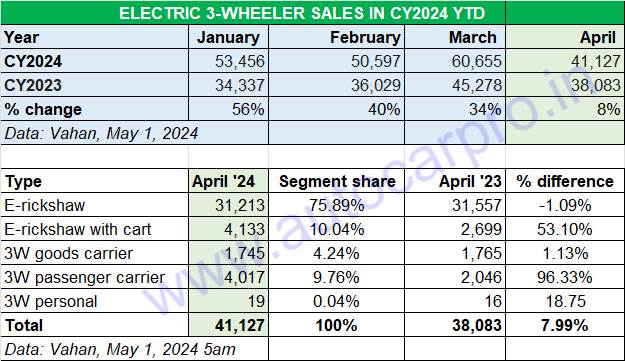

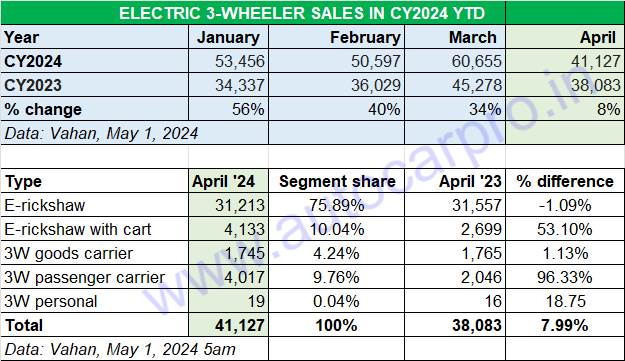

Like the electric two-wheeler industry, e-three-wheelers too have felt the heat of the opening month of FY2024 in terms of slower sales offtake compared to the past few months. Typically used to clocking high double-digit growth, in April 2024, total retail sales were a more sedate 41,127 units and an 8% increase on year-ago sales of 38,083 units in April 2023. Nevertheless, as the two segments did in FY2024, their combined sales of 105,140 units – 41,127 e-three-wheelers and 64,013 e-two-wheelers — account for 93.54% of India EV Inc’s total retails of 112,396 units.

April, typically in India, is a month of slow sales what it being the first month of FY2025 and sales momentum gradually picks up, falls a bit in the monsoon months and then revs up again in the festive season around September-October.

From the perspective of the e-two-wheeler and e-three-wheeler industry, both will have to contend with slow-moving sales at least till June 2024. The now-reduced subsidy has already seen most of the leading OEMs increase product prices. This can somewhat dampen demand albeit the wallet-friendly long-term USP of an EV and the electric three-wheeler segment has seen the fastest transition to e-mobility.

The new Electric Mobility Promotion Scheme (EMPS), valid for a four-month period from April 1 to July 31, 2024, has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (L5 category). While e-two-wheelers get a subsidy of Rs 5,000 per kWh with a maximum limit of Rs 10,000 per unit under EMPS, e-three-wheelers can avail a subsidy of Rs 5,000 per kWh with a maximum limit twice that of two-wheelers at Rs 10,000 per unit. Suffice it to say, July 2024 will see a similar spike in EV sales as in March 2024. Let’s see how the EV industry on two wheels fared in a slow-selling month.

As per Vahan data, on May 1, 2024 at 5am, a total of 80,101 three-wheelers (petrol, CNG, LNG and electric) have been retailed in April 2024. This means e-three-wheelers, at 41,127 units, account for 51% of total retails, reaffirming the fact that every second three-wheeler sold in India is now an EV. CNG-only models accounted for 25,527 units or 32% of all three-wheeler sales last month. Demand for diesel three-wheelers is now down – at 9,762 units, they accounted for just a 12% share of the overall three-wheeler market and it continues to decline.

This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Compared to fossil fuel or CNG-powered models, the long-term wallet-friendly proposition of electric three-wheelers is drawing both single-user buyers (autorickshaw drivers) as well as fleet operators. The retail sales data table above indicates the growth trajectory for the ongoing fiscal year.

