India Auto Inc has had a good outing in FY2024 and the real-world retail numbers reflect just that. As per the official retail sales data released by the Federation of Automobile Dealers Associations of India (FADA), a total of 24.53 million units (2,45,30,334 units) were sold between April 2023 and March 2024. Autocar Professional’s sales forecast for FY2024 was 24.20 million units, which has been surpassed.

This constitutes a 10.29% year-on-year increase (FY2023: 2,22,41,361 units) and comes as a result of all five vehicle segments registering robust growth – two-wheelers (up 9%), three-wheelers (up 49%), passenger vehicles (up 8.45%) commercial vehicles (up 5%) and tractors (up 8%).

Let’s take a closer look at the performance of each of the vehicle segments in FY2024 as well as company’s wise sales.

While the two-wheeler industry has seen a welcome return of demand from rural India, overall retails have been boosted by the best-ever fiscal performances by the three-wheeler, passenger vehicle and tractor segments.

While the two-wheeler industry has seen a welcome return of demand from rural India, overall retails have been boosted by the best-ever fiscal performances by the three-wheeler, passenger vehicle and tractor segments.

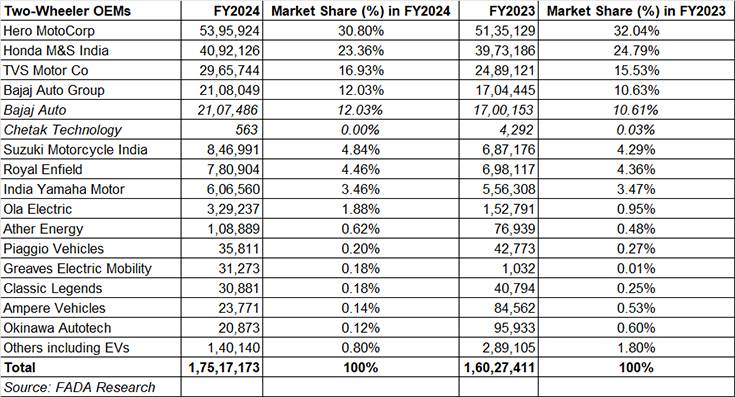

Two-wheeler retail sales : 1,75,17,173 units, up 9.30% YoY

Two-wheeler retail sales : 1,75,17,173 units, up 9.30% YoY

Two-wheelers are the most affordable form of mobility, starting from the humble moped through to fuel-sipping commuter bikes and scooters. FY2024’s sales of 17.51 million units are a 9.30% increase over FY2023’s 16 million units.

This growth trajectory, according to FADA president Manish Raj Singhania, has been fueled by enhanced model availability, sustained introduction of new products and a positive market sentiment, alongside the burgeoning EV market and strategic premium segment launches. What acted as growth catalysts were also special schemes by OEMs to rev up sales and the rural market’s recovery, critical for mass-market motorcycles.

The top four OEMs – Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), TVS Motor Co and Bajaj Auto (each with seven-figure wholesales) together account for 1,45,61,843 units or 14.56 million units – 83% – of the total two-wheeler market. Market leader Hero MotoCorp sold a total of 5.39 million units, accounting for a 31% market share and clearly benefitting from the resurgence of rural market demand which is a big buyer of its fuel-sipping bikes. With the smart growth, Hero MotoCorp is fast regaining lost market share.

HMSI, which clocked sales of 4.09 million units, has a 23.36% market share in FY2024, down from the 25% it had in FY2023. The Activa brand of scooters continue to be the power source of Honda’s sales.

TVS Motor Co, with 2.96 million units, improved its market share to 17% from the 15.53% in FY2023. There’s similar growth for Bajaj Auto – 2.10 million units give it a 12% market share, bettering its FY2023 share of 10.61 percent. Suzuki Motorcycle India (846,991 units) and Royal Enfield (780,904 units) also recorded market share increases. The EV-only Ola Electric, with a record dispatches of 329,237 units, now has a 2% share of the overall two-wheeler market.

