A new global survey commissioned by ABB Robotics and conducted by Automotive Manufacturing Solutions (AMS) concludes that while automation is considered critical to the future of the automotive industry, many companies in the supply chain have yet to take advantage of the benefits offered by robotics and digitalisation.

The ABB survey gathered opinions on a range of topics from a comprehensive mix of nearly 400 industry experts from vehicle manufacturers and suppliers at all levels of management and engineering as well as other key professionals throughout the automotive world. Over half of the respondents are based in either the US, India, Germany or the UK.

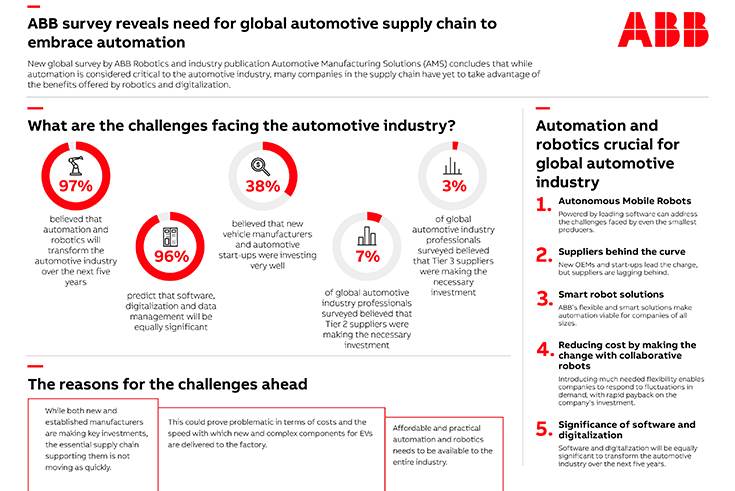

Almost all respondents (97%) believe that automation and robotics will transform the automotive industry over the next five years, with a similar number (96%) predicting that software, digitalization and data management will be equally significant.

When asked about the pace of investment, most believed that new OEMs and start-ups were well ahead of the curve, investing either ‘very well’ (38%) or ‘quite well’ (28%), followed by legacy OEMs who were thought to be embracing automation ‘very well’ by 31%. However, only 7% believed that Tier 2 suppliers were making the necessary investment, with Tier 3 suppliers further behind with only 3%.

“Automation has traditionally been seen as the preserve of only the very largest manufacturers,” said Joerg Reger, Managing Director of ABB Robotics Automotive Business Line. “But the reality is that ABB’s comprehensive portfolio, spanning everything from collaborative robots (cobots), large industrial robots and AI-powered Autonomous Mobile Robots, all powered by leading software solutions, can address the challenges faced by even the smallest producers. Automation can make smaller companies more resilient, flexible and efficient.”

For example, ABB’s dual-armed YuMi cobots have recently helped Japan’s SUS Corporation, a supplier of die-cast alumnium products, to reduce assembly time and increase productivity by 20 percent. Introducing this much-needed flexibility enables the company to respond to fluctuations in demand, with payback on the company’s investment expected within two years.

Daniel Harrison, Automotive Analyst from Automotive Manufacturing Solutions (AMS) said: “While both new and established manufacturers are making key investments, the essential upstream supply chain supporting them is not moving as quickly. This could prove problematic in terms of costs and also the speed new and increasingly complex components for EVs and connected cars are delivered to the factory. Affordable and practical automation and robotics needs to be available to the entire industry.”