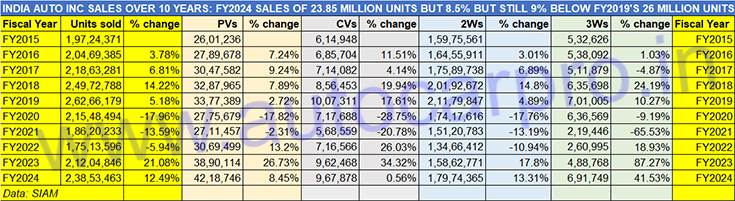

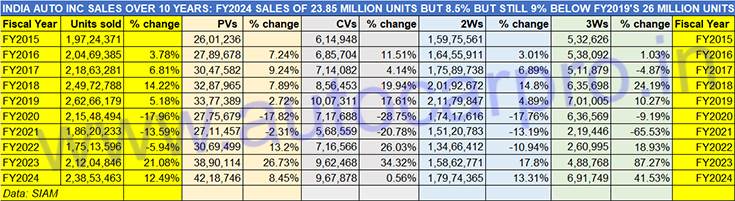

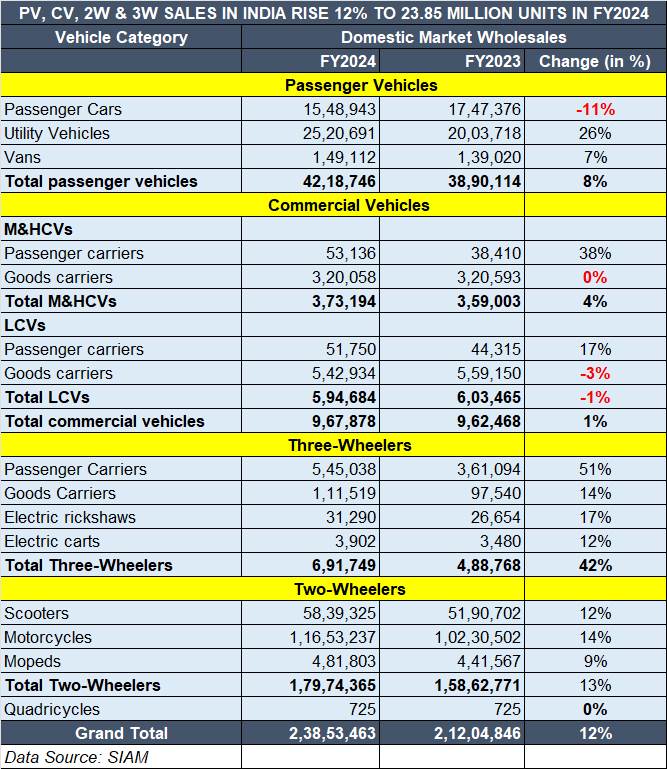

First the good news. The Indian automobile industry has wrapped up FY2024 with total wholesale vehicle dispatches of 23.85 million units, an increase of 12.49% over FY2023’s 21.20 million units. The not-so-good news is that India Auto Inc is still 2.41 million units away from its best-ever fiscal year: FY2019’s 26 million units (see 10-year wholesales data table below).

Though FY2024’s 23.85 million units constitute a strong showing, India Auto Inc is still 2.41 million units away from its best-ever FY2019’s 26 million units as depicted in this decadal wholesales data.

Though FY2024’s 23.85 million units constitute a strong showing, India Auto Inc is still 2.41 million units away from its best-ever FY2019’s 26 million units as depicted in this decadal wholesales data.

FY2019 had seen all four vehicle segments – passenger vehicles, commercial vehicles, two- and three-wheelers – hit record highs, which had contributed to the mega sales. Of these four segments, the PV segment is the only one to have bettered its FY2019 performance of 3.37 million units. . . twice, in FY2023 (3.89 million units) and now in FY2024 (4.21 million units). While the CV sector, with 967,878 units in FY2024 is closing in on the million units it sold in FY2019, the three-wheeler industry with 691,749 units in FY2024 fell short of its best-yet FY2019 figure of 701,005 units by just 9,256 units!

