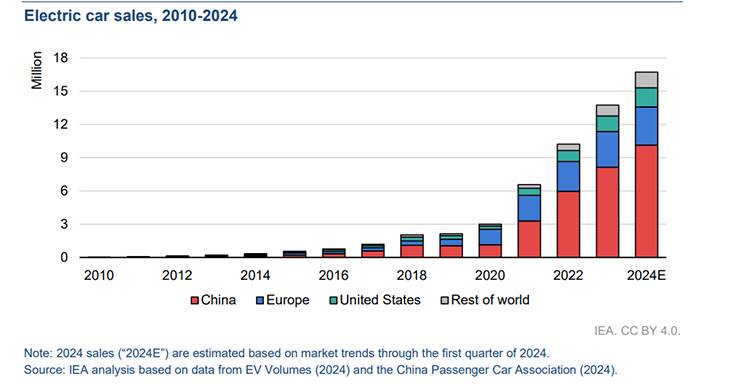

As per the latest Global EV Outlook report, released by the International Energy Agency (IEA), electric car sales neared 14 million units in 2023, 95% of which were in China, Europe and the United States Almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million, closely tracking the sales forecast from the 2023 edition of the Global EV Outlook (GEVO-2023).

Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. This is more than six times higher than in 2018, just 5 years earlier. In 2023, there were over 250 000 new registrations per week, which is more than the annual total in 2013, ten years earlier. Electric cars accounted for around 18% of all cars sold in 2023, up from 14% in 2022 and only 2% five years earlier, in 2018. These trends indicate that growth remains robust as electric car markets mature. Battery electric cars accounted for 70% of the electric car stock in 2023, states the IEA annual report of the EV global parc.

While sales of electric cars are increasing globally, they remain significantly concentrated in just a few major markets. In 2023, just under 60% of new electric car registrations were in the China, just under 25% in Europe, and 10% in the United States – corresponding to nearly 95% of global electric car sales combined. In these countries, electric cars account for a large share of local car markets: more than one in three new car registrations in China was electric in 2023, over one in five in Europe, and one in 10 in the United States. However, sales remain limited elsewhere, even in countries with developed car markets such as Japan and India. As a result of sales concentration, the global electric car stock is also increasingly concentrated. Nevertheless, China, Europe and the United States also represent around two-thirds of total car sales and stocks, meaning that the EV transition in these markets has major repercussions in terms of global trends.

Chinese car makers can undercut rivals in Europe because their production costs are heavily subsidised.

Chinese car makers can undercut rivals in Europe because their production costs are heavily subsidised.

China exported over 1.2 million EVs in 2023

In China, the number of new electric car sales reached 8.1 million in 2023, increasing by 35% relative to 2022. Increasing electric car sales were the main reason for growth in the overall car market, which contracted by 8% for conventional (internal combustion engine) cars but grew by 5% in total, indicating that EV sales are continuing to perform as the market matures.

The year 2023 was the first in which China’s New Energy Vehicle (NEV) 3 industry ran without support from national subsidies for EV purchases, which have facilitated expansion of the market for more than a decade. Tax exemption for EV purchases and non-financial support remain in place, after an extension, as the automotive industry is seen as one of the key drivers of economic growth. Some province-led support and investment also remains in place and plays an important role in China’s EV landscape. As the market matures, the industry is entering a phase marked by increased price competition and consolidation.

In addition, China exported over 4 million cars in 2023, making it the largest auto exporter in the world, among which 1.2 million were EVs. This is markedly more than the previous year – car exports were almost 65% higher than in 2022, and electric car exports were 80% higher. The main export markets for these vehicles were Europe and countries in the Asia Pacific region, such as Thailand and Australia.

In the United States, new electric car registrations totalled 1.4 million in 2023, increasing by more than 40% compared to 2022. While relative annual growth in 2023 was slower than in the preceding two years, demand for electric cars and absolute growth remained strong.

In the European Union, sales amounted to 2.4 million, with similar growth rates. As in China, the high rates of electric car sales seen in Europe suggest that growth remains robust as markets mature, and several European countries reached important milestones in 2023. Germany, for example, became the third country after China and the United States to record half a million new battery electric car registrations in a single year, with 18% of car sales being battery electric (and another 6% plug-in hybrid). However, the phase-out of several purchase subsidies in Germany slowed overall EV sales growth. At the start of 2023, PHEV subsidies were phased out, resulting in lower PHEV sales compared to 2022, and in December 2023, all EV subsidies ended after a ruling on the Climate and Transformation Fund. In Germany, the sales share for electric cars fell from 30% in 2022 to 25% in 2023. This had an impact on the overall electric car sales share in the region.

