India, which is the fastest growing economy in the world and billed to grow at 6.8 percent in FY2025 by no less than the IMF, is also firing on all cylinders on the passenger vehicle (PV) front. A record 4.21 million cars, SUVs, MPVs and vans were sold in FY2024, an increase of 8% over FY2023’s 3.89 million units.

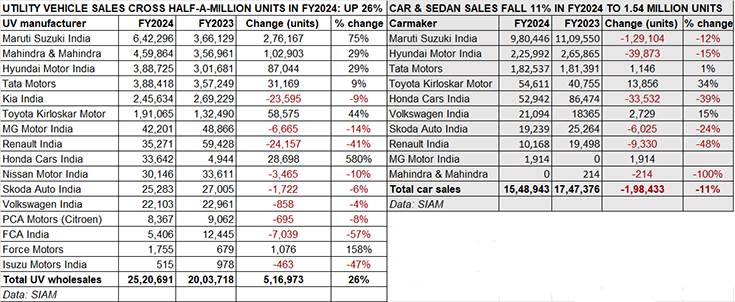

The utility vehicle (UV) sub-segment, which comprises UVs, SUVs and MPVs, is now the mover and shaker of the PV segment. Of the total 4.21 million PVs sold in FY2024, UVs accounted for 25,20,691 units (up 26% YoY) and 59.74% of entire PV sales. Not only is this a big jump over the 51.50% share that UVs had in FY2023 but this is the first time that UV dispatches have surpassed the 2.5-million unit mark.

That’s not all – UV sales have helped buffer the sharp 11 percent decline in passenger car and sedan sales – from 1.74 million units to 1.54 million units in FY2024. That’s just the reason why all the vehicle manufacturers with SUV-laden portfolios have registered handsome gains in FY2024.

Driving the PV market were best-ever fiscal-year performances from Maruti Suzuki India (1.75 million units), Hyundai Motor India (614,717 units), Tata Motors (582,915 units), Mahindra & Mahindra (459,877 units) and Toyota Kirloskar Motor (245,676 units) in FY2024.

Not surprisingly, all these five OEMs with SUV-heavy portfolios have benefited from the wave of demand for SUVs. Maruti Suzuki (642,296 units) accounts for a market-leading 25% share of the 2.52 million UV sales in FY2024. Mahindra (459,864 units, 18.24% UV share) takes second position and Hyundai Motor India (388,725 units, 15.42% UV share) is third. Just 307 UVs behind Hyundai is Tata Motors (388,418 units, 15.40% share). A resurgent Toyota Kirloskar Motor (191,065 units, 7.57% UV share) has ramped up production to meet strong demand coming its way for SUVs and MPVs.

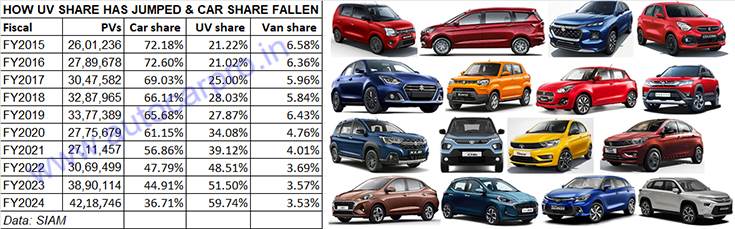

Trading places: The hatchback and sedan market, which had a 72% share of PV sales in FY2015, is now 37% while the SUV-MPV share of the PV segment is grown three-fold to 60% in FY2024 from 21% in FY2015.

Trading places: The hatchback and sedan market, which had a 72% share of PV sales in FY2015, is now 37% while the SUV-MPV share of the PV segment is grown three-fold to 60% in FY2024 from 21% in FY2015.

Car and sedan share plunges from 72% in FY2015 to 37%, UV share of PV sales catapults to 60% from 21%

A close look at 10-year wholesales data reveals just how much the PV market and consumer buying preferences have changed. Hatchback and sedan sales in FY2015, at 18,77,706 units of 2.6 million PVs, accounted for three out of every four PV sales. A decade down the line, in FY2024, demand for this vehicle category has nearly halved to 37% – 15,48,943 or 1.5 million units of the record 4.21 million PVs sold.

Along with the accelerated shift to SUVs, other factors like hatchback and sedan prices rising by over 50% over the past few years due to increased cost inputs and regulatory upgrades as also the much-slackened demand for entry-level hatchbacks as a result of stagnating income in that buyer segment, have played spoilsport.

Hugely changed market dynamics: dice rolls in favour of UVs

In sharp contrast to the sales slide of the hatchback and sedan market, the sales graph of the UV segment has soared and how. From the 552,135 UVs sold in FY2015 through to the record 25,20,691 units sold in FY2024, the increase has been 356% over a decade. The fastest vehicle category to put the pandemic blues behind them, SUV and MPV sales surpassed the million units mark for the first time in FY2021 (10,60,750 units, up 12%), and then have for the next three fiscals delivered high double-digit growth. While FY2022 saw 1.48 million-unit sales and sterling 40% growth, the two-million-milestone was achieved in FY2023 at an equally robust 34% YoY growth rate. And the UV segment has wrapped up FY2024 with 26% growth at 2.52 million units. Ample reason and more why every OEM worth its wheel wants to have a slice of the SUV market.

The consumer in this segment, particularly for SUVs, is truly spoilt – including the 16 SIAM member companies and 14 luxury OEMs there are 30 OEMs with an estimated 115 UV models and a mind-boggling 810-odd variants!

Of the mainstream players, Mahindra, Maruti Suzuki and Toyota are the ones with the highest number of models – 8 each. While M&M’s SUV portfolio covers 103 variants, Maruti has 65 and Toyota 51 variants. However, Tata Motors, with six SUVs (including the Nexon EV and Punch EV), has the highest number of variants – 154! And the luxury pack comprises 16 carmakers encompassing 60-odd models and 150-plus variants.

ALSO READ: SUVs power Maruti, Hyundai, Tata, M&M and Toyota to best-ever sales in FY2024

India auto sales rise 12% to 23.85 million in FY2024, PVs shine, CVs and 3Ws near best-yet FY2019