India Auto Inc is barely a fortnight away from announcing its best-ever wholesales numbers for both passenger vehicles as well as utility vehicles. With apex industry body SIAM releasing the wholesales / dispatch numbers for February 2024, which turned out to be the best-ever February for India PV Inc as did January 2024, March 2024 clearly is looking to be a month which will break a few more number-crunching records.

At 370,786 units, up 11% YoY (February 2023: 334,790 units), last month has turned out to be the best February yet for passenger vehicle OEMs in India. In the first 11 months of FY2024, the 29-day February 2024’s dispatches are the third highest after January’s 393,074 units and October 2023’s 390,014 units, even with two fewer days that those two months. The rapid pace of sales throughout the current fiscal can be gauged from the fact that over the past 11 months, 10 months saw PV wholesales exceed 325,000 units other than the year-ending December 2023 (286,390 units).

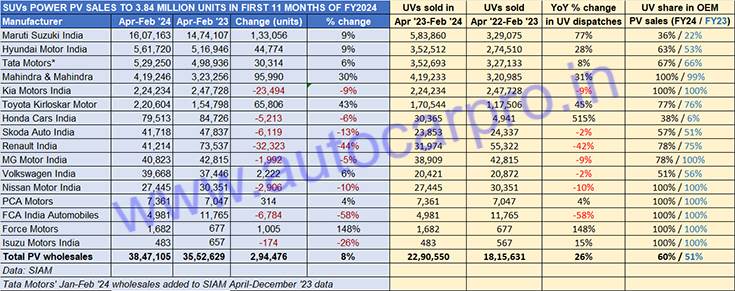

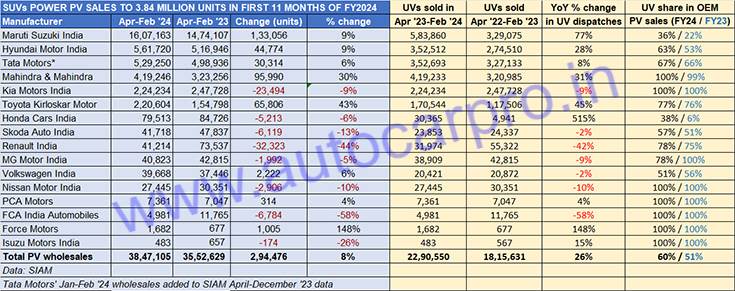

At an estimated 38,47,105 units in the first 11 months of FY2024, India PV Inc is just 43,009 units behind FY2023’s record wholesales of 38,90,114 units. With the fiscal-ending March 2024 will most likely deliver another round of record-breaking numbers, going far beyond March 2023’s 336,255 units, India PV Inc could be driving at a best-yet 400,000-unit sales this month and record total of 4.25 million units in FY2024.

What’s powering the PV industry is the unabating demand for utility vehicles (UVs), which comprise SUVs and MPVs. The UV segment, which now is the heavy lifting champion for the industry, continues to deliver sustained double-digit growth and in the process has helped buffer the sharp decline in mass-market entry-level cars and the slowdown in demand for other vehicle categories like hatchbacks and sedans. Not surprisingly, UV wholesales, currently at an estimated 22,90,550 or 2.29 million units, a 26% YoY increase (April 2022-February 2023: 18,15,631 units), are expected to go past the 2.5 million- mark in FY2024.

A deep dive into SIAM wholesales data reveals that the UV share of the PV market has hit a best-ever 60% – 2.29 million UVs to 3.84 million PVs – in the April 2023-February 2024 period. This is a good eight percentage point increase YoY – in FY2023, UV sales (20,03,718 UVs) accounted for 51.50% of total PV sales (38,90,114 PVs).

As the wholesales data table above depicts, UV OEMs averaged monthly dispatches of 208,231 units in the past 11 months for robust YoY growth of 26 percent. Year on year, UV OEMs have sold an additional 474,919 units (April 2022-February 2023: 18,15,631 UVs), which speaks volumes for the rate of growth.

THE MOVERS AND SHAKERS

What has helped accelerate SUV and MPV sales is a consistent rollout of new models, increased availability of in-demand models due to ramped-up production, effective OEM marketing and an improving economy.

The UV customer in India is spoilt for choice – along with 16 SIAM member companies and luxury carmakers, there are over 110 UVs and a mind-boggling 800-plus variants currently on offer, all fighting for a slice and more of the action in the booming marketplace. Let’s take a close look at the top players, the movers and shakers in the PV industry. Of the 16 SIAM PV OEM members, eight have witnessed growth while the remaining six have seen their sales decline year on year.