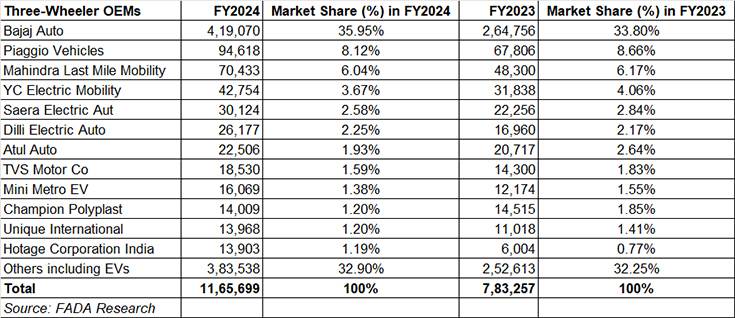

Three-wheeler retail sales: 11,65,699 units, up 49% YoY

Three-wheeler retail sales: 11,65,699 units, up 49% YoY

The three-wheeler segment, which is seeing the fastest transition to electric mobility, drove past the million-units mark for the first time in FY2024. Total wholesales of 1.16 million units are a handsome 49% YoY increase (FY2023: 783,257 units). Electric three-wheeler dispatches for SIAM member companies, at 531,524 units are a 42% YoY increase (FY2023: 373,968 EVs) and account for 46% of overall three-wheeler sales across petrol, CNG and electric.

Every second three-wheeler now sold in India is electric and this trend is also seen in the retail sales – as per Vahan, e-three-wheeler sales jumped 57% in FY2024 to a record 632,500 units. While Mahindra Last Mile Mobility remains the leader with a 10% share, followed by YC EV and Saera Electric, recent entrant Bajaj Auto is the dark horse for FY2025 with sales of 10,886 EVs and a 2% market share in just 10 months.

The FADA president attributes the sterling growth of this segment to the introduction of cost-efficient CNG fuel options, new EV models, expanding city landscapes, demand for last-mile mobility in urban centres.

In terms of vehicle dispatches to showrooms, market leader Bajaj Auto maintained its stranglehold with sales of 419,070 units, which gives it a market share of 36%, up from 34% in FY2023. Piaggio Vehicles is the second-ranked OEM here with 94,618 units, and a share of 8.12%, followed by Mahindra Last Mile Mobility with 70,433 units and a 6% market share.

Passenger vehicle retail sales: 39,48,143 units, up 8.45% YoY

Passenger vehicle retail sales: 39,48,143 units, up 8.45% YoY

The passenger vehicle segment has been firing on all cylinders right through the fiscal year gone by. At 3.94 million units, the YoY growth is a strong 8.45% on a high year-ago base of 36,40,399 units, increasing by an additional 307,744 units. What’s more these retail sales of PVs in FY2024 are 58,029 units more than the entire wholesales of 38,90,114 units in FY2023.

Overall PV sales have been boosted by the unabating demand for SUVs and MPVs in India and the fact that utility vehicles now account for nearly 60% of PV demand, also acting as a buffer for considerably slowed-down sales of hatchbacks and sedans. FY2024’s total is an all-time high for PV retails, driven by factors such as improved vehicle availability due to ramped-up production, a compelling model mix and the launch of new models played pivotal roles. FADA president Manish Raj Singhania said: “Enhanced supply dynamics, strategic marketing efforts, ever-expanding quality road infrastructure and strong demand in the SUV segment, now holding a 50% market share, significantly contributed to this success.”

Industry bellwether Maruti Suzuki India, with 1.60 million units in FY2024, maintains its stranglehold on the PV market, way ahead of its rivals with a 40.66% market share. While Hyundai Motor India (561,371 units) has a 14.22% share, Tata Motors (538,264 units) has 13.63% and Mahindra & Mahindra (424,570 units) has a 10.75% share. Of the top six OEMs, fifth-placed Kia India (225,539 units) is the only one to see a decline in sales. Toyota Kirloskar Motor (212,646 units) has seen its share rise to 5.39% from 4.38% in FY20023.

Interestingly, in terms of wholesales, Maruti Suzuki India (1.75 million, up 10%), Hyundai Motor India (614,721 units), Tata Motors (570,955 units), Mahindra & Mahindra (459,877 units) and Toyota Kirloskar Motor (244,940 units) all recorded their best-ever fiscal year numbers in FY2024.

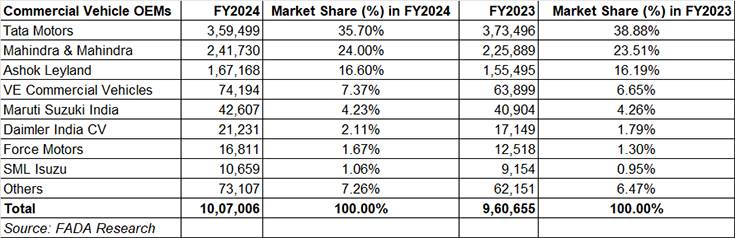

Commercial Vehicle retails: 10,07,006 units, up 4.82%

The CV segment, seen as the barometer of the economy, registered retails sales of over a million units, posting 5% YoY growth. The performance would have been better if it weren’t for a one-percent decline in sales of light commercial vehicles (561,097 units), which accounted for 56% of total CV sales.