In the rest of Europe, however, electric car sales and their sales share increased. Around 25% of all cars sold in France and the United Kingdom were electric, 30% in the Netherlands, and 60% in Sweden. In Norway, sales shares increased slightly despite the overall market contracting, and its sales share remains the highest in Europe, at almost 95%.

Sales in emerging markets are increasing, led by Southeast Asia and Brazil, India and Thailand

Electric car sales continued to increase in emerging market and developing economies (EMDEs) outside China in 2023, but they remained low overall. In many cases, personal cars are not the most common means of passenger transport, especially compared with shared vans and minibuses, or two- and three-wheelers (2/3Ws), which are more prevalent and more often electrified, given their relative accessibility and affordability. The electrification of 2/3Ws and public or shared mobility will be key to achieve emissions reductions in such cases. While switching from internal combustion engine (ICE) to electric cars is important, the effect on overall emissions differs depending on the mode of transport that is displaced. Replacing 2/3Ws, public and shared mobility or more active forms of transport with personal cars may not be desirable in all cases.

In India, electric car registrations were up 70% year-on-year to 80 000, compared to a growth rate of under 10% for total car sales. Around 2% of all cars sold were electric. Purchase incentives under the Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme, supply-side incentives under the Production Linked Incentive (PLI) scheme, tax benefits and the Go Electric campaign have all contributed to fostering demand in recent years.

Local carmakers have thus far maintained a strong foothold in the market, and account for the bulk of electric car sales in cumulative terms since 2010, led by Tata Motors (70%) and Mahindra & Mahindra (10%).

Local carmakers have thus far maintained a strong foothold in the market, and account for the bulk of electric car sales in cumulative terms since 2010, led by Tata Motors (70%) and Mahindra & Mahindra (10%).

In FY2024, electric car and SUV sales in India jumped 90% to over 90,000 units. Increased product choice, strong customer demand along with expanding charging infrastructure across India helped accelerate sales of electric cars, SUVs and MPVs. While Tata Motors with over 63,000 units had a 71% market share, MG Motor India’s share rose to 13% and that of Mahindra & Mahindra to 7 percent. Luxury carmakers sold 2,855 EVs for a 3% share.

In Thailand, electric car registrations more than quadrupled year-on-year to nearly 90,000, reaching a notable 10% sales share – comparable to the share in the United States. New subsidies, including for domestic battery manufacturing, and lower import and excise taxes, combined with the growing presence of Chinese carmakers, have contributed to rapidly increasing sales. Chinese companies account for over half the sales to date, and they could become even more prominent given that BYD plans to start operating EV production facilities in Thailand in 2024, with an annual production capacity of 150,000 vehicles for an investment of just under US$ 500 million. Thailand aims to become a major EV manufacturing hub for domestic and export markets, and is aiming to attract US$ 28 billion in foreign investment within 4 years, backed by specific incentives to foster investment.

Policy support in Indonesia is attracting international majors and boosting electric car sales Until 2019, annual electric car sales in Indonesia were below 100, increasing tenfold to under 1 000 in 2020-2021. In 2022, annual sales jumped to over 10 000, and in 2023 they reached 17 000, supported by purchase incentives. Electric cars benefit from a reduced Value-Added Tax of 1% (compared to 11% for conventional cars), are exempt from the luxury tax that applies to many vehicles, and from import tax, and are eligible for regional tax reductions. Increasing model availability is also helping boost sales. As in many other countries in the region, foreign carmakers – especially Chinese – are increasingly entering the market. Chinese companies accounted for 75% of electric car sales in 2022, and 45% in 2023.

In Vietnam, after an exceptional 2022 for the overall car market, car sales contracted by 25% in 2023, but electric car sales still recorded unprecedented growth: from under 100 in 2021, to 7 000 in 2022, and over 30,000 in 2023, reaching a 15% sales share. Domestic front-runner VinFast, established in 2017, accounted for nearly all domestic sales. VinFast also started selling electric sports utility vehicles (SUVs) in North America in 2023, as well as developing manufacturing facilities in order to unlock domestic content-linked subsidies under the US IRA. VinFast is investing around US$ 2 billion and targets an annual production of 150,000 vehicles in the United States by 2025. VinFast is looking to enter regional markets, such as India, where it broke ground on an integrated EV manufacturing plant in February 2024, and the Philippines.

In Malaysia, electric car registrations more than tripled to 10,000, supported by tax breaks and import duty exemptions, as well as an acceleration in charging infrastructure roll-out. In 2023, Mercedes-Benz marketed the first domestically assembled EV, and both BYD and Tesla also entered the market.

