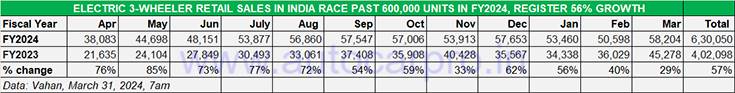

If the Indian electric vehicle (EV) industry has achieved record sales in FY2024, then it’s all credit to the ‘low-hanging fruit’– two- and three-wheelers. While two-wheelers hit a record 930,000-plus sales, three-wheelers also did their bit for the industry by registering best-ever sales of over 630,000 units and robust 57% YoY growth in FY2024 (FY2023: 402,098 units). And, given that every second three-wheeler sold in India is now an EV, the transition to e-mobility is clearly the fastest in this sub-segment.

As accurately forecast by Autocar Professional, e-three-wheeler OEMs surpassed the 600,000 units milestone for the first time, way ahead of FY2023’s 402,098 units and also beat CY2022’s 581,696 units.

Strong and sustained double-digit growth throughout FY2024 has seen the electric three-wheeler industry record handsome gains.

Strong and sustained double-digit growth throughout FY2024 has seen the electric three-wheeler industry record handsome gains.

As per Vahan data as of March 31, 2024 (7am), a total of 11,62,486 three-wheelers (petrol, CNG, LNG and electric) have been retailed between April 2023 and end-March 2024. This means e-three-wheelers account for 54% of total retails, reaffirming the fact that every second three-wheeler sold in India is now an EV. CNG-only models accounted for 353,104 units or 30% of two three-wheeler sales. Demand for diesel three-wheelers is now down – at 132,120 units, they accounted for an 11% share of the overall three-wheeler market.

This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Compared to fossil fuel or CNG-powered models, the long-term wallet-friendly proposition of electric three-wheelers is drawing both single-user buyers (autorickshaw drivers) as well as fleet operators. The retail sales data table above indicates the growth trajectory for the ongoing fiscal year.

MAHINDRA TOPS WITH 60,000+ UNITS, YC ELECTRIC, SAERA No. 2 & 3, BAJAJ AUTO CHECKS IN

This sub-segment of the EV industry, which has nearly 500 players fighting for a slice and more of the action, is dominated by only a few. A deep dive into retail sales in FY2024 reveals that 14 players (see Top 40 OEMs sales table below) have each sold over 10,000 units. Together, they account for 297,446 units or 47% of the e-three-wheeler market.

Mahindra Last Mile Mobility (MLMM), the market leader in FY2023 with 29,497 units and an 8.42% share, remains on top with sales of 60,013 units in FY2024, a handsome increase of 103 percent . The company, whose three-wheeler EV portfolio includes the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo catering to multiple mobility operations, has benefited from the launch of two new products – the Treo Plus and e-Alfa Super passenger and cargo variants. Also, to meet the growing demand for its products MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

At 42,658 units, YC Electric Vehicles is the firm No. 2 OEM and has a 7% market share. The company continues to witness sustained demand for its five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for YC EV.

Saera Electric Auto with 30,088 units is ranked third, maintaining its CY2023 (29,306 units) position. Likewise, No. 4 remains Dilli Electric Auto with 29,119 units.

Piaggio Vehicles, with 24,712 units, is fifth in the EV manufacturer rankings but has gone ahead of its CY2023 sales of 20,742 units. The company is benefiting from its new models and aggressive network expansion. The Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range) are fully assembled by an all-women team at its Baramati factory in Maharashtra.

There are nine other OEMs which have sold over 10,000 units each in CY2023. They comprise Mini Metro EV (16,039 units), Champion Poly Plast (13,989 units), Unique International (13,941 units), Hotage Corporation (13,862 units), Energy EV (11,950 units), JS Auto (11,498 units), Allfine Industries (11,159), Bajaj Auto (10,733), and SKS Trade India (10,685).

The dark horse for FY2025 though is the Pune-based Bajaj Auto, which is the IC engine three-wheeler market leader and is a recent entry into e-three-wheelers in June 2023. With two products – the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 – Bajaj Auto has sold 10,733 units with sales growing month on month. In March 2024, it was the fourth best-selling OEM after Mahindra, YC Electric and Saera Auto. In CY2023, it was ranked 28th in a field of nearly 500 players. In FY2024, it is placed at No. 13 – expect it to up the ante this year with ramped-up production and an expanded EV sales network.

Should the top three players be worried? Your guess is as good as mine! Stay plugged into the exciting e-three-wheeler growth story.

ALSO READ: Electric 2-wheeler retails in India hit highest level in FY2024: 935,000 units

Electric car and SUV sales jump 90% to 90,000 units in FY2024