In comparison, demand was robust for the medium CV segment at 72,907 units, up 17.49%, and for the heavy CV segment, at 324,308 units, up 7.59 percent. According to the FADA president, “Improved vehicle supply, effective planning, and increased freight movement drove significant replacement purchases. Additionally, the segment capitalized on government tenders, better road connectivity and bulk deals, showcasing its adaptability and strategic market positioning.“

In terms of OEM performance, Tata Motors (359,499 units) remains the market leader but with sales down 3.74% its market share has also dropped to 35.70% from 39% in FY2023. Mahindra & Mahindra sold 241,730 units in FY2024, up 7% on FY2023’s 225,889 units and thereby sees its market share improve to 24% from 23.51% a year ago. Ashok Leyland (167,168 units), VECV (74,194 units), Maruti Suzuki India (42,607 units), Daimler India CV (21,231 units), Force Motors (16,811 units) and SML Isuzu (10,659 units) all bettered their year-ago retails.

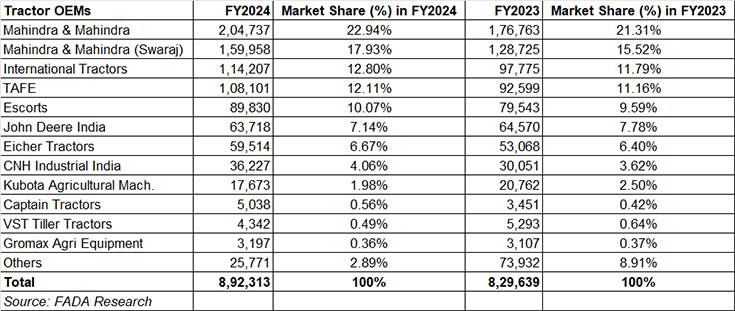

Tractor retail sales: 892,313 units, up 7.55%

The farm equipment segment which includes tractors has, like the three-wheeler and passenger vehicle segments, also notched its best-ever fiscal year numbers. At 892,313 units, FY2024’s tractor retail sales are up 7.55% (FY2023: 829,639 units).

Mahindra & Mahindra, with combined sales of 364,695 units and YoY growth of 19% (FY2023: 305,488 units) has increased its tractor market share to 41% from 37% in FY2023. International Tractors, which makes the Sonalika brand of tractors, sold 114,207 units to post 17% YoY growth and increased its market share to 13% from 12% a year ago. TAFE too did well with sales of 108,101 units, up by a similar 17%, and sees its market share rise to 12% from 11% in FY2023.

India Auto Inc’s growth outlook for the near-term and FY2025

In his growth outlook commentary, the FADA president said that with a notable decline in consumer sentiment among urban Indians, as reported by the Centre for Monitoring Indian Economy (CMIE), the automotive sector faces a nuanced challenge. “This downturn, characterized by a restraint in discretionary spending within urban income brackets, adds a layer of complexity to the industry’s landscape. In this scenario, the decision of the MPC of the RBI to keep lending rates unchanged at 6.5% would continue to badly impact the retail sales of all vehicles, especially entry level vehicles as these buyers are extremely price sensitive. Given the continued inflationary trend without any relief in finance rates, these prospective buyers may continue to hesitate. Coupled with the forthcoming elections, these challenges will influence the industry, potentially curbing vehicle sales across all segments. Despite this, opportunities for rebound and growth linger, bolstered by festive occasions and strategic product unveilings aimed at reviving consumer interest.

The industry’s adaptability is further tested by improved supply dynamics and an increasing bend towards electric mobility, alongside enticing financing options, all poised to mitigate the effects of the current economic sentiment and electoral caution. The automotive sector’s resilience is thus spotlighted, with concerted efforts to tackle these challenges through innovation and strategic market engagement. As it navigates through a period marked by careful optimism, the sector is positioned for a cautious yet hopeful trajectory towards recovery.”

“Heading into FY2025, India Auto Inc is poised for growth amidst a mix of optimism and challenges. The excitement around new product launches, particularly EVs, sets a forward-looking tone. Manufacturers are gearing up with better supply chains and an array of models to meet diverse consumer demands. Economic growth, favourable government policies and an anticipated good monsoon are expected to fuel demand, especially in rural areas and the commercial vehicle sector, which is closely linked to infrastructure projects and economic activity.

Market sentiment is cautiously optimistic, with the industry banking on improved customer engagement and financing schemes to boost sales. However, it faces challenges like high base in PV segment and intense competition. The focus is on overcoming these hurdles with innovation and strategic market engagement, aiming for a balanced growth across all the segments.”

ALSO READ:

EV sales in India jump 42% to 1.67 million in FY2024, 2- and 3Ws, cars and SUVs scale new highs