Five months into CY2024, the Indian two-wheeler industry is well placed to achieve strong numbers this year. While domestic market wholesales are posting strong double-digit growth on the back of a much-awaited rural India recovery, export demand for made-in-India two-wheelers is finally beginning to see the green shoots of recovery. This comes after a fairly long period of dampened economic conditions in some of the key global markets which saw rough macroeconomic conditions, country-specific local currency depreciation, availability of foreign exchange and also regulatory issues.

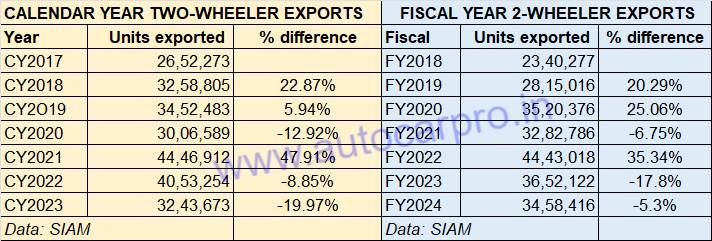

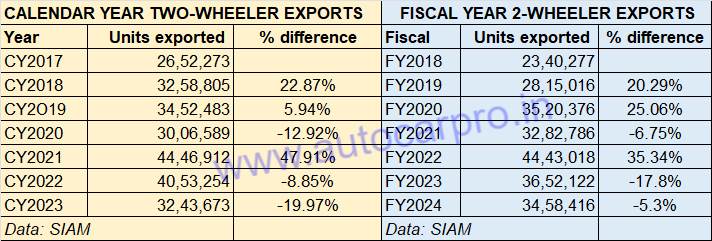

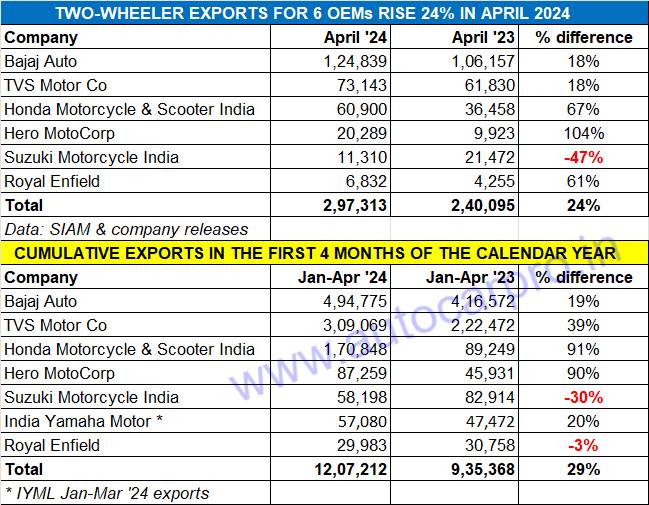

A deep dive into the last seven calendar-year and fiscal-year wholesales (see data tables below, along with the latest export sales data of leading OEMs for April 2024 and January-April 2024, reveals that things have started looking up on the two-wheeler export front. The rate of decline has slowed down and it shouldn’t be long before exports of scooters, motorcycles and mopeds are finally back on growth road.

FY2022 with 4.44 million units shipped overseas and handsome 35% YoY growth was the best-ever export year for India Two-Wheeler Inc.

FY2022 with 4.44 million units shipped overseas and handsome 35% YoY growth was the best-ever export year for India Two-Wheeler Inc.

Indian two-wheeler exports were at their highest level in FY2022 (4.44 million units) and are currently 25 to 28% below that level. India Two-Wheeler Inc closed FY2024 with total shipments of 3.45 million units, down 5.3% YoY. While official April 2024 export numbers have yet to be released, cumulative January-March 2024 exports at 915,907 units, as per SIAM data, are already 28% of CY2023’s 3.24 million units and 26% of FY2024’s 3.45 million units. If the same pace of growth is maintained or exceeded, it can be surmised that exports of made-in-India scooters, motorcycles and mopeds will notch growth in CY2024 and for fiscal year 2025. Let’s take a closer look at the top exporting companies.

HOW THE TOP TWO-WHEELER EXPORTERS ARE FARING

Bajaj Auto, the export market leader, whose FY2024 exports at 14,77,338 units were down 10% YoY, has opened FY2025 on a good note. Dispatches of 124,839 units in April 2024 are an 18% improvement YoY (April 2023: 106,157 units). And in the first four months of CY2024, its export shipments at 494,775 units are up 19% YoY. Considering Bajaj Auto’s two-wheeler exports in CY2023 were 14,17,817 units, the January-April 2024 performance is 35% of that total with eight months still to go in CY2024.

A look at the company’s FY2024 export performance reveals that in the entry-level up to 110cc motorcycle category, exports were down 21% to 630,566 units (FY2023: 794,035), 14% down in the 110-125cc segment to 291,904 (FY2023: 338,632) and a similar 10% down in the 125-150cc category to 187,855 units (FY2023: 209,774). Export demand improves as the cubic capacity improves: sales in the 150-200cc category (Husqvarna, KTM, Pulsar) at 208,070 units were up 20% (FY2023: 173,149). And there a 50% YoY increase in export sales of the 200-250cc segment – to 73,488 units (FY2023: 48,815).

