Coming after the fiscal-year-ending month of March, which typically sees citizens and corporates make a beeline to buy new vehicles and in turn accelerate monthly sales numbers, April is always a bit of a dampener when it comes to numbers. April 2024 has been no different and has provided India EV Inc a reality check. Expect overall auto sales to depict a similar scenario when industry body SIAM releases the April 2024 wholesales later this month.

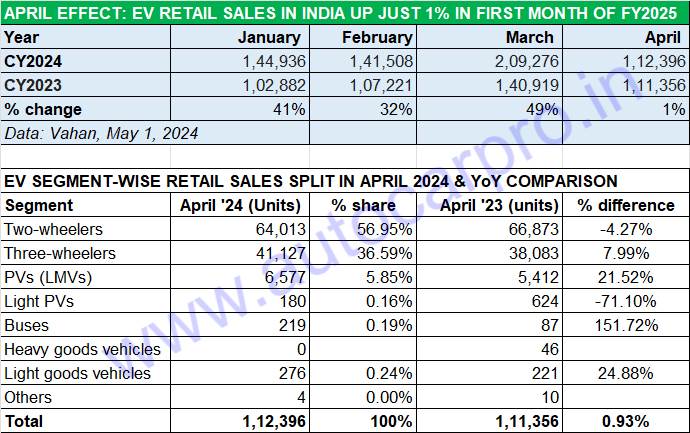

Total EV industry sales of 112,396 units in April 2024, across the electric two- and three-wheeler, car and SUV, and commercial vehicle segments, are up by just 1% (April 2023: 111,356 units) and 54% down on mega March 2024’s 209,276 units.

In April 2024, two- and three-wheeler sales were impacted by the reduced subsidy as well as increased product prices. Demand for electric cars and SUVs, however, rose smartly by 21 percent.

In April 2024, two- and three-wheeler sales were impacted by the reduced subsidy as well as increased product prices. Demand for electric cars and SUVs, however, rose smartly by 21 percent.

While this is the usual trend in India also seen across the overall automobile market, the EV industry is particular has been impacted by the reduced subsidy for two- and three-wheelers, which are the biggest sales contributors and together account for over 94% of overall to EV industry sales. It was the same in April 2024 – despite the reduced numbers, their combined sales of 105,140 units – 64,013 e-two-wheelers and 41,127 e-three-wheelers – account for 93.54% of India EV Inc’s total retails of 112,396 units.

With the FAME II subsidy coming to an end on March 31, 2024, it was expected that March 2024 would be a record-breaking month. As an answer to EV OEMs urging that the subsidy be continued, the government announced the rollout of a new scheme on March 13.

The Electric Mobility Promotion Scheme (EMPS), valid for a four-month period from April 1 to July 31, 2024, has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (L5 category). While e-two-wheelers get a subsidy of Rs 5,000 per kWh with a maximum limit of Rs 10,000 per unit under EMPS, e-three-wheelers can avail a subsidy of Rs 5,000 per kWh with a maximum limit twice that of two-wheelers at Rs 10,000 per unit. Suffice it to say, July 2024 will see a similar spike in EV sales as in March 2024.

July could see sales spike, consumers likely to take increased prices in their stride later

It can be expected that May and June 2024 will display a similar tepid demand for EVs but will see strong growth in the EMPS-ending month of July 2024. Again, there is likely to be a lull for a couple of months before the festive season kicks and demand returns to EV OEMs, particularly the two- and three-wheeler industry which are the volume drivers.

It may be recollected that a similar market scenario played out in CY2023. When the FAME II subsidy was slashed from 40% to 15% starting June 1, 2023, demand jumped 42% in May 2023 to 158,454 EVs from April 2023’s 111,356 units. After that sales fell 35% month on month in June 2023 (102,640) but saw a gradual recovery – July (116,619), August (127,180), September (128,536), October (140,300), November (153,970) and December (141,763).

The fact of the matter is that compared to fossil fuelled vehicles or even CNG-powered mobility, the long-term wallet-friendly and value proposition of a EV remains a winning bet, both for individual users as well as fleet operators.

ALSO READ:

Electric car and SUV sales in India rise 22% to 6,577 units in April

E2W sales brake hard in April at 64,000 units, Ola share at 51%, TVS and Bajaj in close fight

April E3W sales up 8% at 41,127 units, YC EV pips Mahindra, Bajaj races into fourth place