In Latin America, electric car sales reached almost 90,000 in 2023, with markets in Brazil, Colombia, Costa Rica and Mexico leading the region. In Brazil, electric car registrations nearly tripled year-on-year to more than 50,000, a market share of 3%. Growth in Brazil was underpinned by the entry of Chinese carmakers, such as BYD with its Song and Dolphin models, Great Wall with its H6, and Chery with its Tiggo 8, which immediately ranked among the best-selling models in 2023. Road transport electrification in Brazil could bring significant climate benefits given the largely low-emissions power mix, as well as reducing local air pollution. However, EV adoption has been slow thus far, given the national prioritisation of ethanol-based fuels since the late 1970s as a strategy to maintain energy security in the face of oil shocks.

Several major carmakers already in Brazil are developing hybrid ethanol-electric models as a result. China’s BYD and Great Wall are also planning to start domestic manufacturing, counting on local battery metal deposits, and plan to sell both fully electric and hybrid ethanol-electric models. BYD is investing over USD 600 million in its electric car plant in Brazil – its first outside Asia – for an annual capacity of 150 000 vehicles. BYD also partnered with Raízen to develop charging infrastructure in eight Brazilian cities starting in 2024. GM, on the other hand, plans to stop producing ICE (including ethanol) models and go fully electric, notably to produce for export markets. In 2024, Hyundai announced investments of USD 1.1 billion to 2032 to start local manufacturing of electric, hybrid and hydrogen cars.

In Mexico, electric car registrations were up 80% year-on-year to 15 000, a market share just above 1%. Given its proximity to the United States, Mexico’s automotive market is already well integrated with North American partners, and benefits from advantageous trade agreements, large existing manufacturing capacity, and eligibility for subsidies under the IRA. As a result, local EV supply chains are developing quickly, with expectations that this will spill over into domestic markets. Tesla, Ford, Stellantis, BMW, GM, Volkswagen (VW) and Audi have all either started manufacturing or announced plans to manufacture EVs in Mexico. Chinese carmakers such as BYD, Chery and SAIC are also considering expanding to Mexico. Elsewhere in the region, Colombia and Costa Rica are seeing increasing electric car sales, with around 6 000 and 5 000 in 2023, respectively, but sales remain limited in other Central and South American countries.

Throughout Africa, Eurasia and the Middle East, electric cars are still rare, accounting for less than 1% of total car sales. However, as Chinese carmakers look for opportunities abroad, new models – including those produced domestically – could boost EV sales. For example, in Uzbekistan, BYD set up a joint venture with UzAuto Motors in 2023 to produce 50 000 electric cars annually, and Chery International established a partnership with ADM Jizzakh. This partnership has already led to a steep increase in electric car sales in Uzbekistan, reaching around 10 000 in 2023. In the Middle East, Jordan boasts the highest electric car sales share, at more than 45%, supported by much lower import duties relative to ICE cars, followed by the United Arab Emirates, with 13%

Strong electric car sales in the first quarter of 2024

Electric car sales remained strong in the first quarter of 2024, surpassing those of the same period in 2023 by around 25% to reach more than 3 million. This growth rate was similar to the increase observed for the same period in 2023 compared to 2022. The majority of the additional sales came from China, which sold about half a million more electric cars than over the same period in 2023. In relative terms, the most substantial growth was observed outside of the major EV markets, where sales increased by over 50%, suggesting that the transition to electromobility is picking up in an increasing number of countries worldwide.

Nearly 600 electric car models currently on sale worldwide

More electric models are becoming available, but the trend is towards larger ones The number of available electric car models nears 600, twothirds of which are large vehicles and SUVs In 2023, the number of available models for electric cars increased 15% year-onyear to nearly 590, as carmakers scaled up electrification plans, seeking to appeal to a growing consumer base. Meanwhile, the number of fully ICE models (i.e. excluding hybrids) declined for the fourth consecutive year, at an average of 2%. Based on recent original equipment manufacturer (OEM) announcements, the number of new electric car models could reach 1,000 by 2028. If all announced new electric models actually reach the market, and if the number of available ICE car models continues to decline by 2% annually, there could be as many electric as ICE car models before 2030.

All graphics: courtesy International Energy Agency

ALSO READ:

EV sales in India jump 42% to 1.67 million in FY2024

Electric car and SUV sales in India jump 90% to 90,000 units in FY2024

E3W sales in India surge 57% in FY2024, hit record 632,500 units

Electric two-wheeler sales hit highest level in FY2024: 944,000 units