PT Akulaku Finance Indonesia (AFI), a multifinance company backed by fintech company Akulaku, is planning to double down on its paylater (buy now pay later, or BNPL) product this year with regulatory restrictions being lifted last week.

Last October, the Indonesian Financial Services Authority (OJK) had limited the operations of Akulaku over alleged violations in supervisory obligations related to BNPL offerings including regulations on risk management and good corporate governance.

Efrinal Sinaga, President Director of Akulaku Finance Indonesia, told DealStreetAsia that the company has set a 20% growth target this year for paylater financing, which stood at 9 trillion rupiah ($527 million) last year.

“There will be some marketing programmes for paylater products, including co-branding with new partners, adding new channels, and expanding coverage area,” he told DealStreetAsia.

Akulaku Finance has already partnered with some lenders for its paylater services, including Bank Jago, Bank Neo Commerce, Bank OCBC Indonesia, and Bank Permata. Their services can also be found on Bukalapak, TikTok, and Ruangguru, among others.

“We will speed up our services to customers post the lifting of restrictions, especially to cater to demand during Ramadan and Eid Fitr season,” Sinaga added.

Regardless of the supervisory obligations mentioned earlier, Indonesia lacks specific regulations over BNPL offerings, which currently follow rules framed for multifinance companies.

The regulator is now formulating specific regulations for BNPL offerings under the financial services law bill. Some areas that need to be included in the regulations are the credit scoring system, interest rate, personal data protection, debt collection mechanism, and partnerships in BNPL, according to the Roadmap of Multifinance’s Development and Strengthening issued by OJK on Tuesday.

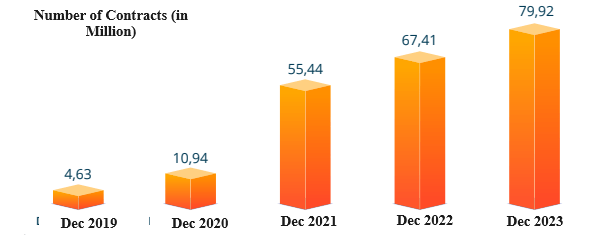

Pioneered by Kredivo, BNPL has been growing in Indonesia since 2014 and currently has seven players. The number of BNPL contracts surged almost 20x to 80 million in 2023 from 4.63 million in 2019. However, the cumulative assets of BNPL only contributed 2% of multifinance’s total assets at 552 trillion rupiah at the end of last year.

BNPL Number of Contracts

Source: OJK