Laying out the government’s stance on concerns flagged by Indian origin startups over levy of hefty taxes for moving their domicile back to India, commerce minister Piyush Goyal said such entities will have to pay tax for onshoring themselves.

In an interaction with journalists from The Economic Times on Friday, Goyal said it would be difficult to justify a “discrimination” on which companies coming back to India should pay tax and which shouldn’t.

“These companies went outside for their own selfishness…not because of any pressure or other reason. They wanted to do better tax planning…they enjoyed that benefit. Why they want to come back is not an altruistic motive. They want to list in India because here’s where you get the valuations. India’s growth story is unparalleled in the world and that’s why they want to come here,” he said.

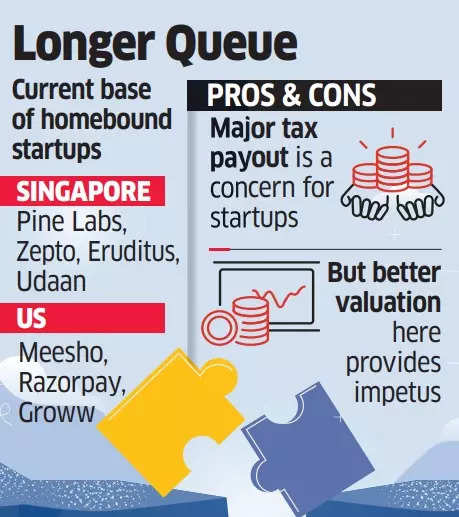

ET has reported earlier that several unicorn startups including Pine Labs, Zepto, Meesho, Razorpay and Eruditus have been planning to move their headquarters back to India from jurisdictions such as Singapore and the US.

“So, if they have to pay tax, it’s good. It’ll help us give more scholarships to poor children or build homes for the poor or replace the slums with proper housing. We have a lot of plans for this country and the tax they are paying is from their income on which they initially saved tax,” the minister added.

When these companies were being incorporated, access to necessary and timely domestic funding was difficult because of which many of these startups turned to overseas investors requiring them to establish their holding companies offshore.

“In hindsight, this is becoming a big issue,” said one founder.

Now, a number of these firms are looking to move their base back to India looking to benefit from the rising valuations being offered by domestic public markets to technology ventures.

In January last year, US-based retail major Walmart paid nearly USD 1 billion in taxes to the Indian government during separation of PhonePe from parent Flipkart and the return of the fintech company’s holding entity to India.

Shortly after that, the Economic Survey for 2022-23 laid down recommendations for the Union government for tax simplification to accelerate the process of reverse-flipping, or shifting domicile from overseas locations back to India.

Goyal also spoke about the angel tax issue affecting startups that the norms around setting of valuations and the applicable tax were brought in considering “fly by night companies” set up and used for “hawala transactions or creating capital”.

“That was the reason that taxes were brought in…and valuation norms have to be there. There is an indirect impact on startups…so we must balance the two. If we totally open it up, then the startup issue will be resolved but the problem of the other sort will start again,” he said.

“The government has intelligently done that if you have such an issue, there is a DPIIT committee, you can come before that, register, and they’ll hear your case…revenue officials are there (on the committee) and approve it. So, we have created that mechanism. It’s working,” he added.