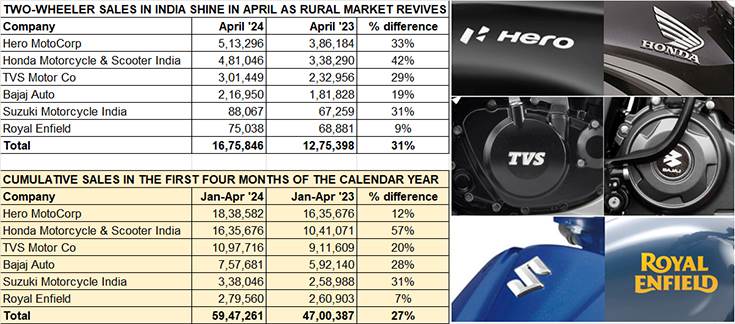

The smiles are back at India Two-Wheeler Inc as the Top Six motorcycle and scooter manufacturers have reported recovery in domestic market volumes and strong double-digit year-on-year growth in April 2024. The combined sales of the Top Six at 1.67 million units in the first month of FY2024 is a smart 31% increase over April 2023’s 1.27 million units.

What’s more, for each of these six OEMs, April 2024 has seen the highest vehicle dispatches in the first four months of CY2024. Cumulative January-April 2024 wholesales for this six-pack at 5.93 million units make for strong 27% YoY growth over the 4.66 million units in January-April 2023 (see data tables below).

Vehicle dispatches in April for each of the each OEMs have been the highest in the first four months of CY2024, setting them up for a high sales year.

Vehicle dispatches in April for each of the each OEMs have been the highest in the first four months of CY2024, setting them up for a high sales year.

Two-wheeler market leader Hero MotoCorp, the bellwether of the industry, is leading from the front. Its April 2024 dispatches at 513,296 units are up 33% (April 2023: 386,184 units). What has helped the company is the revival of rural market demand, which helps drive demand for fuel-sipping 100cc commuter bikes like the HF Deluxe and Splendor.

The company has reported strong growth for both its 125cc and 400cc motorcycles, categories which have seen new launches in January in the form of the Xtreme 125R and Mavrick 440. As per Hero MotoCorp, it is witnessing strong demand from across India for the Xtreme 125R and production is being ramped up to ensure smooth deliveries. Meanwhile, deliveries of the flagship Mavrick 440 have begun along with the fast-growing presence of Hero 2.0 and Premia outlets. Hero MotoCorp’s January-April 2024 cumulative sales at 1.83 million units are up 12% YoY, indicating that the company is well set to achieve strong sales in CY2024.

Honda Motorcycle & Scooter India (HMSI) dispatched 481,046 units in April 2024, up 42% (April 2023: 338,290 units). Its cumulative sales in the first four months of CY2024 at 1.63 million units constitute sterling 57% YoY growth. Expect the Activa, the best-selling scooter brand in India, to account for a high percentage of the sales even as HMSI sees demand grow for its 125c bikes like the Shine and SP125.

TVS Motor Co clocked dispatches of 301,449 units in April 2024, an increase of 68,493 units over April 2023’s 232,956 units and 29% YoY growth. According to the company, motorcycle sales were up 24% to 188,110 units and scooter sales up 34% to 144,126 units. TVS also sold 17,403 electric iQube scooters, a big jump from the 6,227 iQubes sold in April 2023. TVS’ scooter sales continue to be dominated by two products – the Jupiter and the NTorq 125, the former selling more than the latter. On the motorcycle front, two TVS brands dominate – the Raider and the sporty Apache series.

Bajaj Auto, the fourth-ranked OEM which is to launch the latest and biggest iteration of its popular Pulsar brand – the Pulsar NS400 – today is also firing on all cylinders. Its April 2024 sales at 216,950 units are up 19% YoY and its cumulative January-April 2024 dispatches of 757,681 units are a 28% increase on year-ago sales of 592,140 units.

Suzuki Motorcycle India’s April 2024 tally is 88,067 units, up 31% YoY. And in the first four months of this year, the company has dispatched 338,046 units, which is a similar 31% YoY increase. The Access 125 scooter remains a popular buy and is a key contributor to the company’s sales.

Midsize motorcycle market leader Royal Enfield is also on a roll. The Chennai-based OEM’s domestic market wholesales in April comprised 75,038 motorcycles, up 9% YoY. Its January-April 2024 numbers at 279,560 units are up 7% YoY.

The sales recovery in the Indian two-wheeler market is a result of the regular rollout of new products across categories, a positive market sentiment, enhanced OEM financing schemes and, importantly, the return of demand for the critical rural India market. With the IMD forecast of a good monsoon season this year, two-wheeler sales emanating from rural India can only increase in the months ahead.

Of the six OEMs, three – TVS, Bajaj Auto and Hero MotoCorp – have also diversified into EVs. TVS and Bajaj, which both entered the EV market in January 2020, are seeing demand grow for their iQube and Chetak scooters, even as Hero MotoCorp is pulling out all the stops to accelerate sales of its Vida EV.

Meanwhile, two-wheeler exports are also rebounding but that calls for an altogether new analysis. Stay tuned.

Lead image: Representational logos