With Bajaj kicking off exports of Triumph motorcycles, demand in the 350-500cc category in FY2024 were up 18% to 85,381 units (FY2023: 72,546). As per Bajaj Auto’s FY2024 performance commentary, the company continues to see robust growth in Latin America as well as the MENA (Middle East and North Africa), which has to some extent alleviated the slowdown in demand from Africa and Asia.

The longstanding No. 2 two-wheeler export OEM is TVS Motor Co. The Chennai-based scooter, motorcycle and moped manufacturer is fast upping the ante on two-wheeler exports. In FY2024, the company, which is India’s second largest two-wheeler exporter after Bajaj Auto, shipped 887,774 units to overseas markets in FY2024. Exports comprised 22% of its combined domestic market and export sales of 40,44,824 or 4 million units in FY2024. TVS two-wheelers are already sold in over 80 countries in key markets across Asia, Africa and Latin America.

In the past seven-odd months, the scooter and bike maker has strategically entered new markets like Nepal, Vietnam, and France. On November 16, 2023, TVS announced its entry into the European market and signed a pact for import and distribution with the Emil Frey Group. The two companies plan to use their collaborative efforts to enter into distribution arrangements for select EU markets. Last month, Autocar Professional broke the news about TVS kicking off exports of the made-in-India BMW CE 02 electric scooter, which is jointly developed by BMW Motorrad and TVS and produced at TVS’ Hosur factory in Tamil Nadu.

In April 2024, TVS dispatched 73,143 units overseas, up 18% YoY. Its January-April 2024 total at 309,069 units (up 39% YoY) marks 39% YoY growth and is currently 38% of its entire CY2023 exports of 812,490 units.

Honda Motorcycle & Scooter India (HMSI), the No. 2 in the domestic market is No. 3 in exports. Its April 2024 exports at 60,900 units were up by a substantial 67% on year-ago overseas dispatches of 36,458 units. In CY2023, HMSI’s exports were 306,195 units – the company’s January-April 2024 total of 170,848 are up by 91% YoY and 56% of that total. HMSI currently exports its bikes and scooters to 58 markets spanning Europe, Central and Latin America, Middle East, South-East Asia, Japan, Australia, New Zealand, and the SAARC nations.

The company has outlined a strategic export growth programme. On April 18, HMSI inaugurated a new state-of-the-art engine assembly line at its Global Resource Factory in Manesar, Gurugram (Haryana), with a focus on CKD (Completely Knocked Down) exports. The new assembly line has an manufacturing managing of 600 engines a day and can produce engines for models ranging from 110cc to 300cc, catering to diverse needs and preferences of Honda customers globally.

Hero MotoCorp, the world’s largest two-wheeler manufacturer and the domestic market leader, exported 20,289 units in April 2024, up 104% on low year-ago base of 9,923 units. The company’s exports in the January-April 2024 period were 87,259 units, which constitutes a smart 90% increase (January-April 2023: 45,931 units).

The company has three overseas assembly plants – in Bangladesh (150,000 units per annum) Colombia (80,000 per annum) and Nepal (75,000 units per annum). The Nepal assembly plant, inaugurated last month, will produce the Xpulse 200 4V, Super Splendor, Splendor+ motorcycles, and Xoom 110 scooter.

Suzuki Motorcycle India is the sole OEM from among the top players to see a decline in both April 2024 (11,310 units, down 47%) as well as January-April 2024 (58,198 units, down 30%) export sales. In CY2023, the company exported 227,448 bikes and scooters, which makes the export contribution from the first four months of CY2024 26% of last year’s total. The Access is the company’s best-selling export model along with the Gixxer motorcycle.

In FY2024, Hero MotoCorp revamped distribution setup, network expansion, and sales promotion activities in its key African markets of Nigeria, Kenya, and Uganda. There was also more focus on scaling up market share in Latin American countries such as Colombia, Mexico, Guatemala, Bolivia, and Peru, and on increasing retail finance in markets such as Colombia, Bangladesh, Nepal, Mexico, and Africa to improve affordability and boost sales. In addition to its existing portfolio, Hero launched the Xoom scooter and new Hunk 160 bike in Nepal, Bangladesh and LATAM.

India Yamaha Motor, which exported 2,21,736 units in FY2024, down xx on FY2023’s 2,74,986 units, has shipped a total of 57,080 units in the January-March 2024 period, up 20% YoY.

Royal Enfield, whose FY2024 exports of 100,055 units were down 22% on FY2023’s 77,937 units. The company’s line-up includes the Hunter 350 roadster, Meteor 350, Super Meteor 650 cruiser, Interceptor 650 and Continental GT 650 twins, Shotgun 650, the all-new Himalayan adventure tourer, the Scram 411 ADV Crossover, and the Bullet 350 and Classic 350. Along with its two production facilities at Oragadam and Vallam Vadagal, near Chennai. Royal Enfield also has five modern CKD assembly facilities in Nepal, Brazil, Thailand, Argentina and Colombia.

GROWTH OUTLOOK

What is heartening is that the reviving two-wheeler export growth story is benefiting all the major OEMs, which augurs well for India Two-Wheeler Inc. Strong domestic sales can only add tailwind to that growth trajectory. Judicious management of both domestic and export market sales help inventory management as well as capacity utilisation. Bajaj Auto, TVS and Honda have all recorded smart export growth and with demand picking up in key global markets, it is expected things can only get better. The icing on the export ‘cake’ is that the profit margins are often better on the made-in-India products.