Maruti Suzuki India: 16,07,163 PVs, up 9% YoY / 583,860 UVs, up 77%

UV share of PV sales: 36% in April 2023-Feb 2024 vs 22% a year ago

India’s largest carmaker Maruti Suzuki is also the UV market leader with a current market share of 25 percent. Between April 2023 and February 2024, the company has dispatched over 1.6 million PVs, up 9% and 583,860 UVs, up 77%.

Leading the charge from the seven-model portfolio is the Brezza, followed by the Ertiga MPV, Fronx, Grand Vitara, XL6, Jimny and the Invicto MPV (3,885 units). The last five are premium models from the Nexa channel and cumulatively, at 293,709 units, account for 50% of Maruti Suzuki’s UV sales in the first 11 months of FY2024. The shift in Maruti Suzuki model growth trajectory is seen in the growing contribution to its PV sales – at end-February 2024, this was 36% compared to 22% in the year-ago period.

Hyundai Motor India: 561,720 PVs, up 9% YoY / 352,512 UVs, up 28% YoY

UV share of PV sales: 63% in April 2023-Feb 2024 vs 53% a year ago

Longstanding No. 2 PV OEM Hyundai Motor India has clocked wholesales of 561,720 PVs in the past 11 months, up 28% YoY. Its cumulative UV sales are 352,512 units, up 28% YoY – the share of UVs in Hyundai’s PVs has increased to 63% from 53% a year ago.

SUV sales for the company, which has a seven-model portfolio, continue to be led by the Creta, the best-selling midsize SUV in India, with 146,315 units. The company claims to have received 80,000 bookings for the refreshed Creta launched on January 16, and is currently sitting at an order backlog of around 48,000-50,000 units, with the SUV having a waiting period ranging from six weeks to four months.

Up next are Hyundai’s first compact SUV, the Venue (119,281) and its second compact SUV, the recently launched Exter (62,826 units). While the flagship Alcazar (19,333 units) is the fourth highest seller, it is followed by the Tucson (2,773 units), all-electric Ioniq 5 (1,335 units) and the Kona (649 units).

Tata Motors: 529,250 PVs, up 6% YoY / 352,693 UVs, up up 8% YoY

UV share of PV sales: 67% in April 2023-Feb 2024 vs 63% a year ago

Tata Motors, with 529,250 PVs in the past 11 months, has clocked 6% YoY growth. The car and SUV maker, like Maruti Suzuki and Hyundai, has successfully surfed the wave of soaring demand for SUVs. Sustained demand for its four-model range has seen it dispatch 352,693 units (which puts it ahead of Hyundai at this stage by 181 units), more or less maintaining its UV:PV ratio of 67:33 percent.

Tata Motors’ UV portfolio comprises two compact SUVs (Nexon and Punch) and two midsize SUVs (Harrier and Safari). While the Nexon, which is available with petrol, diesel, CNG and electric powerplants is the currently the UV market leader. Like the Nexon, the Punch too has crossed the 150,000-unit sales mark in the past 11 months. Of the company’s four models, three – Nexon, Harrier and Safari – have aced the Global NCAP crash test with a five-star rating under the new protocol.

Mahindra & Mahindra: 419,246 units, up 30% YoY / 419,233 UVs, up 31% YoY

Mahindra & Mahindra, which has a stable full of SUVs, has registered wholesales of 419,246 units, up 30% YoY, giving it an 11% PV market share and an 18% UV market share. The company, which had 226,000 SUV bookings on hand as of early February, has ramped up production to 600,000 units per annum, continues to see strong demand for the Scorpio and Scorpio Classic (126,311 units). They are followed by the Bolero (100,494 units), flagship XUV700 (72,787 units), Thar (59,197 units), XUV300 (51,890 units), the all-electric XUV400 (7,887 units) and the Marazzo MPV (667 units).

Kia India: 224,234 UVs, down 9% YoY

Fifth-ranked Kia India has dispatched a total of 224,234 UVs in last 11 months, down 9% (April 2022-February 2023: 247,728 units). The Seltos (92,511 units) remains Kia’s best-selling SUV in India, followed by the Sonet (72,634 units), the Carens MPV (58,430 units) and the all-electric EV6 (659 units).