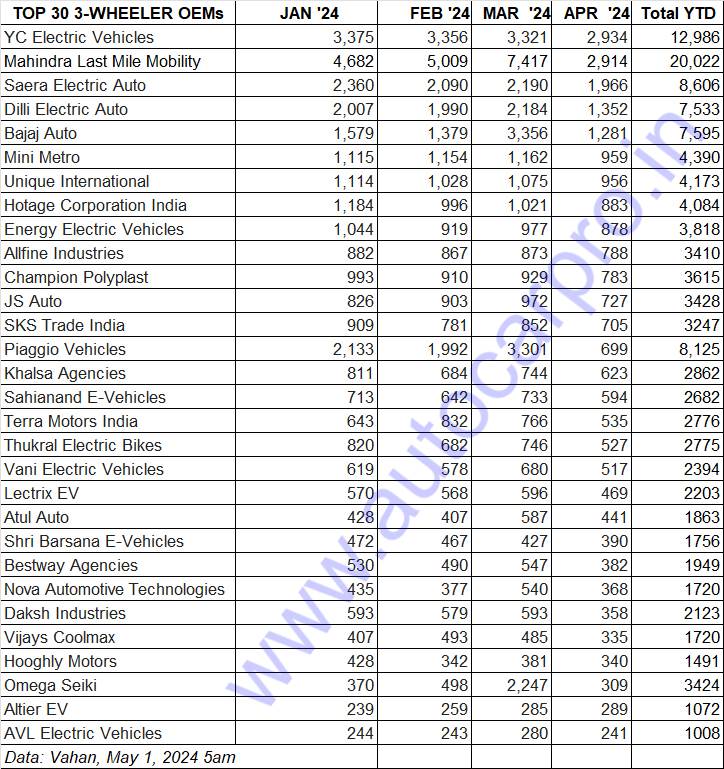

YC Electric pips Mahindra in April, Bajaj catapults into No. 4 position

This sub-segment of the EV industry, which has all of 475 players fighting for a slice and more of the action, is dominated by only a few. Vahan data of the retail sales in April 2024 reveals that only the top four OEMs have clocked four-figure sales while the next 26 OEMs have registered sales between 950 units and 200 units (see Top 35 OEM sales table below). Together, they account for 24,543 units or 60% of the e-three-wheeler market in April 2024.

From a pure numbers perspective, YC Electric Vehicles, as of 5am on May 1, 2024 on the dynamic Vahan website, YC Electric Vehicles was 20 units ahead of market leader Mahindra & Mahindra. YC EV sold 2,934 units to Mahindra’s 2,914 units in April 2024. YC EV continues to witness sustained demand for its five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for YC EV.

Nevertheless, on the cumulative first four-months period (January-April 2024), Mahindra Last Mile Mobility (MLMM), the market leader in FY2024 with 60,542 units, remains on top with 20,022 units. The company, whose portfolio includes the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo catering to multiple mobility operations, has benefited from the launch of two new products – the Treo Plus and e-Alfa Super passenger and cargo variants. Also, to meet the growing demand for its products MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

Saera Electric Auto with 1,966 units is ranked third among 475 players, maintaining its position. Likewise, No. 4 remains Dilli Electric Auto with 1,352 units.

Piaggio Vehicles, with cumulative January-April 2024 sales of 8,125 units, is fifth in the EV manufacturer rankings in the year to date but 14th in April with 699 units. The company is benefiting from its new models and aggressive network expansion. The Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range) are fully assembled by an all-women team at its Baramati factory in Maharashtra.

The OEMs with sales between 700 to 900 units in April include Mini Metro EV (959 units), Unique International (956 units), Hotage Corporation (883 units), Energy EV (878 units), Allfine Industries (788 units), Champion Poly Plast (783 units), JS Auto (727 units), and SKS Trade India (705).

Bajaj Auto: the dark horse for FY2025

The big growth story in the e-three-wheeler domain remains Bajaj Auto. As we wrote in our growth outlook for FY2025 last month, the dark horse in this fiscal is the Pune-based Bajaj Auto, which is the IC engine three-wheeler market leader and is a recent entry into e-three-wheelers in June 2023. With two products – the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 – Bajaj Auto has sold 1,281 units in April. This gives it the fourth rank among 475 players and a 3% market share. Not bad for a company which entered the market 11 months ago.

The company’s sales spike is reflected in its rate of growth. In CY2023 (six months since market entry in June 2023), Bajaj Auto was ranked 28th. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share and was ranked No. 13.

With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to be making the headlines regularly, as well as keeping the top OEMs worried.

ALSO READ:

India EV sales in April are 50% of mega March’s 210,000 units

Electric car and SUV sales in India rise 22% to 6,577 units in April

E2W sales brake hard in April at 64,000 units, Ola share at 51%, TVS and Bajaj in close fight