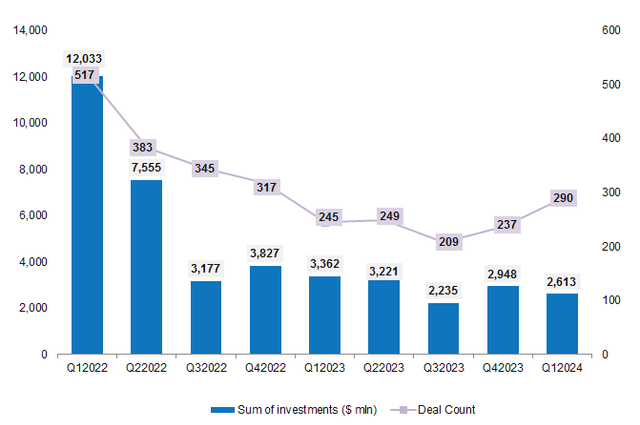

As the funding winter prolongs, private equity and venture capital investments into Indian startups stood at a mere $2.61 billion in Q1 2024, registering a drop of 11% from $2.94 billion in the previous quarter, according to data from DealStreetAsia DATA VANTAGE‘s latest report India Deal Review: Q1 2024.

On a year-on-year basis, fundraising value was down 22%.

Some signs of revival were, however, seen in March when funding into startups surpassed the billion-dollar mark for the first time this year. Venture funding has been slow since the second half of 2022, forcing startups to focus on efficiency and profitability. Many were forced to undertake layoffs as a part of cost-saving measures.

The deal volume jumped 22% to 290 in the first quarter from 237 in Q4 2023 on the back of an increase in seed to Series A deals. Dealmaking in the late stages was muted as investors shied away from writing large cheques.

“Despite 2024 seeing around 60 countries face elections, including India, the US, the UK, etc, investors are eager to begin deployments across the board. India should see funding numbers bounce back in the third quarter of the year as the election results and budget should conclude by the end of June. Deals are already being negotiated now and many companies have filed or will file their IPO papers soon,” said Siddarth Pai, Founding Partner of 3one4 Capital.

Only three startups—Avanse Financial Services, Pocket FM, and Shadowfax—sealed megadeals in Q1 2024 against five in Q4 2023 and nine in Q1 2023. Their share in total funding dropped to 12% in Q1 2024 from about 32% in the previous quarter as investors continued to tread cautiously.

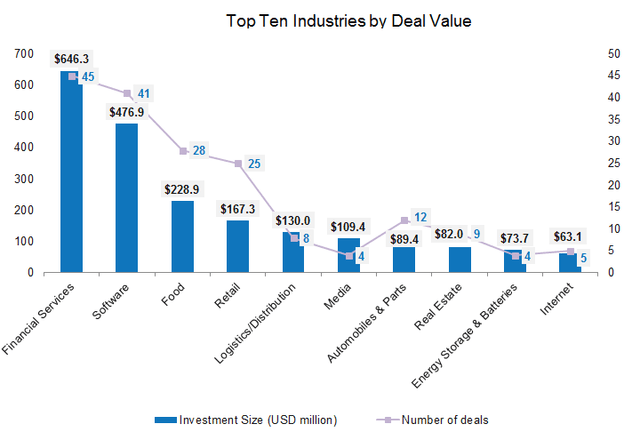

Financial services was the most funded industry

Financial services pipped retail to emerge as the most funded industry in Q1 with a total investment of $646.3 million across 45 transactions. This is an increase of 58% over the previous quarter when financial services startups garnered $408.3 million through 33 transactions.

Top deals included Avanse Financial Services ($120 million), Ambit Finvest ($83 million), Vivifi India Finance ($75 million), and mPokket ($60 million).

Software moved up to the second spot with a total $476.9 million in financing led by customer loyalty and engagement solutions provider Capillary Technologies, which secured $95 million in secondary transactions. While the deal value increased 20% over Q4 2023, the deal volume of the industry also rose 41%. The food industry followed with nearly $228.9 million in funding from 28 transactions in Q1, almost double of Q4 2023.

Bengaluru startups retain their lead

Bengaluru continued to remain one of the favourite destinations for investors in 2024. However, capital flow into the startup city was lower at $1.16 billion in Q1 from $1.47 billion in the previous quarter. Top startups based in the city that raised funds included Pocket FM, Shadowfax, Capillary Technologies, Perfios, AiDash , Krutrim, and ShareChat.

The other favourite destinations included Mumbai and Gurugram. The top three startup hubs—Bengaluru, Mumbai, and Gurugram—together closed 168 transactions worth $1.88 billion, accounting for 72% of the total investments in the quarter. Startups across the three cities had raised $2.3 billion in Q4 2023.

VCs go slow on growth-stage deals

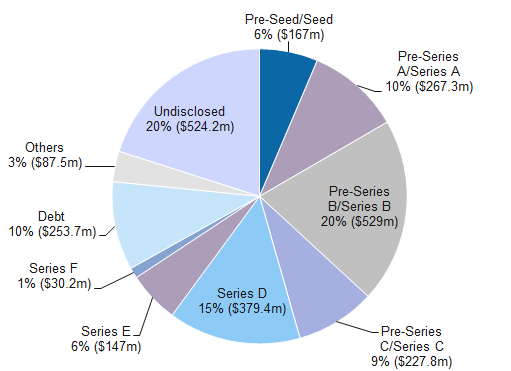

Risk capital investors are being more stringent in their analysis and taking longer to close bigger deals. Companies in Series B or post-Series B rounds collected an aggregate of $1.3 billion across 52 transactions, including private equity deals, accounting for 50% of the total deal value. This is however 23.5% lower compared to the $1.7 billion garnered across 43 growth-stage deals in Q4 2023.

Startups in pre-Series A and Series A stages scooped up $267.3 million through 66 deals against $356.5 million across 58 startups in the previous quarter. Meanwhile, pre-seed and seed-stage funding rose about 28% to $167 million.

Top investors

Venture Catalysts, along with its early-stage startup fund 9Unicorns, once again made it to the top of the investors’ list with 14 investments. These include Knocksense, ControlZ, Kidbea, Bandhoo, Relso, Fiona Diamonds, Attron Automotive, Neodocs, dubpro.ai, among others.

Angel investing platform Inflection Point Ventures (IPV) took the second spot with 12 investments in Jan-Mar as against 10 in the previous quarter. The firm funded startups including Maidaan, Bookingjini, Snap-E Cabs, BonV Aero, GlamPlus, MyCaptain, Bharatsure, Settl, Bharatsure, and Indic Wisdom.

The India Deal Review: Q1 2024 report has extensive data on:

- Top deals of Q1 2024

- Top sectors by fundraising

- Megadeals clocked by startups in Q1

- Most active investors in Q1

- Insights from prominent investors

Unlock the report for only $299 or upgrade to a Premium Plus subscription for greater savings and enjoy full access to up to 36 research reports a year, all for just $1200 ($100/month). Still not sure? Opt for a one-month trial.