Of the top-selling 30 models, the ones with the lowest inventory were mostly Toyota and Honda models. The Toyota Grand Highlander remained at the lowest level, while the Ford Maverick and the Chevrolet Trax were the only domestics in the bottom 10.

Graphic: Cox Automotive

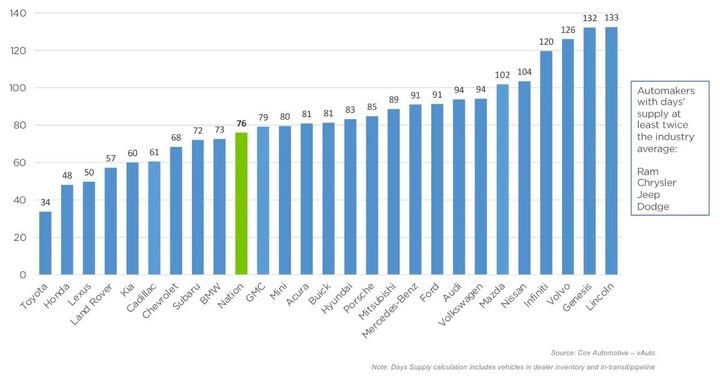

March opened with 76 days of supply across the industry, down from 80 days in January, as brisk February sales drew down new-vehicle inventory as measured in days’ supply, according to Cox Automotive’s analysis of vAuto Live Market View data released March 14.

But the total U.S. supply of available unsold new vehicles opened March up 52% from a year ago at 2.74 million units, up 942,000 units, and higher than February’s measure of 2.61 million.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which ended March 5. Sales during that period ran 12% ahead of a year ago. For the full calendar month of February, sales increase 6% to a seasonally adjusted annual rate (SAAR) of 15.8 million, up from February 2023’s 14.9 million, and up from January’s downwardly revised 14.9 million. February’s SAAR was slightly stronger than the pace in the second half of last year and represented a rebound from weather disruptions in January.

Domestic Automakers Have Highest Inventory Levels

The domestics continued to have the highest inventory. Dodge led the pack of five at the top, followed by Jeep, Chrysler, Ram and Lincoln. Brands with the lowest supply were Asian imports. Toyota had the lowest at 34 days of supply, followed by Honda and Lexus, with Land Rover, Kia and Cadillac rounding out the bottom six.

Of the top-selling 30 models, the ones with the lowest inventory were mostly Toyota and Honda models. The Toyota Grand Highlander remained at the lowest level, while the Ford Maverick and the Chevrolet Trax were the only domestics in the bottom 10.

At the other end of the spectrum, pickup trucks, led by the Ram 1500, and SUVs, led by the Ford Explorer, had the highest inventory among the best-selling products in the U.S.

The average new-vehicle listing price opened March at $47,285, up only 0.6% from a year ago. The average listing price remained relatively flat throughout February but is down 2.8% from the beginning of the year.

The average transaction price (ATP) of a new vehicle last month was $47,244, according to Kelley Blue Book, down 2.2% from February 2023 and down 5.4% from the market peak in December 2022. Still, new-vehicle prices in the U.S. remain elevated, higher by nearly 14% compared to February 2021. Discounts and incentives in February averaged 5.9% of ATP, up from 5.7% in January and significantly higher than the average 3.1% recorded in February one year ago.

Originally posted on Automotive Fleet