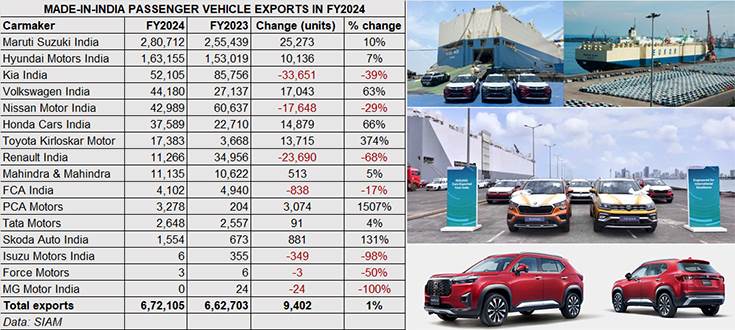

With the domestic passenger vehicle market firing on all cylinders to register a record 4.21 million units in FY2024, it is understandable that overall export numbers would be muted as OEMs focused on the demand in hand. Vehicle manufacturers shipped a total of 672,105 cars, utility vehicles and vans overseas in FY2024, up 1.4% on FY2023’s 662,703 units.

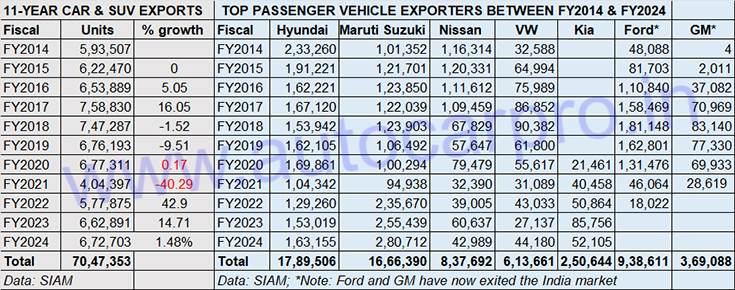

India PV Inc’s best-ever export year was FY2017 when a total of 758,830 units were shipped overseas (see decadal export data at the bottom of this analysis), with Hyundai Motor India, Maruti Suzuki and Nissan Motor India leading the charge.

FY2024’s YoY growth of 1.4% per se may be tepid but PV exports are the sole vehicle category to be in positive territory last fiscal, as they were in FY2023. Exports for the three other segments continue to be down – two-wheelers (-5%), three-wheelers (-18%) and commercial vehicles (-16%).

While FY2024’s exports point to a gradual recovery since the Covid-impacted years, when PV exports slid to their lowest level in the past 10 years – 404,400 units in FY2021 – they are still 86,725 units lesser than the 758,830 units of FY2017.

With 280,712 units, up 10% YoY, Maruti Suzuki posted its best-ever export performance and accounted for 42% of passenger vehicle exports in FY2024.

With 280,712 units, up 10% YoY, Maruti Suzuki posted its best-ever export performance and accounted for 42% of passenger vehicle exports in FY2024.

Maruti Suzuki No. 1 car and SUV exporter for third straight year

Maruti Suzuki India has retained India’s top car and SUV exporter title for the third year running with 280,712 units, up 10% and its best export performance yet (FY2023: 255,439 units). The company exports 17 models with the Grand Vitara being the latest to join the export portfolio. At present, the Maruti Suzuki models with the highest export demand are the Dzire sedan, the Swift, S-Presso and Baleno hatchbacks, and the Brezza SUV. Maruti Suzuki exports to nearly 100 countries. Africa, Latin America, Asia, and Middle East are important export markets for the company.

Hyundai Motor India, with exports of 163,155 units, up 7%, remains in No. 2 position in FY2024. The company, which lost the top exporter title to Maruti Suzuki in FY2022, has been stretched for manufacturing capacity and has focused on catering to demand in the domestic market. But with additional capacity coming its way with the acquisition of GM India’s Talegaon plant, it will be better placed to cater to exports in the coming years. Hyundai’s top PV exports included the and i10 and i20 hatchbacks (80,790 units), the new sixth-generation Verna sedan (55,170 units), Venue and Exter SUVs (12,504 units), flagship Alcazar SUV (10,825 units) and the Creta SUV (3,859 units).

Kia India remains the third-ranked exporter but has seen a sharp decline in numbers: 52,105 units versus 85,756 units in FY2023 – that’s 33,651 fewer units YoY and a decline of 39 percent. Numbers have been dragged down by the big decline in exports of its biggest export model, the Seltos. While the Sonet (30,574 units, up 5%), the Seltos at 13,042 units was down 73% (FY2023: 48,554 units). The Carens at 8,489 units was up 6 percent.

Volkswagen India, which witnessed strong export demand in FY2024, shipped 44,180 units to record 63% YoY growth (FY2023: 27,137 units) and in has jumped two ranks to fourth position from sixth in FY2023. Leading the charge for the German carmaker is the made-in-India Virtus global sedan with 31,495 units, up 74% (FY2023: 18,084 units) and the Taigun midsize SUV with 12,621 units, up 59% (FY2023: 7,958 units). Both the models are built on VW’s MQB-AO-IN platform (as are Skoda Auto India’s Slavia sedan and Kushaq SUV).

Skoda Auto Volkswagen India aims to leverage its local manufacturing capabilities as well as the geographical advantage to drive exports to Mexico, AGCC, North Africa and far-eastern markets from India, for both right-hand-drive and left-hand-drive vehicles.

Nissan Motor India slips one position in FY2024 to fifth place as a result of its 29% decline in exports to 42,989 units. Demand for the its main export model, the Sunny sedan fell sharply by 31% to 33,659 units from 48,941 units in FY2024. Export sales of the Magnite were also down by 19% to 9,314 units.

Honda Cars India, with a strong showing in FY2024, has risen one rank to sixth position. The Japanese car and SUV maker shipped 37,589 units, a YoY increase of 66% (FY2023: 22,710 units). This is mainly a result of exports of the made-in-India WR-V (the rebadged Elevate SUV). A total of 10,273 WR-Vs were exported over the past six months, accounting for 27% of total exports. The City remains the most exported Honda product with 26,206 units, up 25%. Honda also exported 844 Amaze sedans last fiscal.

Toyota Kirloskar Motor has witnessed strong export demand. Total overseas shipments of 17,383 units are up 374% on a low year-ago base of 3,668 units but clearly increased production capacity at its plants in Bidadi, Karnataka are paying dividends. TKM’s ranking has jumped three ranks to seventh place from 10th position in FY2023.

Making cars and SUVs in India, for the world

Decadal data mining the PV export numbers reveals some interesting takeaways. Between FY2014 and FY2024, Hyundai has topped the export chart seven times and Maruti Suzuki thrice (FY2022, FY2023 and FY2024). Of the 7.04 million PVs exported during this period, these two OEMs together account for 3.45 million units or 49 percent. In overall numbers though, Hyundai leads with 1.78 million units to Maruti Suzuki’s 1.66 million units.

Nineteen percent or 13,07,699 units were exported by Ford India and GM India, both of whom are no longer present in the Indian market. Two other major exporters are Nissan Motor India with 837,692 units and a 12% share of 11-year exports, and a fast-rising Volkswagen India with 613,661 units which gives it a 9% share of exports since FY2014.

ALSO READ:

India auto sales rise 12% to 23.85 million in FY2024, PVs shine, CVs and 3Ws near best-yet FY2019

FY2024 retail sales rise 10% to 24.53 million units, all vehicle segments register robust growth

EV sales in India jump 42% to 1.67 million in FY2024, 2- and 3Ws, cars and SUVs scale new highs