementing a circularity scheme to promote the use of scrap as a secondary raw material.

A collaboration has also been established with SSAB to supply Gestamp with SSAB Fossil-free, a fossil-free steel to be used in the production of BiW and chassis products. And finally, as part of the collaboration established with Tata Steel, the company plans to almost double the percentage of recycled steel in components supplied to the automotive sector.

ALSO READ:

Gestamp forecasts over 50% of its revenues by 2027 will come from EVs

Gestamp joins Catena-X open-data ecosystem for global auto industry