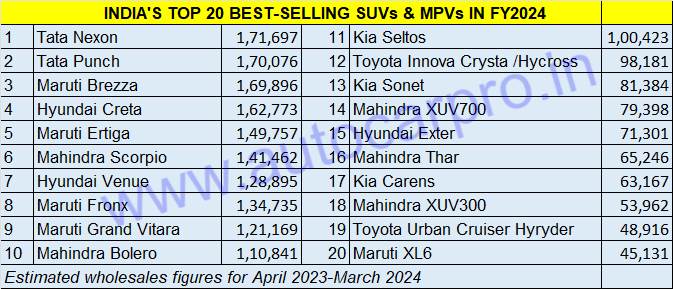

The Tata Nexon has retained its title as India’s best-selling utility vehicle (UV) for the third fiscal year in a row in FY2024 with estimated wholesales of 171,697 units in the 12-month period of April 2023 to March 2024. The Nexon, which isd equipped with petrol, diesel and electric powertrains, was also the country’s best-selling SUV in FY2023 and FY2022.

The battle to be the SUV boss in FY2024 was close. At end-February 2024, only 2,356 units separated the Tata Nexon and the Maruti Brezza, which was perceived to be its main challenger to the No. 1 UV title in FY2024.

While the Nexon (171,697 units), which sold 0.25% less than the 172,138 units in FY2023, has once again taken the crown, interestingly another Tata Motors’ SUV – the Tata Punch with 170,076 units – has snatched the No. 2 rank from the Brezza, which was ahead of the Punch till February 2024. The Brezza is now ranked third with 169,896 units and retains the same ranking it had in FY2023 (145,665 units), its sales increasing by 17 percent.

The Punch’s rapid progress packed a punch in March 2024 – its 17,547 units not only made it the best-selling SUV for the month but it was also India’s best-selling passenger vehicle for the first time in a month. The Punch, initially available only with petrol power, continues to punh above its weight and is clearly benefiting from its recently launched CNG and electric variants and sold 27% more units in FY2024 compared to the 133,819 units it sold in FY2023.

As a result of the continuing robust customer demand for compact SUVs and the no-holds-barred battle between the top three compact SUVs, the Hyundai Creta midsize SUV, ranked second in FY2023 (150,372 units) as well as FY2022 (118,092 units), takes fourth position in FY2024 despite delivering a much better performance 162,773 units. This is its best yet in a fiscal, energised by the launch of the new Creta in mid-January 2024.

Cumulative sales of the Top 20 UVs at 2.16 million units account for 86% of the total estimated UV sales of 2.52 million units in FY2024.

Cumulative sales of the Top 20 UVs at 2.16 million units account for 86% of the total estimated UV sales of 2.52 million units in FY2024.

Compact SUVs rule, demand grows for midsize SUVs

Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Kia India and Toyota Kirloskar India are the top six UV manufacturers in the country and are well represented in the Top 20 UV rankings, some more than others.

The Top 20 UV data table for FY2024 reveals that the market leader Maruti Suzuki has five models (Brezza, Ertiga, Fronx, Grand Vitara and XL6). Mahindra & Mahindra also has five models (Scorpio, Bolero, XUV700, Thar and XUV300). While Hyundai has three (Creta, Venue, Exter) as does Kia (Seltos, Sonet and Carens), Tata Motors has two models (Nexon and Punch) like Toyota (Innova Crysta/Hycross and Urban Cruiser Hyryder).

In terms of vehicle category, compact SUVs lead with 10 models, followed by midsize SUVs with seven models and MPVs with three models.

Utility vehicles’ share of PV market jumps to 60%

While apex industry body SIAM will release the official data for FY2024 next week, total wholesales (dispatches to showrooms) of passenger vehicles are estimated to be a record 4.23 million units, up 9% on what is now the previous best – FY2023’s 3.89 million. The big news is that UVs, at an estimated 2.52 million units – with the 2.5 million milestone surpassed for the first time by UVs – will account for 60% of total PV sales, substantially improving upon their 51.50% share (20,03,718 UVs to 38,90,114 PVs) in FY2024.

The consumer in this segment, particularly for SUVs, is truly spoilt – a deep dive into Autocar India’s Buyer’s Guide reveals that there are 30 OEMs comprising 16 mainstream OEMs in the Indian market (who are SIAM members), and 14 luxury OEMs, retailing around 115 UV models and a mind-boggling 810 variants! Given this hugely competitive marketplace vying for the value-conscious and demanding Indian UV, SUV and MPV customer, these Top 20 UVs are true champions. Their cumulative wholesales of 2.16 million units account for 86% of the total estimated UV sales of 2.52 million units in FY2024.

With the wave of demand for SUVs and MPVs continuing, expect the companies with UV-heavy portfolios continue to make gains month after month in FY2025.

ALSO READ: FY2024 India auto retail sales rise 10% to 24.53 million units