Indonesia-listed tech firm GoTo’s group adjusted EBITDA loss came down by 89% year-on-year in Q1 2024 as gross revenue grew 18%, according to its disclosure.

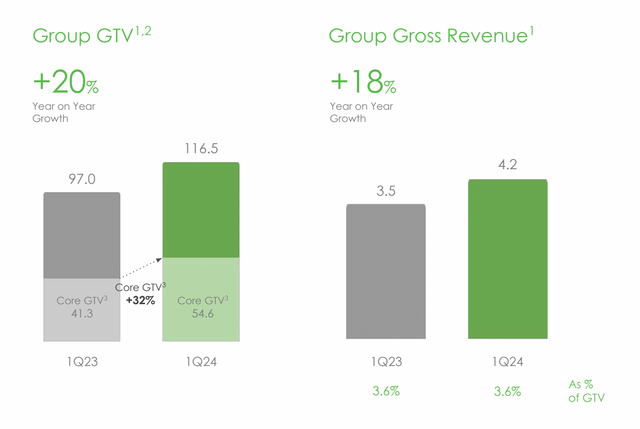

While gross revenue rose to 4.2 trillion rupiah during the quarter from 3.5 trillion rupiah in Q1 2023, the firm’s net revenue increased by 63% to 3 trillion rupiah from 1.89 trillion rupiah during the period. The group adjusted EBITDA loss, meanwhile, came down to a negative 102 billion rupiah.

The company credited the all-round improvement in its performance to factors such as user growth, the rise of buy now, pay later (BNPL) in e-commerce, and accelerated integration and payment adoption linked with TikTok.

The company managed to hit a positive adjusted EBITDA in Q4 2023.

The IDX-listed firm’s gross transaction value (GTV) increased 20% YoY to 116.5 trillion rupiah, while core GTV, which excludes merchant payment gateway, grew 32% YoY to 54.6 trillion rupiah.

Patrick Walujo, CEO of GoTo Group, said in a press statement that the company laid the groundwork and initiated a growth strategy last year focusing on expanding the user base, increasing customer wallet share, reducing operating costs, and strengthening partnership with TikTok.

“In the first quarter, we accelerated this strategy as we reinvested in our products, yielding promising results in March as well as April. We expect even faster growth for the rest of the year while also remaining committed to our profitability goals,” Walujo said.

In Q1 2024, there was a 31% YoY decrease in group incentive and product marketing spending, while recurring cash fixed costs and reported recurring cash corporate costs decreased 25% and 30%, respectively.

As of March 31, 2024, the company held 23 trillion rupiah ($1.5 billion) in cash, cash equivalents, and short-term time deposits. This balance remains unchanged since the deconsolidation of Tokopedia on February 1, 2024.

GoTo also has engaged in a conditional sale and purchase agreement to divest ownership of the delivery and fulfillment businesses within GoTo Logistics that support Tokopedia. That said, GoTo Logistics will no longer be part of the group although it does not affect GoSend, the consumer-to-consumer delivery service available on the Gojek app.

At the group level, GoTo is presenting pro forma figures assuming that Tokopedia and its associated delivery and fulfillment businesses within GoTo Logistics were deconsolidated from January 1, 2023, allowing comparable YoY performance analysis for the first quarter.

“In the first quarter, we continued to see strong top-line growth. Group core GTV increased by 32% year-on-year, while gross revenues also saw a significant uplift of 18% year-on-year,” said Jacky Lo, GoTo Group CFO.

“At the same time, adjusted EBITDA remained in line with our plan, putting us on track to meet our target to maintain adjusted EBITDA profitability for the full year 2024. We will continue to invest prudently while maintaining cost discipline as we aim to ensure that our growth can be sustained over the long term,” Lo continued.

For the 2024 outlook, GoTo anticipates expanding its user base across various demographics in its core on-demand services and fintech segments more efficiently. With investments directed towards its growing fintech business and other growth initiatives, GoTo expects to break even at the group adjusted EBITDA level for the full year 2024.