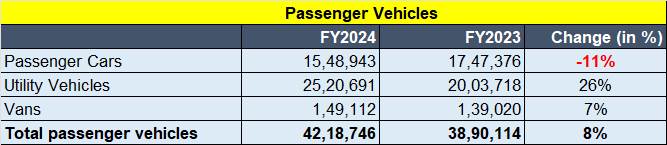

PASSENGER VEHICLES%: 42,18,746 units / up 8.45

Utility Vehicles: 25,20,691 units / up 26%, accounts for 60% of PV sales

The passenger vehicle (PV) segment is the segment which has been hogging the headlines for the past three-odd years, and has been the fastest to put the ghost of Covid-impacted sales behind it. Pin that down to the unabated and surging demand for UVs, SUVs and MPVs. Of the total 4.21 million units sold in FY2024, the UV sub-segment accounted for 25,20,691 units (up 26% YoY) and 59.74% of entire PV sales. Not only is this a big jump over the 51.50% share that UVs had in FY2023’s PV sales but this is the first time that UV dispatches have surpassed the 2.5-million units mark. That’s not all – UV sales have helped buffer the sharp 11% decline in passenger car and sedan sales – from 1.74 million units to 1.54 million units in FY2024.

Driving the PV sales growth were best-ever fiscal performances from Maruti Suzuki India (1.75 million units), Hyundai Motor India (614,717 units), Tata Motors (582,915 units), Mahindra & Mahindra (459,877 units) and Toyota Kirloskar Motor (245,676 units).

Not surprisingly, all these five OEMs with SUV-heavy portfolios have benefited from the wave of demand for SUVs. Maruti Suzuki (642,296 units) accounts for a market-leading 25% share of the 2.52 million UV sales in FY2024. Mahindra (459,864 units, 18.24% UV share) takes second position and Hyundai Motor India (388,725 units, 15.42% UV share) is third. Just 307 UVs behind Hyundai is Tata Motors (388,418 units, 15.40% share). A resurgent Toyota Kirloskar Motor (191,065 units, 7.57% UV share) has ramped up production to meet strong demand coming its way for SUVs and MPVs.

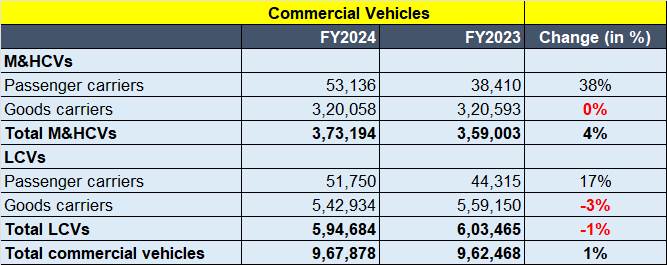

COMMERCIAL VEHICLES: 967,878 units / up 0.56%

This is the sector which spells the health of the country’s economy. From passenger-ferrying small and large buses through to the medium and heavy goods carriers, they are the vehicles traversing the length and breadth of the country with essential goods as well as the ones implementing the last-mile mobility mantra of business.

Combined M&HCV and LCV wholesales data reveals that the CV industry clocked 967,878 units – flat sales growth of 0.56% over FY2023’s 962,468 units. This is the sector’s best performance in five fiscals but remains 39,433 units less than its best-yet show in FY2019 when it surpassed a million units (10,07,311) for the first time.

The massive government as well as private sector spend in infrastructure development, mining and related activities is leading to fresh demand, particularly for HCVs, even as replacement demand is up and about with a vengeance as MCV operators scramble to update their fleets. However, demand for goods carriers, both M&HCV and LCV, was flat.

Commenting on the segment’s performance, SIAM president Vinod Aggarwal said: “The domestic commercial vehicle industry had a marginal growth to 9.7 million units and within that, some drop was experienced in LCVs and SCVs due to degrowth in the CNG segment. The growth in CVs was also impacted due to migration to higher-tonnage trucks which created higher payload capacity, that is not reflected in the number of units.”

