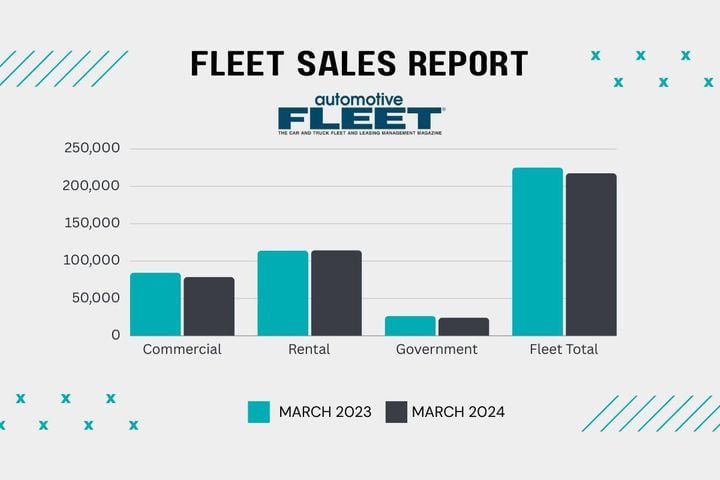

The overall monthly total of 217,446 vehicles sold into the three fleet sectors in March 2024 was down slightly at 3.4% compared to 225,200 vehicles in March 2023.

Source: Bobit

While rental car fleet sales were flat in March compared to March 2023, their strength compared to declines in the commercial and government fleet sectors helped maintain the upward trend for Q1 fleet sales overall, according to Bobit/Automotive Fleet sales data released April 2.

Despite the dips, year-to-date fleet sales through the Q1 are 599,868, up 6.4% from 563,533 fleet vehicles sold in Q1 2023. If such sales trends continue over the next three quarters, fleet sales would be set to exceed 2023’s 2 million+ benchmark total in another sign of the vehicle production and sales recovery from the pandemic years.

Bobit fleet sales numbers reflect aggregate sales from the three major Detroit-based auto manufacturers and the Asian Big 6. Numbers for March 2024 broken down by sector show:

Commercial Fleets: 78,704 vehicles sold in March 2024, down 6.9% from 84,506 in March 2023.

Rental Fleets: 114,396 vehicles sold in March 2024, up 0.3% from 114,075 in March 2023. If February, auto rental fleet sales drove the overall momentum.

Government Fleets: 24,346 vehicles sold in March 2024, down 8.5% from 26,619 in March 2023. Four automakers — Hyundai, Nissan, Subaru, and Toyota — did not report government fleet sales for March.

The overall monthly total of 217,446 vehicles sold into the three fleet sectors in March 2024 was down slightly at 3.4% compared to 225,200 vehicles in March 2023.

Originally posted on Automotive Fleet