Toyota Kirloskar Motor: 220,604 PVs, up 43% YoY / 170,544 UVs, up 45% YoY

UV share of PV sales: 77% in April 2023-Feb 2024 vs 76% a year ago

Just 3,630 units behind Kia is a resurgent Toyota Kirloskar Motor, which has delivered a strong performance throughout the current fiscal. The Japanese car and SUV manufacturer’s cumulative 11-month wholesales of 220,604 units are up 43% YoY.

Demand is led by the popular Innova Crysta/Hycross MPV (88,280 units, up 86% YoY), followed by the Urban Cruiser Hyryder (42,951 units). The Rumion MPV, launched in August, has sold 5,285 units till end-February 2024. Combined sales of three other models (Fortuner, Hilux and Vellfire) add another 34,028 units to TKM’s total UV sales for the first 11 months of FY2024.

Honda Cars India is ranked seventh with 79,513 PV sales, down 6% on the year-ago 84,726 units. The company, which has been missing out on the mega action in the SUV market is back in the game with its Elevate midsize SUV, which has sold 30,365 units since launch barely five months ago. As a result, the Elevate has contributed 38% to Honda’s total PV sales, compared to the UV share of just 6% a year ago.

Next up is Skoda Auto India with wholesales of 41,718 PVs, down 13% YoY. This total comprises 22,102 Kushaqs (down 4% on year-ago 23,048 units), 17,734 Octavias and Slavias (down 20% on year-ago 22,065 units), 1,751 Kodiaqs (up 36% on year-ago 1,289 units), and 131 Superb sedans. The 23,853 SUVs sold see Skoda’s UV share of its PV sales rise to 57% from 51% a year ago.

Renault India is the No. 9 PV OEM with 41,214 units comprising 9,240 Kwids (down 49% on year-ago 18,215 units), 31,974 Kiger and Triber SUVs (down 42% on year-ago 55,322 units).

MG Motor India has sold a total of 40,823 PVs, down 5% YoY. The wholesales comprise 1,914 units of the Comet EV, 1,747 ZS EVs, 25,548 Hectors, 9,295 Astors, 2,319 Glosters.

Volkswagen India with 39,668 units has registered a PV sales increase of 6% over the year-ago 37,446 units. The wholesales comprise 19,247 Virtus sedans, 18,897 Taiguns and 1,524 Tiguans. The strong performance of the Virtus has impacted the UV:PV share ratio, which is now 51% compared to 56% a year ago.

Nissan Motor India, which has a single product in the Magnite SUV sold 27,445 units in the period under review, down 10% YoY.

PCA Motors, the OEM representative for Citroen India has chalked up sales of 7,361 units in the first 11 months of the current fiscal, up 4%. The dispatches comprise 5,732 units of the C3 and eC3, a similar 1,573 units of the C3 Aircross launched six months ago, and 56 units of the C5 Aircross.

Force Motors, with sales of 1,682 units of the Trax, posted 148% growth on a low year-ago base of 677 units.

The 16th OEM in the ranking table is Isuzu Motors India, with 483 units (34 MU-X, 365 Hi-Lander, 84 V-Cross), down 26% YoY.

Mega March to help India Auto Inc hit record PV and UV sales

With the wave of UV demand continuing, it’s not surprising that the companies with SUV-heavy portfolios continue to make gains month after month in the overall PV market. And it should be the same in the fiscal year-ending March 2024.

In the first 11 months of FY2024, five of the top six OEMs with six-pack sales numbers have either already exceeded or will surpass their entire FY2023 sales – Maruti Suzuki with 16,07,163 PVs (FY23: 16,06,870 PVs including 366,129 UVs), Hyundai Motor India with 561,720 PVs (FY23: 5,67,546 including 3,01,681 UVs), Tata Motors with 529,250 PVs (FY23: 544,391 PVs including 3,57,249 UVs, Mahindra with 419,246 units (FY2023: 359,253 units) and Toyota Kirloskar Motor with 220,604 PVs (FY23: 1,73,245 PVs including 132,490 UVs).

Given the strong customer demand and market momentum, it can be surmised that March 2024 should see vehicle manufacturers dispatch a high number of SUVs and MPVs well in excess of 200,000 units to a UV-hungry market. This will provide enough ammo to power the industry across the 2.5 million UV sales milestone for the first time in a fiscal, and India PV Inc to a record 4.25 million units.