Aggarwal also anticipates strong pent-up demand for M&HCVs after the elections, which typically tend to slow down infrastructure activities. “Historically, several infrastructure projects slowed down slightly during this (election) period. Therefore, we anticipate a huge pent-up demand once the new government gets formed after the elections,” he said.

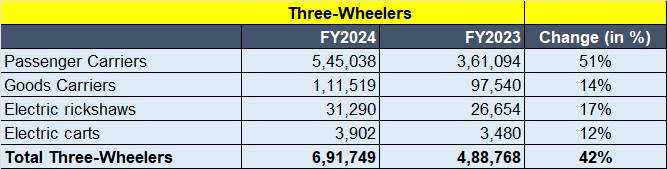

THREE-WHEELERS: 691,749 units / up 41.53%

Look at the data table above and one sees growth across all four sub-segments in the three-wheeler category. Total sales of 691,749 units are up by a strong 42% (FY2023: 488,768 units) thanks to huge demand for passenger-ferrying autorickshaws (545,038 units, up 51%). If another 9,256 units had been sold, the segment would have surpassed its best-yet dispatch number of 701,005units in FY2019. Three-wheeled goods carriers have crossed the 100,000 mark at 111,519 units, up 14% YoY. best-yet FY2019 figure of 701,005 units by just 9,256 units!

The three-wheeler industry is also seeing the fastest transition to electric mobility and as per Vahan retail data, every second three-wheeler sold in the country is now electric.

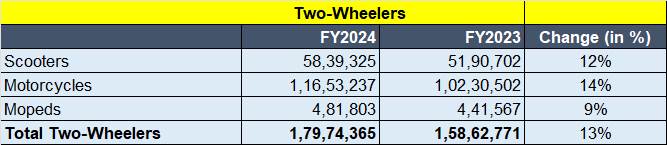

TWO-WHEELERS: 1,79,74,365 units / up 13% YoY

The segment on two wheels only clocked total wholesales of nearly 18 million units recording 13% YoY growth. While this is the best performance in the past five fiscals, it is still short of the best-yet 21.1 million units in FY2019.

The segment on two wheels only clocked total wholesales of nearly 18 million units recording 13% YoY growth. While this is the best performance in the past five fiscals, it is still short of the best-yet 21.1 million units in FY2019.

Motorcycles, with 1,16,53,237 units, accounted for 65% of total sales and saw YoY growth of 14%. Scooters, with 58,39,325 units, recorded YoY growth of 12%. Mopeds sales at 481,803 units were up 9 percent.

However, despite a robust performance, the segment still remained below its earlier peak achieved in FY18-19, by around 15 percent. Compared to FY18-19, the entry-level two-wheelers – 75-125cc vehicles – registered a 20% decline. “However, we expect the two-wheeler segment to recover further as there are strong indications about a recovery in the rural market owing to a good monsoon projection in FY2025,” said SIAM’s Vinod Aggarwal.

INDIA AUTO INC GROWTH OUTLOOK FOR FY2025

With the industry achieving a “satisfactory performance” in FY2024, SIAM is optimistic about the strong fundamentals to drive growth in FY2025. According to Aggarwal, “We are optimistic about the industry growth in FY2025 based on the macroeconomic fundamentals. The fundamentals are strong, particularly with the booming economy that would require more products and services to be produced and transported. We expect good economic growth as well as good monsoon this year. The overall industry growth could be to the tune of high single-digit in FY2025.”

“With regard to the Red Sea crisis, the industry has taken several measures to achieve a workaround. However, it has led to an increase in the transit lead time by 15-20 percent, thereby also impacting the shipment costs,” he said, while updating the industry’s countermeasures in dealing with the ongoing adversity.

ALSO READ: FY2024 retail sales rise 10% to 24.53 million units, all vehicle segments register robust growth

EV sales in India jump 42% to 1.67 million in FY2024, 2- and 3Ws, cars and SUVs scale new highs