After a slow start to the year, Southeast Asia-focused private equity (PE) funds made a strong comeback in the second half of 2023, finds a new report. They closed the year with six fund closes, raising $2 billion in new capital.

The 2023 performance was on par with the previous year’s tally of six fund closes and a $2.1 billion haul.

According to Private Equity in SE Asia: H2 2023 Review, the second half saw three funds holding final closes after bagging $1.55 billion – more than triple the amount raised in the first six months of the year.

This performance stood in contrast to the global PE market, which experienced an 11.5% year-over-year decline in fundraising value, hitting its lowest level since 2017, according to Preqin data. The number of fund closes worldwide also dropped to its lowest point since 2015.

As the global economy continues to grapple with uncertainties, the ability of Southeast Asia-focused funds to maintain a steady fundraising momentum highlights the region’s continued relevance as an investment destination.

Falling short

A strong rebound in H2 aside, Southeast Asia-focused fund managers did not emerge entirely unscathed from the challenging fundraising environment of 2023. Five of the six funds that closed last year failed to meet their original targets as limited partners (LPs) adopted a more cautious approach amid macroeconomic headwinds.

Growtheum Capital, a newcomer to the Southeast Asian PE scene, had set its sights on raising $600-800 million for its debut fund. However, it ultimately closed the fund at $567 million in August.

Asia Partners also dealt with tempered investor appetite. The firm had initially sought $600 million for its second fund but managed to secure only $474 million when it closed the fund in December.

The Asia Energy Transition Fund, managed by Swiss firm SUSI Partners, faced similar challenges. Despite the growing interest in sustainable investments, the fund closed at $120 million in June, well below its $250 million target.

Novo Tellus Capital stood out as an exception, surpassing its initial goal by 36% and raising $510 million for its third fund. The firm’s co-founder and managing partner, Wai San Loke, attributed the performance to the firm’s early and consistent investment in Southeast Asia’s tech supply chain, and its ability to deliver top quartile returns through a strategy focused on business transformation rather than de-leveraging.

“The consistency of our investment strategy and our strong track record of generating proprietary deal opportunities with top quartile returns played important roles,” Loke said.

Funds in the market

In 2023, six regional PE funds also reported interim closes, collectively securing close to $1 billion against a target of $1.8 billion. Quadria Capital, a major player in the healthcare sector, crossed a significant milestone in October with a $500 million interim close for its third fund.

Last year saw the unveiling of six new Southeast Asia-focused funds with a combined target corpus of $1.75 billion. This aggregate value represents a notable decline from 2022, when five new funds were launched with a combined target of $3.25 billion. The more modest fundraising goals could signal a strategic shift among fund managers towards more achievable targets in response to prevailing market conditions.

Chinh Xuan Hoang, managing partner of Vietnam-focused Excelsior Capital Partners that is currently in the market for its second fund, acknowledges that LPs have turned more cautious.

“We see investors asking more questions about exits and DPIs, getting more cautious about the macro situation and how geopolitical tensions and a slowdown in global demand in the world and this region may impact Vietnam’s already open economy,” he said.

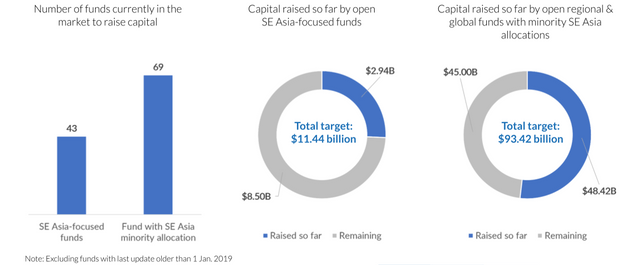

There are currently 43 Southeast Asia-focused funds in the market, seeking to amass over $11.44 billion in capital commitments. To date, these funds have secured at least 26% of their target corpus.

As the global economy navigates turbulent waters, fund managers in Southeast Asia are adapting their strategies, opting for more conservative targets and a measured approach to fundraising. This prudent stance aims to align with investor sentiment while positioning funds to capitalise on opportunities as conditions improve.

Age of decoupling

One of the underlying factors contributing to Southeast Asia’s allure is the increasing recognition of the region’s potential as an attractive alternative to traditional investment destinations, amidst the gradual decoupling of the US supply chain from China.

As manufacturers and tech giants seek to diversify their supply chains beyond China, countries like Vietnam, Malaysia, and Indonesia are rapidly developing robust manufacturing capabilities. Combined with India’s economic rise, this shifting landscape presents compelling opportunities for investors willing to look beyond traditional spheres.

Loke highlights that Novo Tellus’s strategy has always focused on Southeast Asian industrial companies complementing the global technology supply chain. The US-China tensions have further validated this approach, extending coverage to Southeast Asia and other markets under the “Alt Asia” umbrella. He sees the decades-long supply chain reconfiguration as an enduring, investable trend.

As an investor focused on Vietnam, Chinh expressed confidence that the country will continue to benefit from China-US tensions, evidenced by the sustained support from LPs.

Speaking from the perspective of private credit, KKR’s managing director and Southeast Asia and India credit head SJ Lim said global investors are considering larger allocations to Asia to complement and diversify their existing US and European credit allocations.

“One of the common concerns we encounter around Southeast Asia is regulatory risk or jurisdiction-related considerations. Many LPs who are less familiar still equate Asia credit with special situations or distressed investing; however, we believe the most attractive risk-reward lies within performing private credit where we are investing behind large, stable, healthy businesses with quality professional management,” Lim said.

KKR, he said, viewed Southeast Asia as a net beneficiary of several global and regional trends, including the global supply chain shifts, rising middle class consumption, and energy transition.

Private Equity in SE Asia: H2 2023 Review covers fundraising by private equity firms based in Southeast Asia and their regional and global counterparts with a mandate to invest in the region. It offers:

- Fundraising data for SE Asian PE firms since 2019

- Fundraising data for Asian, APAC and global funds with SE Asia allocations since 2019

- Fundraising milestones across strategies

- List of funds currently in the market

- Insights from prominent investors on the region’s PE landscape